Successfully navigating Thompsonville’s commercial real estate market depends on more than identifying the right property—you also need a team of seasoned local professionals to guide you through each transaction and beyond. By leveraging their specialized expertise, you’ll reduce risk, streamline timelines, and position your investment for long-term success. Below are the key advisors you’ll want on your team.

Working with Brook Walsh, Commercial Broker

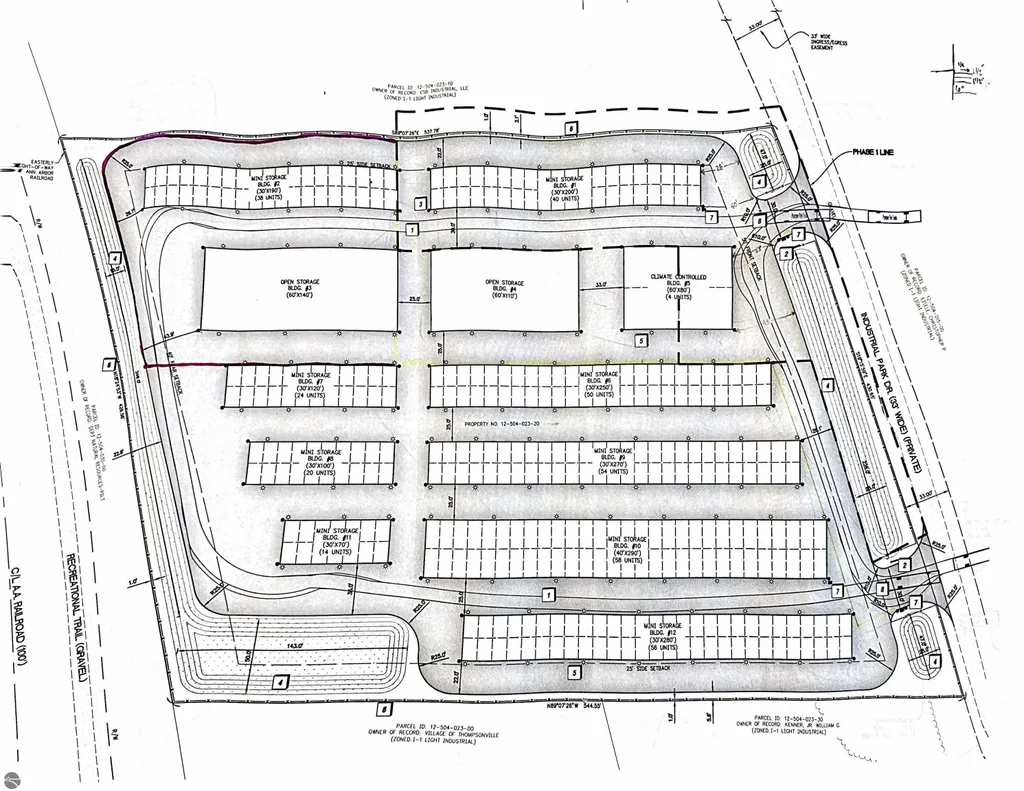

Brook Walsh of BrookWalsh.com and Northern Michigan Escapes brings unparalleled local market mastery to your search. With deep experience closing transactions on Main Street, within the Industrial Park Zone, and along the waterfront, Brook understands the subtle price variances—such as why corner storefronts command a $2–$4 per square foot premium over C-2 corridors. Brook’s proprietary network uncovers “quiet listings” before they hit the open market, giving you a competitive edge. By diving into your business model, growth projections, and financing needs, Brook crafts a tailored acquisition or leasing strategy. Beyond price negotiations, he advocates for tenant improvement allowances, rent abatements, and CAM caps to protect your bottom line.

Legal Counsel & Due Diligence

Commercial real estate transactions involve intricate contracts, title nuances, zoning compliance, and risk allocation. Engaging an attorney proficient in Michigan real estate law ensures you’re fully protected:

-

Title Review & Surveys: Your lawyer will coordinate with a title company to identify liens, easements, or encroachments that could jeopardize your plans, and verify boundary surveys against intended uses.

-

Zoning & Entitlement Confirmation: Even after Brook Walsh confirms zoning viability, counsel should verify that your precise use is permitted “by right.” If you need a special land-use permit or variance, your attorney can prepare applications and represent you at Planning Commission hearings.

-

Contract Drafting & Review: From purchase agreements to commercial leases, your attorney will negotiate indemnity clauses, environmental warranties, and default provisions—ensuring you’re not saddled with hidden liabilities.

-

Regulatory Compliance: Counsel can audit existing permits and certificates of occupancy, flagging any expired approvals or code violations before you close or take possession.

By addressing legal and regulatory issues up front, you’ll avoid costly delays, fines, or forced remediation down the road.

Property Management with Northern Michigan Escapes

Once you’ve acquired or leased your commercial asset, Brook Walsh’s team at Northern Michigan Escapes offers full-service property management tailored to Benzie County’s unique dynamics. Their services include:

-

Tenant Relations & Retention: Proactive communication, regular site walks, and rapid issue resolution keep your tenants satisfied and reduce turnover.

-

Financial Oversight: Transparent CAM reconciliations, detailed budgeting, and monthly performance reports help you track ROI and plan for future investments.

-

Maintenance & Repairs: With a vetted local vendor network, the team coordinates everything from HVAC servicing to roof inspections, ensuring compliance and asset longevity.

-

Marketing & Lease Administration: When vacancies arise, Northern Michigan Escapes deploys targeted marketing—both online and through community networks—and handles lease renewals, rent escalations, and deposit management.

By partnering with Brook Walsh and his network of expert advisors, you’ll gain a competitive advantage, ensuring every phase—from site selection to daily operations—is handled with local insight and professionalism.