Investing in Northern Michigan Real Estate

If you value lifestyle in combination with an appreciation profile, there just might be a place in your portfolio for investing in Northern Michigan real estate that makes financial sense. Vacation home prices typically lag major market residential rates by 12-36 months.

But with asking prices for Northern Michigan waterfront and ski-proximate real estate up 10 percent to 20 percent this year (based on 24 months sold price per sq ft averages), discounting has not hit our market.

While the obligations and negative cash flow aspects of ownership can sometimes be burdensome, the numbers still work as illustrated on our Investment Performance page. Now is the time to explore the pluses and minuses of buying a Northern Michigan vacation home property as it fits your particular situation.

Learn more about investing in the Northern Michigan real estate market, or explore Northern Michigan communities now and plan your next investment.

Understanding the Northern Michigan Real Estate Market

Whether you’re looking for the convenience of ski-in/ski-out lodging near lifts or the style and privacy of a single-family home, we can help you understand what Northern Michigan real estate has to offer. Strategic positioning and the economic drivers of real estate should be your first consideration. Why? Because a misguided strategy perfectly executed still produces a misguided result.

Some of the questions you should be asking:

- “When will I be there?”

- “How long will I stay?”

- “Will I be a vacationer, semi-retired, or do I plan to be a resident?

A general rule of thumb is the shorter your stays, the more important location becomes.

A general rule of thumb is the shorter your stays, the more important location becomes.

Start by narrowing your search down to the type of property you are interested in and the location you like best. Do you want a condo near skiing or a house with a private beach?

Northern Michigan is home to Boyne City, Harbor Springs, Charlevoix, Bay Harbor, Traverse City, Petoskey, and many other places – explore and find where is best for you.

Take your time and consider your plan before making any binding decisions.

The Northern Michigan Real Estate Market

History & Market Trends

Data analysis confirms that we are certainly past the bottom of the longest-lasting downturn since the Great Depression.

Vacation homes typically lag major market residential by 12-36 months and with asking prices for Northern Michigan real estate up 10%-20% (based upon 24 months sold price per sqft averages), the past four years of heavy discounting is now over.

Learn more about the Northern Michigan real estate market below, or connect with Brook Walsh today for trusted guidance with your next investment.

Market History

During the worst of the Great Recession, prices dropped by about 20% from high water mark 2006/7 valuations but have since rebounded, cutting that loss gap in half.

Looking forward, our most immediate concern is a fading buyer window which is probably already over for reasons too complex to address efficiently.

A recovering price structure in combination with unsustainably low-interest rates means that the cost of ownership may never be lower; it's just hard to know how long discounted pricing and the artificially manipulated FED cost of funds will last.

Seasonal Changes

July is the height of our inventory accumulation cycle with most if not all of the well-priced properties selling to a more confident buyer base.

With the stock market indices setting record highs, investors have been reluctant to redeploy capital but this will probably change as returns slow down and profit-taking occurs due to trading range consolidation. Momentum-driven exuberance is bound to fade if top-line performance continues to stagnate, paving the way for alternative asset class investments.

The good news is that increased confidence in net worth and employment income has historically driven demand for high-end luxury goods spending. In combination with baby boomer demographics, a highly affluent customer base, the stage is set for the return of our long-term 5% rate of appreciation, supporting the premise that you can have fun and make money if you know how to go about it.

Market Trends

Consumers continue to struggle with the idea of high-end luxury good spending, much less an extravagant Northern Michigan property, in these volatile and still uncertain economic times. Why should such an idea even be considered when frugality and de-leveraging are all the rage? Financially savvy consumers intuitively understand timing and the scarcity of unique assets; knowing that prices are down, the cost of capital is at record lows, and windows of opportunity short-lived.

The stock market continues to be riddled with insider trading scandals, bonds are poised for massive losses due to Federal Reserve manipulated interest rates, and with cash-paying, almost nothing why not consider an asset class that can deliver an immediate lifestyle dividend in combination with a history of reliable and likely to continue long term appreciation?

