Northern Michigan Investment Performance

Evaluating Cash Flow & ROI

The opportunity cost of diverted capital is an important consideration for most clients when evaluating whether a vacation home makes financial sense. If the family net worth is sufficiently large, so that the down payment, mortgage debt, and the cost of carrying elements do not affect longer-term financial goals and objectives, then you probably fit the buyer profile.

Conversely, if the yield is the all-consuming driver, then there are certainly better-performing asset classes. Keep in mind that one-half of the benefit stream can't be measured on an ROI basis. The ideal combination for a vacation home would be lifestyle enhancement and a return on invested capital equal to or greater than a stock or bond market purchase.

Browse investment communities in Northern Michigan now, and be sure to connect with Brook Walsh for more info on investing in Northern Michigan real estate. He'd be happy to help!

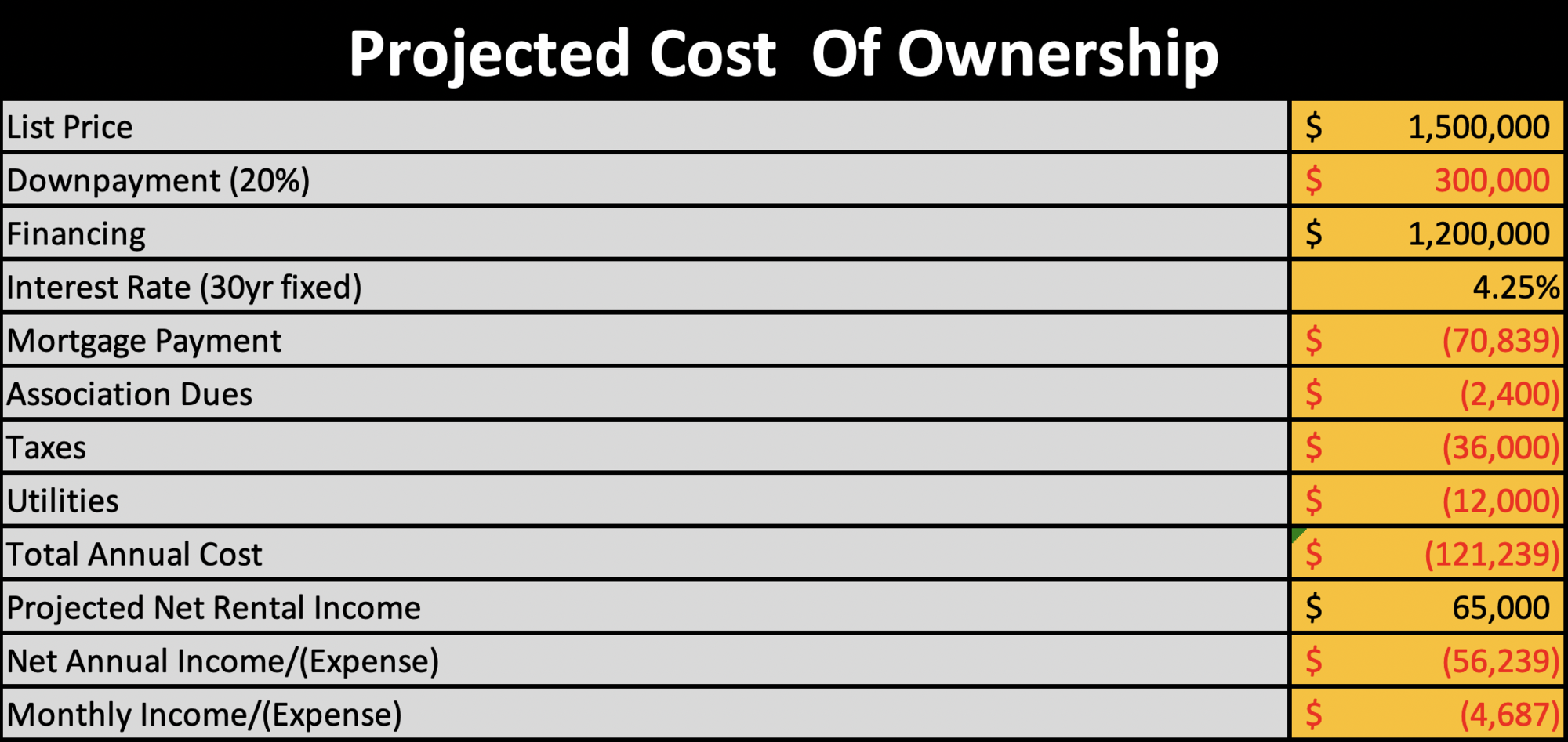

The following is an example concerning negative cash flow on an investment property:

