Real Estate Statistics

| Average Price | $547K |

|---|---|

| Lowest Price | $148K |

| Highest Price | $1.3M |

| Total Listings | 13 |

| Avg. Days On Market | 360 |

| Avg. Price/SQFT | $99 |

Property Types (active listings)

Browse Cheboygan, MI Commercial Real Estate for Sale and Lease

- All Listings

- $100,000 - $200,000

- $200,000 - $300,000

- $600,000 - $700,000

- $900,000 - $1,000,000

- Over $1,000,000

Cheboygan, MI Commercial Real Estate for Sale and Lease: 7 Prime Opportunities

Explore prime properties, market trends, financing tips, and leasing strategies to maximize your investment returns.

Market Overview of Cheboygan

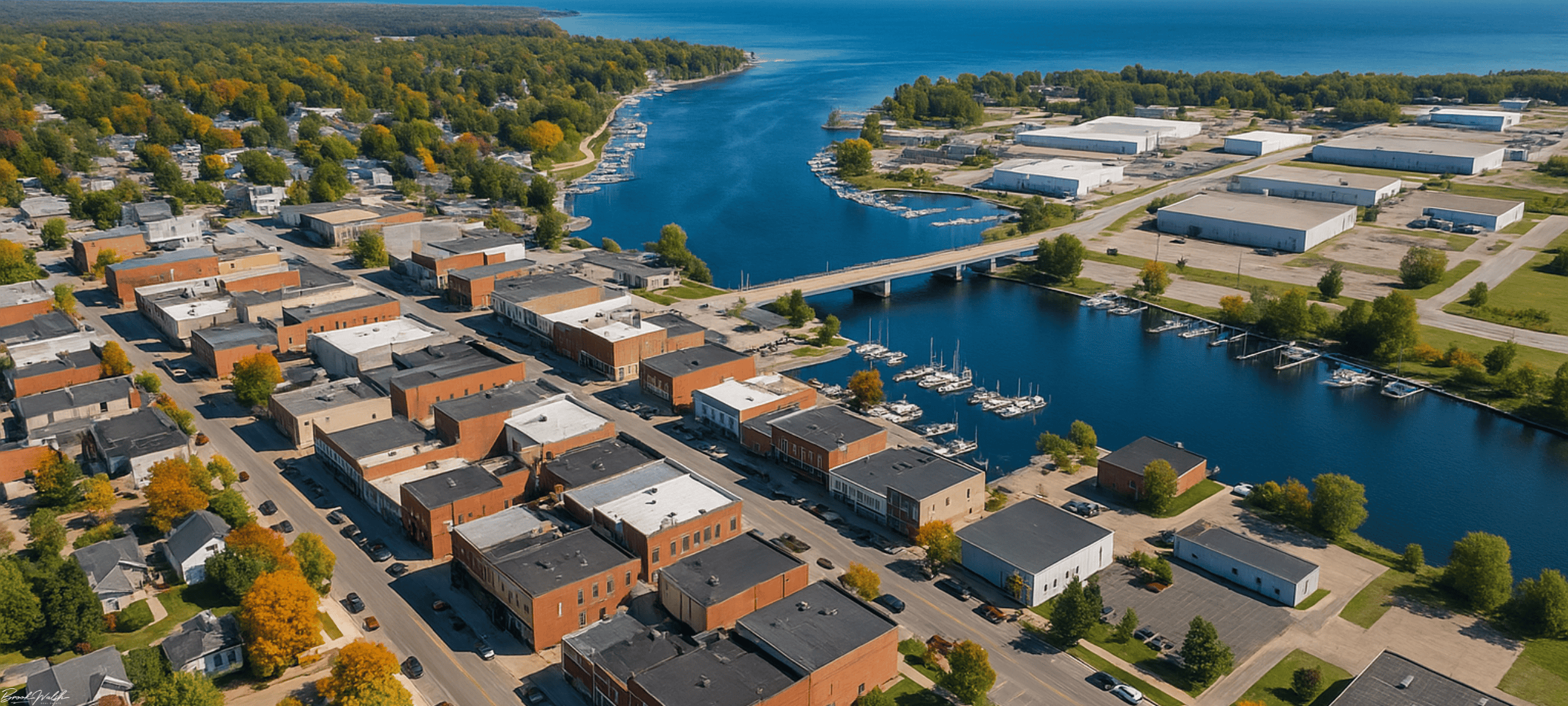

First and foremost, Cheboygan, MI Commercial Real Estate for Sale and Lease attracts investors and local entrepreneurs alike. Located at the northern tip of Lake Huron’s Inland Waterway, this waterfront city of roughly 4,500 residents offers small-town charm with a business-friendly environment. When it comes to Cheboygan, MI Commercial Real Estate for Sale and Lease, you’ll find a balanced mix of retail, office, industrial, and hospitality properties, anchored by steady year-round economic activity and robust seasonal tourism.