Thinking Ahead

The big story for the next couple of years is going to be the lack of available inventory. Best buy opportunities are still out there but not as plentiful as one might think. Six years of market illiquidity should have produced plenty of supply as sellers waited for market conditions to improve, which they have, but the exact opposite has occurred. Maybe prices aren't yet high enough or perhaps potential sellers think of their Northern Michigan property as a family legacy asset, but no matter the reason they're just not selling. Supply vs. demand ratios hasn't been this low since 2006.

Browse Northern Michigan communities now, or register with Brook Walsh Home Search to be notified when new listings become available!

Finding A Good Deal in the Northern Michigan Real Estate Market

Can a good deal still be found?

If you know how to go about it. Finding a good deal requires patience, perseverance, and an in-depth understanding of relevant valuation metrics, but if you actively engage in the process there will be opportunities.

A typical example would be a buyer interested in a family home:

- With 4+ bedrooms;

- Located within a 5-10 minute drive of the chairlifts or sandy beach;

- Purchase price not to exceed $2 million;

- Short term rental income offsets;

- Upside appreciation profile.

A search produces 40 results from which a shortlist of best fit properties is selected. Candidates cannot suffer from pricing defects, environmental defects, or shell and core/floor plan defects. The top 25% of the results yield 10 possibilities that make the final cut.

Experience suggests that only 2 of the presented homes are likely to be of serious interest which is a small fraction of total inventory. The challenge here has to do with statistical probability: The odds that one of the two shortlisted properties is owned by one of five price realistic sellers is only 10% (2/10 x 5/10 = 10/100) making the chances of a successful acquisition both frustrating and alarmingly challenging.

So much for buyers who think they are going to get the deal of a lifetime, from sellers who are patiently willing to sell, on the one day that buyer happens to be in town looking at real estate.

Data research, shows the following to be true:

- The Northern Michigan property market is at the end of a 10-year structural correction cycle.

- Leading Indicators show inventory levels below long-term absorption averages.

- Capital markets are improving as a result of the biggest stock market run-up in modern economic history.

- The demand for high-end luxury goods is up.

- Consumer confidence and GDP performance are strengthening and a favorable FED monetary policy is in place.

- Well-priced vacation homes have been selling but buyers are still reluctant to commit.

As the fear subsides there will be an increasing appetite for yield and diversification ultimately bringing an end to the current capital preservation mentality.

All of these indicators support a "take action now" strategy with the key being to get out in front of the herd while there are still deals to be had, the worst is over, but the stampede towards freer spending has not yet begun.

Brook Walsh is from Northern Michigan and understands lifestyle-based real estate investing which is one of the reasons he's chosen to pursue his dream of helping real estate investors with their home buying needs. Learn more about Brook or start your home search now.

Northern Michigan Investment Performance

Evaluating Cash Flow & ROI

The opportunity cost of diverted capital is an important consideration for most clients when evaluating whether a vacation home makes financial sense. If family net worth is sufficiently large, so that the down payment, mortgage debt, and the cost of carrying elements do not affect longer-term financial goals and objectives, then you probably fit the buyer profile.

Conversely, if the yield is the all-consuming driver, then there are certainly better-performing asset classes. Keep in mind that one-half of the benefit stream can't be measured on an ROI basis. The ideal combination for a vacation home would be lifestyle enhancement and a return on invested capital equal to or greater than a stock or bond market purchase.

Browse investment communities in Northern Michigan now, and be sure to connect with Brook Walsh for more info on investing in Northern Michigan real estate. He'd be happy to help!