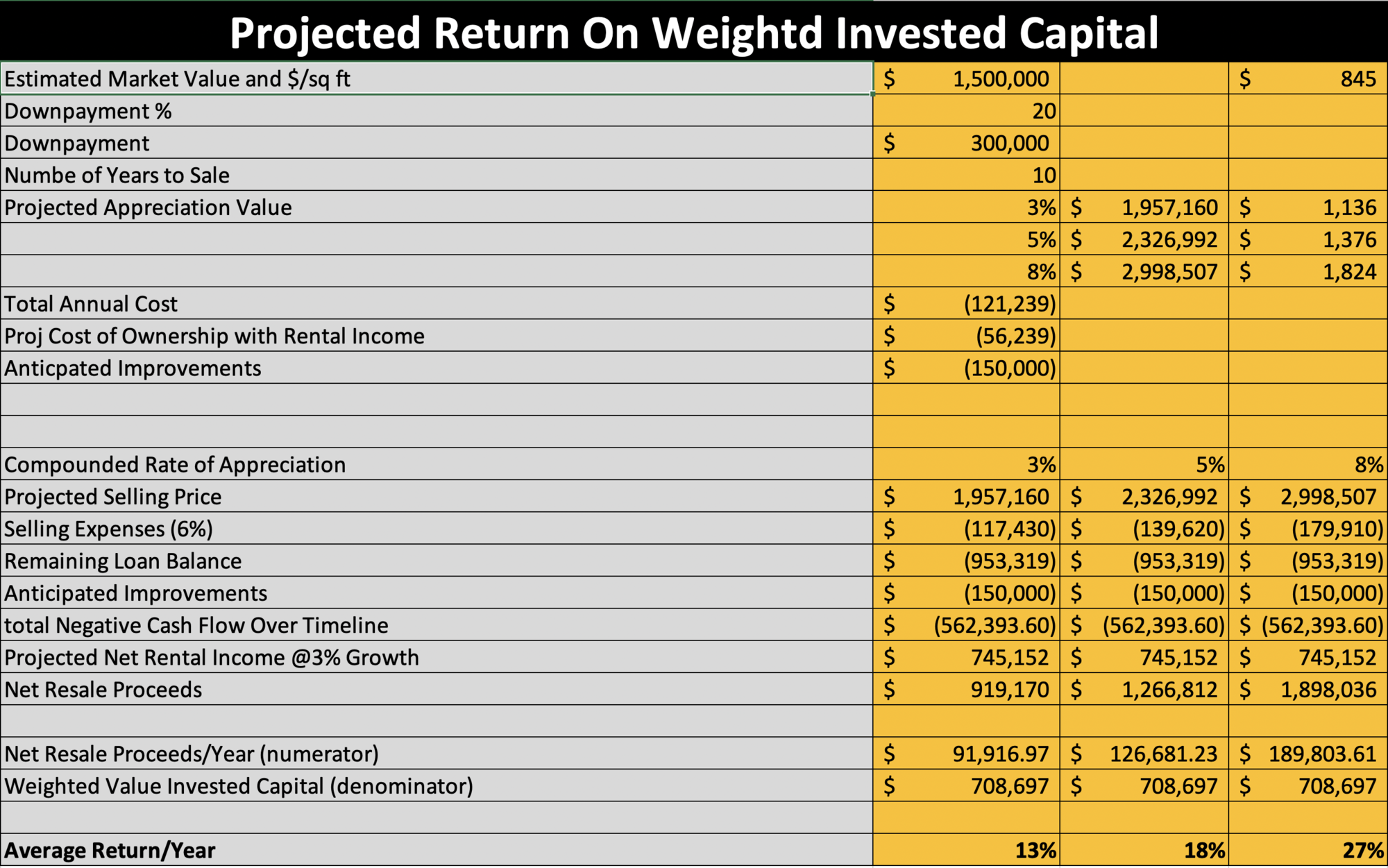

Now that the negative cash flow aspect is understood we can look strategically at a projected return on Weighted Invested Capital:

Constructing a valuation profile that fairly represented a return on invested capital took more than 10 years of trial and error. The presented format has three capital call elements based on a Weighted Cost of Capital approach because of the differences in the timing of injected capital. A down payment is paid day one and is the easiest of the three to calculate. Negative cash flow occurs monthly over the holding period (say 10 years), which over time can be as much as the initial down payment, the wrinkle being that only half of the amount is outstanding over the timeline. Anticipated Improvements is the last and toughest element to estimate.

It's very difficult to buy a property built 1968-1994, use it for 10 years, and then remarket the asset at a 50%+ mark up without spending money on an interior remodel and/or deteriorated shell and core elements. Most clients buy property, catch their breath, use it for a couple of years, and remodel in year 3, if not sooner. As with the periodic negative cash flow, the delayed timing of these elements favored a Weighted Cost of Capital approach where 50% of the negative cash flow and 85% of the anticipated improvements are added to the down payment to calculate a total invested amount denominator.

As for the numerator, several refinements need to be explained. The purchase price of the property is assumed to be 95% off list price. Remodeling increases value, but it is unlikely to enjoy a 100% flow through, so only 70% is added to acquisition cost. This total now becomes the basis for the 3%, 5%, and 8% rates of appreciation projections utilized in the sensitivity analysis.

Expenses associated with the sale, reimbursement of negative cash flow, and anticipated improvements are deducted from the appreciated value, short term rental income offsets calculated, with the remaining net balance annualized. The presented Return on the Weighted Invested Capital is then computed, to demonstrate that Northern Michigan property ownership can make financial sense with returns equal to or greater than other competing investments. An important "buyer beware" caveat is that the projections are a total capital appreciation play with no recognition as to the time value (IRR) of money.

Disclaimer: This example was put together using a "best-effort" approach. Every property is unique, and a tremendous number of variables influence virtually every sign line item in the financial analysis. Said differently, this analysis was put together on a speculative basis ONLY and your due diligence is required.

BECAUSE IT'S NOT ONLY A HOME… IT'S AN INVESTMENT

Interested in investing in Northern Michigan real estate? Contact Brook Walsh today or call 231-459-3179.