To begin with, tourism plays a starring role in Cheboygan’s economy. Each summer, over 200,000 boating enthusiasts and shoreline visitors descend on the city, boosting demand for retail shops, cafés, and lodging. Downtown storefront vacancy rates hover around just 4%, reflecting strong tenant interest. Waterfront properties—particularly those with direct river or lake access—tend to lease within 60 to 90 days during peak season, making them hot commodities. In addition, the city’s annual Tall Ship Celebration and blueberry festival draw crowds in late summer, extending the window for retail and hospitality revenues.

Moreover, manufacturing and logistics sectors have gained momentum over the past five years. Cheboygan’s Industrial Park, situated just off US-23, has welcomed small-batch producers and distributors thanks to competitive land costs and proximity to rail spurs. Current cap rates for warehouse and light industrial properties range between 7% and 8%, providing investors with attractive yields. Importantly, utility rates remain below the state average—electricity at around $0.12 per kWh and city water/sewer rates that are subsidized for new industrial tenants—further sweetening the deal for manufacturing users.

Geographically, Cheboygan benefits from excellent connectivity. US-23 and M-33 intersect near the city, linking it to Alpena, Traverse City, and the Mackinac Bridge corridor. Pellston Regional Airport sits just 20 miles to the west, offering flights to Detroit Metro and beyond, which can be critical for time-sensitive distribution or executive travel. At the end of the day, this accessibility enhances both retail foot traffic and industrial supply-chain efficiency, making commercial parcels here especially appealing.

Demographically, the workforce is diverse and growing modestly. The median household income is about $50,000, and roughly 25% of residents hold management or professional roles. Local colleges and vocational programs in nearby counties supply skilled labor, particularly in manufacturing trades and hospitality management. As a result, employers can tap into a stable labor pool, reducing recruitment costs and downtime—a key factor when choosing between leasing and buying a commercial property in Cheboygan.

In terms of supply dynamics, inventory levels have remained tight, especially for retail and mixed-use spaces. Active commercial listings average around 50 properties, with average days on market near 120 days. However, specialty venues—like historic storefronts or fully renovated office suites—often secure tenants within 90 days due to limited alternatives. Land parcels designated for commercial development can range from $50,000 to $150,000 per acre, while premium waterfront lots command upward of $500,000 per acre, reflecting the high demand for scenic business locations.

Seasonal fluctuations pose challenges, but local property owners have adapted. Many retail and hospitality landlords offer flexible winter lease terms or reduced rates from November through March to keep spaces occupied and cash flow steady. Industrial facilities often include heated loading docks and improved insulation to ensure uninterrupted operations during heavy lake-effect snowstorms. These measures help maintain occupancy and protect long-term investment returns.

Finally, city incentives and infrastructure projects are bolstering prospects. The Cheboygan Main Street program and Chamber of Commerce provide grants up to $5,000 for exterior building improvements. Recent upgrades to the downtown streetscape, including wider sidewalks and new street lighting, have increased pedestrian traffic by 15%. Meanwhile, improvements to the US-23 corridor and plans for a riverfront boardwalk are slated for completion in the next two years, promising to elevate property values across the commercial districts.

Here’s a quick snapshot of key market indicators:

-

Population (2024 est.): 4,500

-

Annual Visitors: 200,000+

-

Retail Vacancy Rate: 4%

-

Average Retail Rent: $10–18/sq ft

-

Industrial Cap Rate: 7%–8%

-

Median Household Income: $50,000

-

Active Listings: ~50 properties

-

Avg. Days on Market: 120 days

At the end of the day, Cheboygan’s commercial real estate landscape is defined by its strategic location, diversified economy, and proactive community initiatives. Whether you’re eyeing a prime downtown storefront or a high-yield industrial building, understanding these market fundamentals is crucial. In the next section, we’ll explore the key commercial districts where these opportunities are concentrated.

Key Commercial Districts

Cheboygan’s commercial real estate landscape is organized into three primary districts, each offering unique advantages depending on your business goals and investment horizon. Understanding these areas will help you pinpoint the right location for optimal visibility, traffic, and growth potential.

Downtown Core and Retail Corridors

The historic downtown district is the heart and soul of Cheboygan’s retail and service economy. Here you’ll find:

-

Historic Storefronts: Charming brick-and-mortar buildings dating back to the late 19th century, many of which have been revitalized with modern amenities while preserving their architectural character.

-

Foot Traffic Hotspots: Main Street and State Street see an average of 1,200 pedestrians per day during peak season, supporting boutiques, coffee shops, and professional services.

-

Anchor Tenants: Local favorites like the Cheboygan Coffee Company and Riverside Bookstore draw visitors year-round, helping stabilize rent rolls for neighboring spaces.