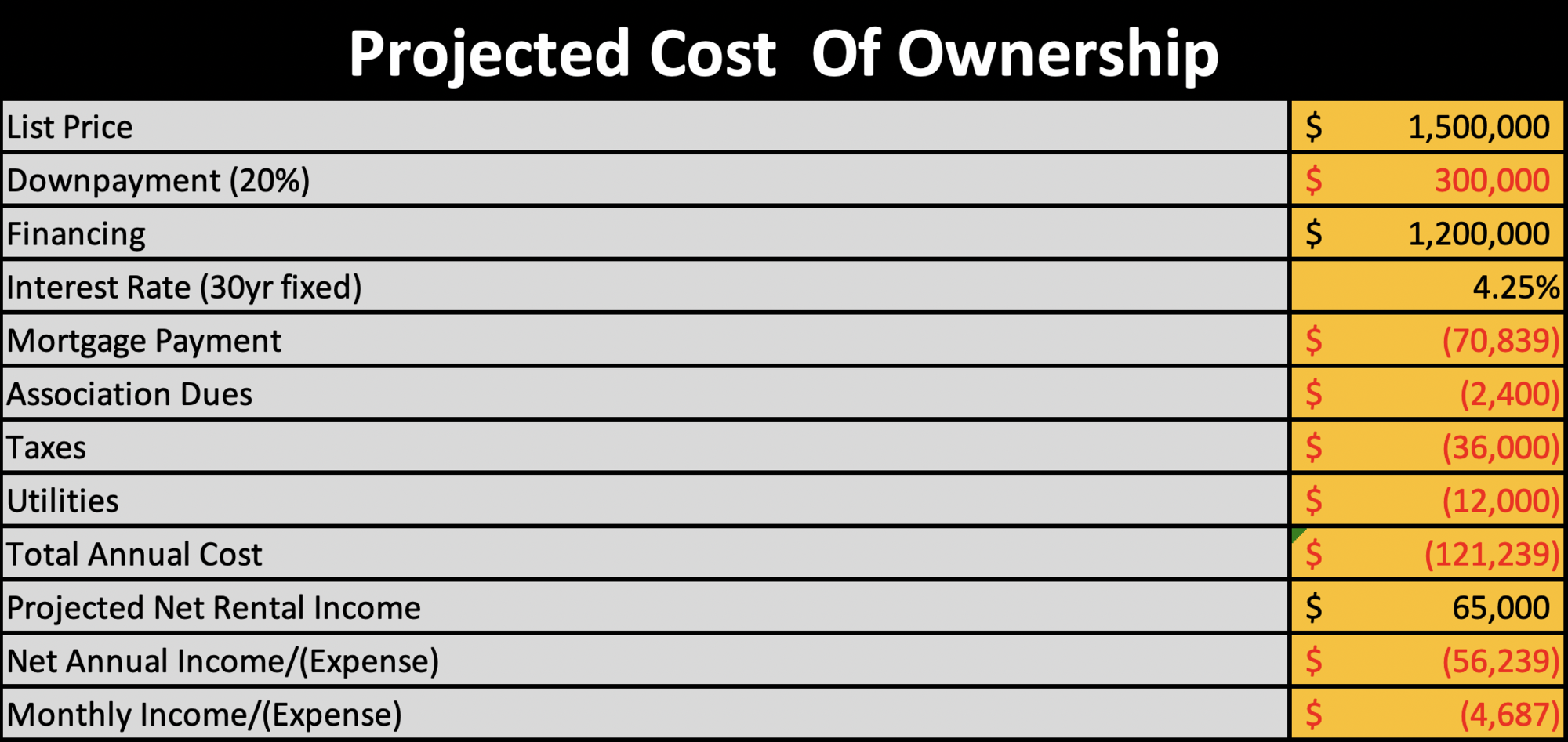

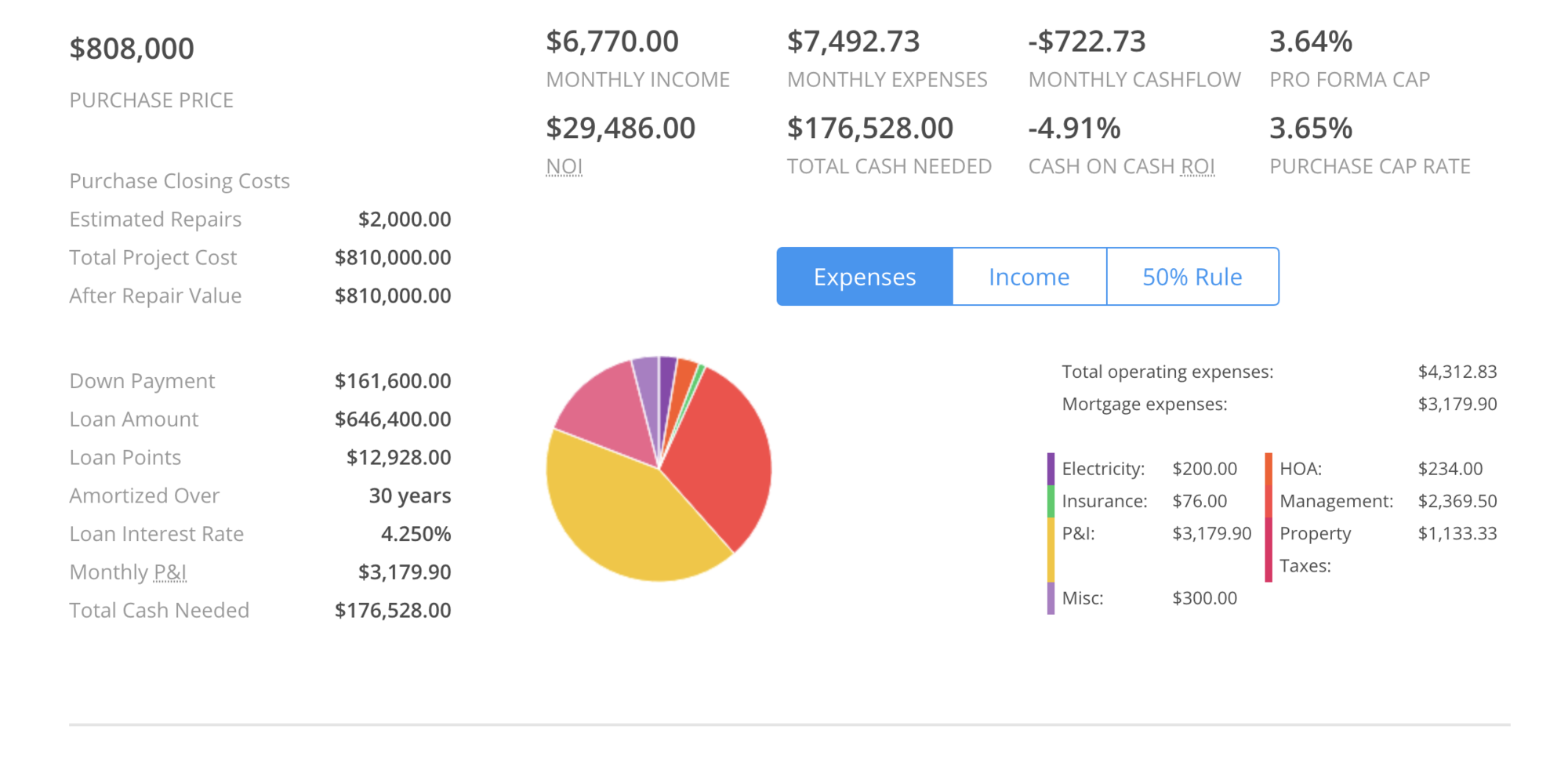

The following is an example concerning negative cash flow on an investment property:

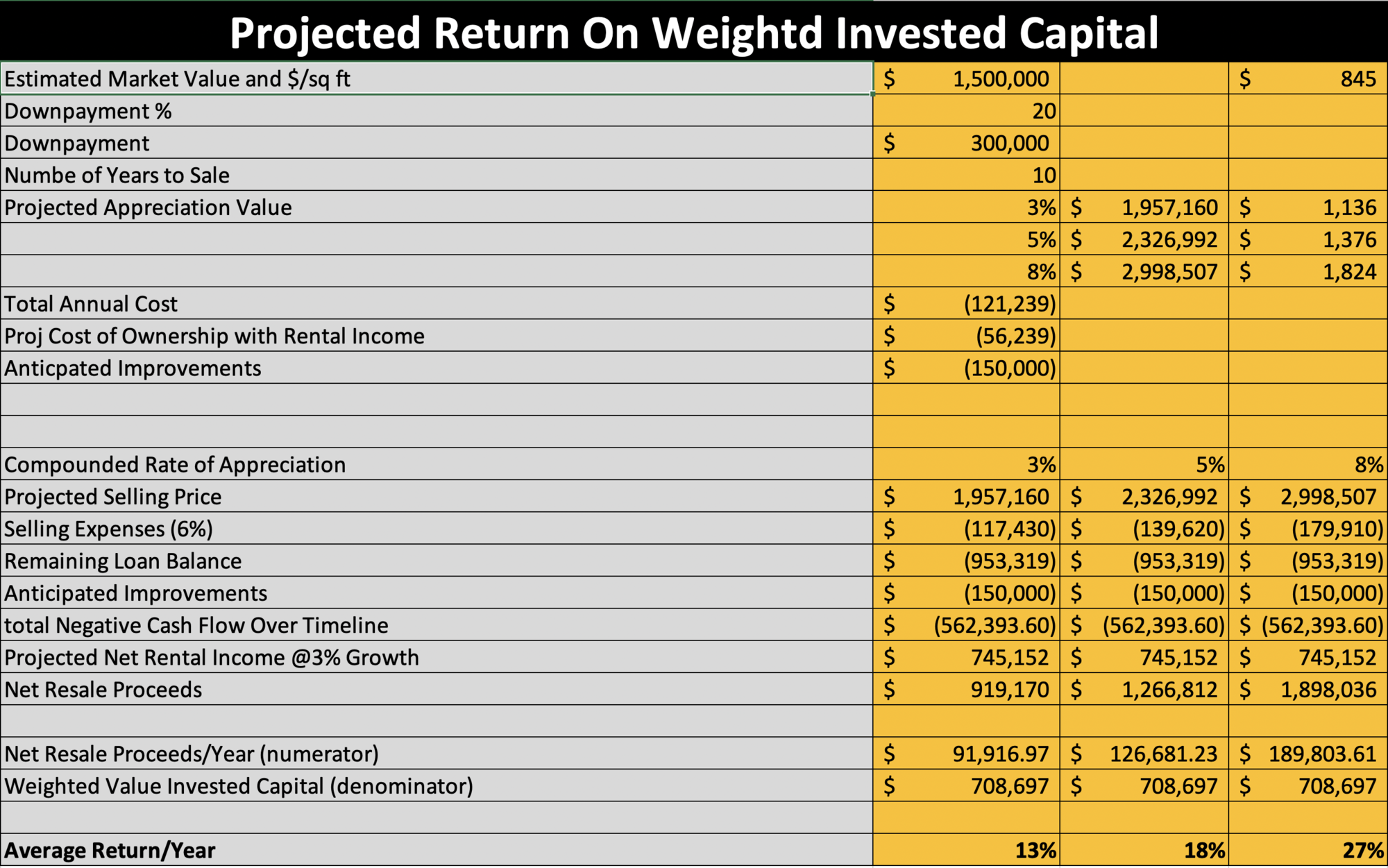

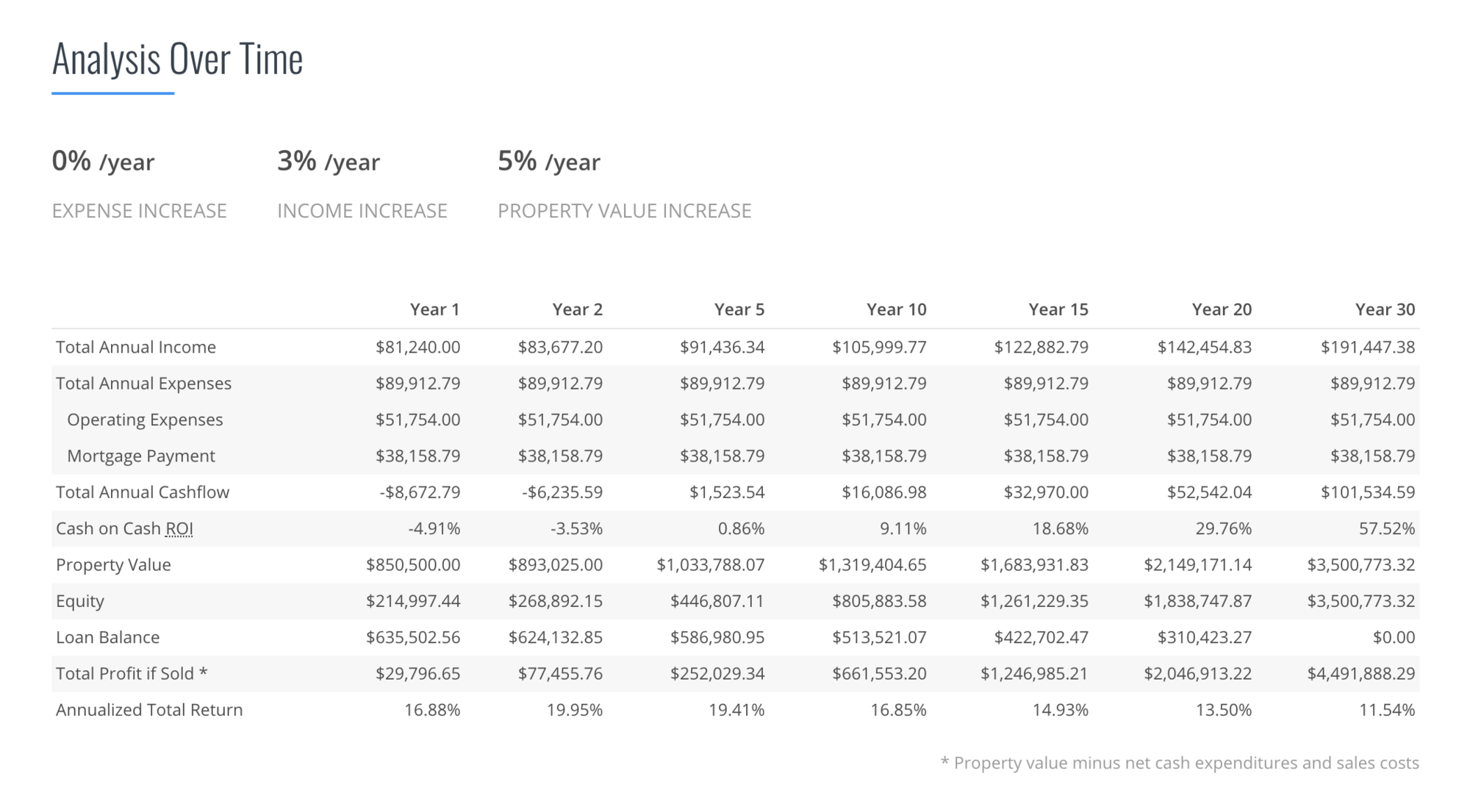

Now that the negative cash flow aspect is understood we can look strategically at a projected return on Weighted Invested Capital:

Constructing a valuation profile that fairly represented a return on invested capital took more than 10 years of trial and error. The presented format has three capital call elements based on a Weighted Cost of Capital approach because of the differences in the timing of injected capital. A down payment is paid on day one and is the easiest of the three to calculate. Negative cash flow occurs monthly over the holding period (say 10 years), which over time can be as much as the initial down payment, the wrinkle being that only half of the amount is outstanding over the timeline. Anticipated Improvements are the last and toughest element to estimate.

It's very difficult to buy a property built 1968-1994, use it for 10 years, and then remarket the asset at a 50%+ mark up without spending money on an interior remodel and/or deteriorated shell and core elements. Most clients buy property, catch their breath, use it for a couple of years, and remodel in year 3, if not sooner. As with the periodic negative cash flow, the delayed timing of these elements favored a Weighted Cost of Capital approach where 50% of the negative cash flow and 85% of the anticipated improvements are added to the down payment to calculate a total invested amount denominator.

As for the numerator, several refinements need to be explained. The purchase price of the property is assumed to be 95% off the list price. Remodeling increases value, but it is unlikely to enjoy a 100% flow through, so only 70% is added to the acquisition cost. This total now becomes the basis for the 3%, 5%, and 8% rates of appreciation projections utilized in the sensitivity analysis.

Expenses associated with the sale, reimbursement of negative cash flow, and anticipated improvements are deducted from the appreciated value, short-term rental income offsets calculated, with the remaining net balance annualized. The presented Return on the Weighted Invested Capital is then computed, to demonstrate that Northern Michigan property ownership can make financial sense with returns equal to or greater than other competing investments. An important "buyer beware" caveat is that the projections are a total capital appreciation play with no recognition as to the time value (IRR) of money.

Disclaimer: This example was put together using a "best-effort" approach. Every property is unique, and a tremendous number of variables influence virtually every sign line item in the financial analysis. Said differently, this analysis was put together on a speculative basis ONLY and your due diligence is required.