-

Mixed-Use Potential: Upper floors frequently house apartments or office suites, creating built-in customer bases and multifamily income streams.

Leasing Highlights:

| Property Type | Avg. Rent (per sq ft) | Vacancy Rate | Typical Term |

|---|---|---|---|

| Ground-Floor Retail | $12–18 | 4% | 3–5 years |

| Second-Floor Office Suites | $8–12 | 7% | 2–4 years |

| Live/Work Lofts | $14–20 | 5% | 5–7 years |

When considering a downtown location, factor in costs for historic-preservation guidelines and potential façade-improvement grants through the Cheboygan Main Street program. These incentives can offset renovation expenses and fast-track permitting.

Industrial Park and Logistics Zone

Just south of the city limits, the Cheboygan Industrial Park spans over 200 acres of flat, shovel-ready land with the following features:

-

Transportation Access: Frontage on US-23 connects directly to I-75 and the Mackinac Bridge, while a CSX rail spur services heavy freight users.

-

Utilities & Infrastructure: High-voltage power lines, 8-inch water mains, and 4-inch sewer lines are already in place—ideal for light manufacturing, cold storage, or distribution facilities.

-

Site Sizes: Parcels range from 2 to 30 acres, accommodating everything from small fabrication shops to regional distribution centers.

-

Development Incentives: State of Michigan Business Development Program (MBDP) grants and federal Opportunity Zone benefits can apply, reducing development costs and offering tax deferral on capital gains.

Investors targeting industrial assets often see cap rates between 7% and 8%, with long-term triple-net (NNN) leases providing stable passive income. Tenants appreciate the park’s 24/7 truck access, on-site weighbridge, and proximity to major northern Michigan markets.

Waterfront and Harborfront Developments

If you’re seeking a high-visibility location with scenic vistas, Cheboygan’s waterfront district delivers unmatched appeal:

“Waterfront sites in Cheboygan command premium rents due to direct views of Lake Huron and the Cheboygan River—perfect for restaurants, event venues, and upscale retail.”

Key characteristics include:

-

Marina Access: Properties adjacent to Dock 63 Marina attract boaters looking for fuel stops, dining, and marine supplies. Seasonal dock slips create built-in customer traffic for waterfront businesses.

-

Riverwalk Corridor: A planned 1-mile boardwalk along the Cheboygan River will link parks, shops, and eateries, further boosting pedestrian counts by an estimated 20% upon completion.

-

Adaptive Reuse Opportunities: Old fish-packing warehouses and cannery buildings offer large open-floor plans suitable for breweries, galleries, or co-working spaces.

-

Event-Driven Traffic: Annual festivals like the Tall Ship Celebration and Harbor Days fill waterfront parking areas, driving spill-over traffic into nearby commercial venues.

Comparison of Waterfront Lease Types:

| Use Case | Avg. Rent (per sq ft) | Seasonality | Notes |

|---|---|---|---|

| Restaurant/Bar | $20–28 | High | Seasonal patios boost summer revenue |

| Retail Boutiques | $18–24 | Medium | Winterized interiors extend operation |

| Event Venues | $25–30 | High | Flexible leases for peak dates |

Because waterfront real estate often involves conservation easements and shoreline regulations, you’ll want to engage with Michigan’s Department of Environment, Great Lakes, and Energy (EGLE) early in the planning phase. That way you can secure necessary permits for docks, patios, or shoreline stabilization projects without unexpected delays.

By carefully evaluating each district’s unique characteristics—be it the lively downtown core, the infrastructure-rich industrial park, or the picturesque waterfront—you’ll be well equipped to make informed decisions about leasing or purchasing in Cheboygan. In the next section, we’ll delve into the various property types available and how they align with your investment or business objectives.

Property Types Available

Cheboygan’s diverse commercial districts support a wide array of property types, each tailored to different business models and investment strategies. From street-level retail to large industrial complexes, understanding the advantages and considerations of each category will help you match your objectives with the right asset.

Retail Spaces and Shopping Centers

Retail properties remain at the forefront of Cheboygan’s commercial landscape, catering to tourists, locals, and seasonal populations.

-

Standalone Retail Buildings: Ideal for specialty retailers or service providers (e.g., hair salons, fitness studios). Many are located on high-traffic arterials like US-23 or along Main Street.

-

Neighborhood Shopping Centers: Small strip centers anchored by convenience tenants (e.g., grocery, pharmacy). Rents typically range from $10–16 per sq ft (NNN), with average center sizes of 15,000–40,000 sq ft.

-

Power Centers: Cheboygan lacks big-box power centers, which presents opportunities for developers to assemble parcels and introduce category-killer anchors, capturing unmet demand for national brands.