BECAUSE IT'S NOT ONLY A HOME… IT'S AN INVESTMENT

Interested in investing in Northern Michigan real estate? Contact Brook Walsh today or call 231-459-3179.

Investment Characteristics

In the coming years. Northern Michigan's premier communities are poised for continuing success in lifestyle enhancement and financial performance. Although one might argue that these sectors appear similar to the ups and downs of real estate, they are in actuality driven by completely different forces. To more clearly understand these distinctions, we offer the following commentary on world-class Northern Michigan property, which is rare and very limited in supply.

Population Demographics

78 million baby boomers, representing one out of every four Americans, are increasingly demanding more travel, leisure, recreation, and vacation homeownership in their never-ending search for lifestyle enhancement and extended family-centered activities.

In a prior survey of 25,000 households with incomes over $200,000, American Demographics magazine listed a vacation home as the number one desired asset for the nation's most affluent households. As wealth continues to concentrate, these top 10% of families will drive demand for the "best of the best."

Socio-Economic Profile

A study by the National Association of REALTORS® concluded that due to 'price elasticity characteristics,' world-class destinations had outpaced national average rates of appreciation by 2:1, with the only question being whether that trend will be reinstated now that the Great Recession is over. Affluent enthusiasts will always seek out sophisticated, diversified communities such as Northern Michigan, capable of meeting their recreational passions and quality of life criteria in a safe and politically stable environment.

Boyne Resorts

The operator of Boyne Highlands and Boyne Mountain is a recognized industry leader in both ski mountain operations and resort real estate development in Northern Michigan.

Their long-running corporate strategy of stripping market share through capital expenditures on resort products, goods, and services is a proven success formula that will continue in the years ahead.

It is important to recognize that the economic engine driving most ski towns is ultimately the ski hills and the successes or failures of ski companies. Therefore, a vibrant, responsive operator who delivers quality and reliable experience will increase demand in the area and see the community prosper.

Appreciation

Since 1991, the compounded average growth rate (CAGR) for Northern Michigan's premiere neighborhoods has been just under five percent (4.88%). This appreciation trend line is bound to continue based on the premise of fixed supply and increasing demand. The US has 113 million households, with the richest 10% controlling nearly 70% of the wealth.

Imagine what would happen if that number were to double as a result of a larger worldwide customer base! The implications of this expanding international component are significant, and as with all multinational corporations, growing markets make for increasingly successful businesses and capital spending.

Summary

You can probably tell that I'm extremely bullish about the future of Northern Michigan real estate. As always, I invite your questions, comments, and interest in becoming part of this exciting transformation.

Now is the time to look at this unique and under-appreciated asset class while prices remain favorable and interest rates low. Don't hesitate to learn more about specific opportunities in our part of the world! I would be pleased to send additional information on this matter.

BECAUSE IT'S NOT ONLY A HOME… IT'S AN INVESTMENT

Browse Northern Michigan real estate listings today, or contact Brook Walsh for more info on investing in Northern Michigan homes for sale.

Northern Michigan's Alpine House Investment Example

The Alpine House has it all! This beautiful 4 bedrooms private home located in the gated community at Boyne Mountain provides an abundance of gathering space and seating areas for your entire group and is TRULY only STEPS away from the Alpine chairlift (the skiway that runs under the lift). You can sit in the living room and watch the chairlift pass by!

Easy access on and off of Boyne Mountain will make this property a favorite for you and your group, and one that you will want to build traditions in. Private hot tub, ski storage, gas-burning outdoor fire-pit, surround sound throughout the home, bumper pool table and 2 larger living rooms will allow everyone in the group to make themselves right at home.

Financial Analysis Behind The Investment

The investor prefers lifestyle properties in resorts with a buy-and-hold philosophy based on an appreciation profile. Here is the purchase information:

You will notice this has NEGATIVE cash flow for a few years. Not unusual for an investment property but very few investors understand this. Now, using a "buy and hold" philosophy, let's see how the investment looks over time:

There is considerably more to the analysis than this but this is a high-level example of lifestyle real estate investing.

Ready to invest in Northern Michigan real estate? Register today with Brook Walsh Home Search. For more Northern Michigan real estate info, contact Brook Walsh today!