Pros and Cons of Retail Assets:

| Pros | Cons |

|---|---|

| High visibility and foot traffic | Seasonal revenue fluctuations |

| Variety of tenant mix | Tenant turnover can be cyclical |

| Incentive programs for façade work | Requires active management |

Key considerations include parking ratios (4–5 spaces per 1,000 sq ft is standard) and signage visibility. In-line tenancy and endcaps command a rent premium of 10–15% over interior spaces.

Office Buildings and Professional Suites

Office inventory in Cheboygan ranges from converted historic homes to purpose-built two-story structures.

-

Professional Suites: Small-format units (500–2,000 sq ft) popular with medical practitioners, accountants, and legal professionals. Rents generally fall between $8–12 per sq ft (full-service).

-

Multi-Tenant Office Complexes: Buildings with multiple landlords and shared amenities (conference rooms, break areas). Cap rates hover around 6.5–7% for stabilized assets.

-

Executive Office Condominiums: Owner-occupied units allow professionals to build equity and enjoy tax advantages of real estate ownership.

Office Space Comparison:

| Feature | Professional Suites | Multi-Tenant Complexes | Owner-Occupied Condos |

|---|---|---|---|

| Avg. Rent (per sq ft) | $8–12 | $10–14 | N/A (ownership) |

| Typical Lease Term | 2–4 years | 3–5 years | Ownership |

| Tenant Improvement Costs | Moderate | Shared cost pools | Owner-paid |

Reliable broadband and fiber connectivity have become critical; most Class A and B offices offer speeds of 100 Mbps to 1 Gbps, making them suitable for tech-driven SMEs and remote-work hubs. Proximity to court facilities and the county administration building also drives demand for downtown office suites.

Industrial and Warehouse Facilities

Cheboygan’s Industrial Park and nearby logistics zones cater to a broad spectrum of industrial users.

-

Light Manufacturing Plants: Facilities equipped with 12–16-foot clear heights, 3-phase power, and small office components. Typical sizes range from 5,000 to 25,000 sq ft.

-

Cold Storage and Food Processing: Given the region’s agricultural output, there’s growing interest in refrigerated warehouses. Rents run $8–10 per sq ft (NNN) with temperature-controlled systems.

-

Bulk Distribution Centers: Larger footprints (30,000–100,000 sq ft) ideal for regional distributors servicing northern Michigan markets. Many offer drive-in doors, dock-high loading, and 24-hour access.

Industrial Key Metrics:

| Metric | Light Mfg. | Cold Storage | Bulk Distribution |

|---|---|---|---|

| Avg. Rent (per sq ft) | $7–9 | $8–10 | $6–8 |

| Cap Rate | 7–8% | 7.5–8.5% | 6.5–7.5% |

| Typical Lease Term | 5–10 years | 7–12 years | 10–15 years |

Accessibility to CSX rail spurs and major highways reduces last-mile delivery times, making Cheboygan competitive for logistics operations. Developers often include 50–100 trailer parking spaces to accommodate fluctuating freight demands.

Mixed-Use and Adaptive Reuse Projects

With a growing emphasis on live-work-play environments, mixed-use developments and adaptive reuse of historic structures have become increasingly popular.

-

Mixed-Use Developments: Combine ground-floor retail or dining with upper-level residences or offices. Typical projects range from 10,000 to 50,000 sq ft, with rental rates reflecting blended uses (retail at $15–20, residential at $1,200–1,500/unit per month).

-

Adaptive Reuse: Converting former industrial or civic buildings into lofts, studios, or coworking spaces. These unique assets often qualify for Historic Tax Credits, covering up to 20% of rehabilitation costs.

-

Live/Work Lofts: Tailored for creative professionals seeking integrated spaces. These units usually start at $1,500 per month, with flexible zoning allowing for home-based businesses.

Benefits of Mixed-Use & Reuse:

-

Diversified income streams mitigate risk.

-

Higher per-square-foot returns than single-use assets.

-

Community revitalization and market differentiation.

When pursuing adaptive reuse, it’s crucial to coordinate with local preservation commissions and understand building-code requirements for fire safety, accessibility, and structural upgrades. Successful projects tap into Cheboygan’s rich heritage, transforming underutilized sites into vibrant community anchors.

By evaluating the spectrum of property types—from storefronts and offices to industrial parks and innovative mixed-use projects—you can align your Cheboygan investment strategy with the opportunities that best suit your risk profile and growth ambitions. In the following section, we’ll examine investment and financing considerations, delving into cap rates, ROI expectations, and incentive programs.

Investment & Financing Considerations

Securing the right financing and understanding key investment metrics can make or break your success with Cheboygan, MI Commercial Real Estate for Sale and Lease. In this section, we’ll unpack cap rates, net operating income (NOI), expected ROI, available loan products, and incentive programs that can enhance your return profile.

Cap Rates, NOI, and Expected ROI

First off, cap rates serve as a shorthand gauge of a property’s income‐producing potential. In Cheboygan:

-

Retail Assets: Cap rates typically range from 6.5% to 7.5%, reflecting stable foot‐traffic venues and national‐brand tenants.

-

Office Buildings: Expect cap rates near 6%–7%, given moderate demand and mixed tenancy.

-

Industrial Facilities: These command higher rates—around 7%–8%—due to growing logistics and manufacturing interest.

-

Mixed‐Use/Adaptive Reuse: Specialty properties often yield cap rates of 6%–7%, factoring in tax‐credit benefits and unique income streams.

NOI Calculation Example:

A waterfront restaurant generating $300,000 in gross rent, less $60,000 operating expenses, yields an NOI of $240,000. At a 7% cap rate, its indicative value is:

In terms of expected ROI, most Cheboygan investors target a blended cash‐on‐cash return of 8%–12%, depending on leverage and property type. With conservative leverage (60% loan‐to‐value), annual debt service coverage ratios (DSCR) of 1.2–1.4 are common, ensuring sufficient cushion against revenue dips during off‐peak months.

Financing Options and Lender Landscape

When it comes to financing northern Michigan commercial real estate in Cheboygan, a variety of loan products are on the table:

-

Conventional Bank Loans: Local banks and credit unions often provide 5–10‐year terms with amortizations up to 25 years. Rates typically float around Prime + 1% or fix near 5%–6%, depending on creditworthiness and collateral quality.

-

Small Business Administration (SBA) 7(a) & 504 Loans: For owner‐occupied or adaptive‐reuse projects, SBA loans offer low down payments (10%–15%) and long amortizations (up to 25 years for real estate). The SBA 504 program, in particular, can finance up to 90% of project costs when paired with a certified development company.

-

Commercial Mortgage‐Backed Securities (CMBS): For stabilized, multi‐tenant properties over $5 million in value, CMBS offers non‐recourse financing with 7–10‐year fixed rates in the low-5% range. Prepayment penalties and defeasance provisions, however, add complexity.

-

Hard Money & Bridge Loans: Short-term, higher-interest (8%–12%) loans can bridge gaps during renovation or repositioning phases, typically for 6–24 months. These loans prioritize loan-to-cost ratios, often capping at 65%–75%.

-

Federal & State Programs: Michigan’s Business Development Program (MBDP) and the Michigan Economic Development Corporation (MEDC) offer low-interest loans and grants for job-creating development, particularly in designated Opportunity Zones.

Tip: Always shop multiple lenders and compare all-in costs—including origination fees, rate locks, and balloon payment requirements—to find the most competitive financing structure for your project.

Tax Credits, Grants, and Incentives

Cheboygan’s proactive business climate means a suite of incentives is at your disposal:

-

Federal Historic Tax Credit (HTC): If you’re undertaking an adaptive‐reuse conversion of a certified historic building, you can claim 20% of qualified rehabilitation expenditures as a dollar-for-dollar credit against federal tax liability.

-

State Historic Preservation Tax Credit: Michigan offers an additional 25% credit on eligible expenses, subject to program caps and local historic‐district approvals.

-

Rehabilitation Investment Tax Credit (RITC): For non-historic properties undergoing substantial improvements, you may qualify for a 10% credit on qualified costs.

-

Brownfield Redevelopment Credits: Contaminated or underutilized sites that require environmental remediation may be eligible for refundable tax credits covering up to 50% of eligible cleanup expenses.

-

Local Façade Improvement Grants: The Cheboygan Main Street program provides matching grants (up to $5,000) for exterior upgrades that enhance the historic character of downtown buildings.

-

Opportunity Zone Deferrals: Certain census tracts in Cheboygan are designated Opportunity Zones. By investing capital gains into a qualified Opportunity Fund, you can defer and potentially reduce tax liability on those gains.

Pro Tip: Layering credits—such as pairing Federal HTC with state credits and local grants—can significantly lower your effective development cost, boosting your leveraged IRR by 2–3 percentage points.

Navigating the intersection of cap rates, financing products, and incentive programs is crucial to structuring a deal that makes sense for your risk tolerance and return expectations. In the next section, we’ll weigh the pros and cons of leasing versus buying in Cheboygan, helping you decide which path aligns best with your strategic objectives.

Leasing vs. Buying in Cheboygan

Deciding whether to lease or buy commercial real estate in Cheboygan hinges on your capital position, risk tolerance, and long-term objectives. Both paths have distinct advantages and trade-offs, so let’s break them down.

Advantages of Leasing Commercial Space

-

Lower Up-Front Costs

Leasing allows you to occupy a space without a hefty down payment or large equity requirement. You’ll typically pay a security deposit and the first month’s rent, freeing up capital for inventory, marketing, or tenant improvements. -

Flexibility and Scalability

If your business grows (or contracts), a lease term of 3–5 years with renewal options lets you upsize, downsize, or relocate with relative ease. This is especially useful in Cheboygan’s seasonal market, where foot traffic spikes in summer but slows in winter. -

Maintenance and Repairs

Many leases—particularly gross or modified gross structures—shift maintenance obligations to the landlord. This can simplify budgeting, as you’re not on the hook for major roof, HVAC, or structural repairs. -

Speed to Market

Because the landlord often handles larger improvements, you can move in and begin operations faster. Quick turnaround is key if you’re capitalizing on events like the Tall Ship Celebration or harbor-front festivals. -

Operational Focus

Leasing frees you from the administrative burden of property ownership—no property tax filings, no insurance negotiations, no capital-expense planning—letting you concentrate on running your business.

Benefits of Ownership and Equity Building

-

Long-Term Wealth Creation

Buying commercial property turns rent payments into equity. As Cheboygan’s market values appreciate—fueled by waterfront boardwalk enhancements and infrastructure grants—you stand to benefit from both cash-flow and capital gains. -

Fixed Costs

With a fixed-rate mortgage, your principal and interest remain constant over the loan term, shielding you from market rent escalations. Predictable occupancy costs are invaluable for multi-year planning and financial forecasting. -

Tax Advantages

Owners can deduct mortgage interest, property taxes, depreciation, and qualified improvement expenses, effectively lowering taxable income. Historic and rehab tax credits can further boost your after-tax return. -

Control Over Asset

As owner, you call the shots on tenant mix, property upgrades, and leasing terms. You can pursue value-add strategies—like converting vacant upstairs offices into income-generating apartments—without seeking landlord approval. -

Potential for Passive Income

By securing long-term, triple-net (NNN) leases with creditworthy tenants, you can enjoy steady, low-management income, turning your property into a reliable wealth-building asset.

Negotiation Strategies and Lease Structures

Whether you lease or prepare to buy, sharpen your negotiation toolkit:

-

Escalation Clauses: Build annual rent increases (e.g., 2–3% per year or tied to CPI) into leases to protect the landlord’s value—and anticipate your future operating costs.

-

Tenant Improvement (TI) Allowances: Negotiate landlord-funded build-outs or shop-doors to customize the space with minimal cash outlay. Average TI packages in Cheboygan range from $10 to $30 per sq ft, depending on the landlord’s class of asset.

-

Lease Term & Renewal Options: Aim for initial terms of at least three years with two to three five-year renewal options. This provides long-term security while preserving flexibility.

-

Exclusivity Clauses: If you’re a specialty retailer or restaurant, secure exclusivity to prevent the landlord from leasing adjacent spaces to direct competitors.

-

Right of First Refusal (ROFR): If the landlord decides to sell, an ROFR gives you the chance to match any third-party offer—an invaluable tool if you’ve built your business around that location.

-

Early Termination & Subleasing: Even in ownership scenarios, negotiate for sublease rights or early buy-out clauses to mitigate risk should your plans change.

Tip: Always run a pro forma analysis comparing total lease costs (rent + operating expenses + TI amortization) versus debt service and ownership costs. A well-structured pro forma will reveal the true economic break-even point and highlight which strategy aligns best with your cash-flow requirements.

By weighing these leasing and buying considerations against your business model and Cheboygan’s market dynamics—seasonal demand swings, evolving waterfront amenities, and local incentive programs—you can chart a path that maximizes upside while minimizing risk. Next up, we’ll explore development and redevelopment opportunities, from raw-land projects to historic adaptive-reuse ventures.

Development & Redevelopment Opportunities

Cheboygan’s evolving landscape presents compelling avenues for both ground-up development and adaptive reuse, driven by supportive zoning, targeted incentives, and growing demand for modernized commercial spaces. Whether you’re eyeing a raw-land project in the Industrial Park or a heritage building in the downtown core, understanding the local frameworks and best practices will accelerate your timeline and optimize returns.

Zoning, Permitting & Entitlements

-

Zoning Districts

-

Commercial Downtown (C-1): Permits retail, restaurants, offices, and live/work units. Height limits up to 35 ft create opportunities for multi-story mixed-use.

-

General Commercial (C-2): Along US-23 and M-33, allows larger footprint retail, gyms, and automotive services. Setbacks and parking ratios are more flexible here.

-

Industrial (I-1): Covers the 200-acre Industrial Park; supports light manufacturing, warehousing, and distribution. Minimize site plan review time by adhering to lot coverage and building-height standards.

-

Riverfront Overlay: Overlay district along the Cheboygan River imposes design guidelines for façades, signage, and landscaping to enhance the waterfront experience.

-

-

Permitting Process

-

Site Plan Review: Submit to the Planning Commission for projects exceeding 2,000 sq ft or involving new construction. Typical review takes 30–45 days.

-

Building Permits: Issued by the City’s Building Department; plan checks for structural, mechanical, and electrical systems average 2–3 weeks.

-

EGLE Permits: Required for any shoreline work, dock installations, or stormwater discharges into Lake Huron. Early coordination can prevent costly redesigns.

-

-

Entitlements & Variances

When a project doesn’t conform to existing zoning—such as reducing parking or increasing building height—applying for a variance through the Zoning Board of Appeals is key. Success hinges on demonstrating minimal impact to neighbors and alignment with the city’s master plan goals.

Major Planned Projects & Infrastructure

-

Riverwalk Boardwalk Extension: Scheduled completion in Q3 2026, this 1-mile pedestrian path will connect the downtown core to the marina district, unlocking new retail frontage and event-space potential. Early developers are already securing lots adjacent to the planned route.

-

US-23 Corridor Upgrade: MDOT’s $18 million widening and streetscape enhancement project (2025–2027) will add turning lanes, bike lanes, and pedestrian crossings, elevating visibility for adjacent commercial parcels and improving traffic flow.

-

Industrial Park Utility Expansion: A $3 million grant will extend 12-inch water mains and roadway improvements to the Park’s southern sector by late 2025, opening 40 acres of new shovel-ready land.

Ground-Up Development Strategies

-

Speculative vs. Pre-Leased Construction:

-

Speculative (“Spec”) Buildings: Build to suit projected market demand—ideal for industrial facilities or flex spaces. Higher risk but faster delivery when the market is tight.

-

Pre-Leased Projects: Secure anchor tenants before breaking ground to reduce financing risk and often qualify for better loan terms. Common for retail centers and professional office buildings where creditworthy tenants are plentiful.

-

-

Site Selection Criteria:

-

Visibility & Access: Frontage on major arterials commands rent premiums of 10–15%.

-

Utilities & Topography: Flat sites with existing infrastructure significantly reduce site-prep costs, which can range from $5 to $15 per sq ft.

-

Environmental Assessments: Phase I ESAs are recommended upfront—especially for industrial parcels—to identify potential brownfield liabilities and capture remediation credits.

-

-

Cost Drivers & Budgeting:

-

Construction Costs: Average $150–$200 per sq ft for core and shell industrial; $200–$275 per sq ft for Class A office; $225–$325 per sq ft for retail centers (2025 estimates).

-

Soft Costs: Plan for 20%–25% of total project costs covering architectural, engineering, permits, and financing fees.

-

Contingency Reserves: Allocate 5%–10% for unforeseen site conditions, such as soil remediation or utility relocation.

-

Adaptive Reuse & Historic Rehabilitation

-

Identifying Candidates:

-

Historic Warehouses & Mills: Solid masonry shells, open-plan interiors, and river-adjacent locations make these ideal for breweries, event spaces, or creative studios.

-

Downtown Heritage Buildings: Structures built before 1930 often qualify for Historic Tax Credits and can accommodate retail below with apartments or offices above.

-

-

Incentive Stacking:

-

Combine the 20% Federal Historic Tax Credit, 25% Michigan Historic Tax Credit, and local façade grants to offset up to 65% of qualified rehab expenditures.

-

Leverage Brownfield Credits for sites requiring environmental cleanup to further reduce net costs.

-

-

Design & Regulatory Considerations:

-

Preservation Standards: Follow the Secretary of the Interior’s Standards for Rehabilitation to maintain credit eligibility.

-

Accessibility Upgrades: Integrate ADA ramps, elevators, and restroom facilities without compromising historic character.

-

Energy Efficiency: Insulate roof and walls, upgrade windows with historically appropriate storefronts, and install high-efficiency HVAC to improve operating margins.

-

Risk Mitigation & Project Management

-

Phased Delivery: Break projects into modules—such as core and shell followed by tenant fit-outs—to manage cash flow and respond to market feedback.

-

Guaranteed Maximum Price (GMP) Contracts: Secure a GMP with your general contractor to cap cost overruns, shifting some financial risk away from the developer.

-

Local Partnerships: Collaborate with BrookWalsh.com and NorthernMichiganEscapes.com for on-the-ground insights, contractor referrals, and connections to incentive programs.

By tapping into Cheboygan’s growth-oriented infrastructure plans, incentivized redevelopment frameworks, and adaptive reuse potential, developers can position themselves at the forefront of the city’s commercial renaissance. In the next section, we’ll outline how to partner effectively with Brook Walsh at BrookWalsh.com and NorthernMichiganEscapes.com to streamline your search and execution process.

Working with Brook Walsh at BrookWalsh.com

Partnering with a local expert is the fastest way to navigate Cheboygan’s dynamic commercial real estate market. As the managing broker behind BrookWalsh.com, Brook Walsh combines deep Northern Michigan roots with sophisticated investment know-how to help you identify—and close on—the best opportunities.

Why Partner with NorthernMichiganEscapes.com

-

Local Intelligence & Network

Brook’s decades of experience in Northern Michigan translate into insider knowledge of off-market listings, upcoming infrastructure plans, and the most motivated sellers. Through NorthernMichiganEscapes.com, he’s cultivated relationships with town planners, contractors, and fellow brokers, giving clients first-look access to premium assets. -

Customized Strategy

Every investor and business owner has unique goals. Brook develops tailored pro formas, performs rigorous market analyses, and leverages incentive-stacking techniques (historic tax credits, façade grants, Opportunity Zone deferrals) to maximize your return on investment. -

End-to-End Service

From initial site scouting to deal structuring, due diligence, financing coordination, and lease negotiation, Brook’s hands-on approach ensures a seamless transaction. His background in hospitality management via NorthernMichiganEscapes.com also benefits retail and hospitality clients seeking proven operational best practices.

Steps to Get Started with Your Search

-

Initial Consultation

Visit BrookWalsh.com to schedule a no-obligation call. Brook will review your investment criteria—asset type, budget range, desired cap rate—and provide preliminary market insights. -

Property Shortlist & Analysis

Based on your goals, Brook compiles a curated list of 8–12 properties. Each listing includes a detailed pro forma, zoning review, and a comparative-market snapshot to help you weigh pros and cons. -

Site Tours & Due Diligence

Accompanied by Brook, tour your top choices in person. He’ll introduce you to local officials as needed, coordinate environmental and structural assessments, and refine financial models in real time. -

Offer & Negotiation

Leveraging his negotiation expertise and relationships with local lenders, Brook structures an offer designed to secure favorable terms—whether you’re leasing with attractive tenant improvements or buying with seller financing. -

Closing & Transition

Brook stays at your side through closing, ensuring all documentation is in order. Post-closing, he can connect you with property managers, contractors, and marketing specialists via NorthernMichiganEscapes.com to hit the ground running.

Frequently Asked Questions

1. What is the average time on market for commercial listings in Cheboygan?

A. Active properties typically spend 120 days on market, though high-demand waterfront and downtown storefronts often lease or sell within 60–90 days.

2. Are there any tax incentives for rehabilitating historic buildings?

A. Yes—properties on the National Register qualify for a 20% federal Historic Tax Credit and a 25% Michigan state credit on qualified rehabilitation expenditures.

3. Can I lease seasonally to match Cheboygan’s tourism cycle?

A. Absolutely. Many landlords offer flexible lease terms—such as 8-month summer leases or gross leases with graduated rent—to align with peak tourist seasons and winter demand fluctuations.

4. How much parking is required for retail versus office properties?

A. Retail centers generally require 4–5 spaces per 1,000 sq ft. Office buildings often need 3–4 spaces per 1,000 sq ft, though downtown professional suites sometimes leverage shared municipal parking.

5. What financing options exist for adaptive-reuse projects?

A. You can combine SBA 504 loans (up to 90% financing), historic-tax-credit equity, and Brownfield remediation credits to cover up to 80% of redevelopment costs.

6. How do Opportunity Zones affect my investment?

A. By reinvesting capital gains into a qualified Opportunity Fund focused on Cheboygan’s OZ tracts, you can defer taxes on those gains until 2026—and potentially reduce or eliminate tax on fund-generated appreciation if held 10+ years.

Conclusion & Next Steps

Cheboygan, MI offers a compelling canvas for commercial real estate investors and business owners alike. With its waterfront allure, robust industrial park, and revitalized downtown, you can choose from a spectrum of property types and structures to meet your strategic goals. By leveraging detailed market analysis, diverse financing tools, and local incentive programs—and by partnering with Brook Walsh through BrookWalsh.com and NorthernMichiganEscapes.com—you’ll gain the insights and support needed to thrive.

Ready to explore Cheboygan’s prime commercial opportunities?

-

Visit BrookWalsh.com for a complimentary consultation.

-

Download our Cheboygan Commercial Property Guide on NorthernMichiganEscapes.com for in-depth market data and off-market listings.

-

Schedule your site tours and start turning market insights into action.

Continue your Northern Michigan commercial real estate search in the communities below or contact Brook Walsh to help you with your search.

Browse Other Communities

- Alanson, MI Commercial Real Estate

- Alpena, MI Commercial Real Estate

- Atlanta, MI Commercial Real Estate

- Bay Harbor, MI Commercial Real Estate

- Beaver Island, MI Commercial Real Estate

- Bellaire, MI Commercial Real Estate

- Beulah, MI Commercial Real Estate

- Brutus, MI Commercial Real Estate

- Boyne City, MI Commercial Real Estate

- Boyne Falls, MI Commercial Real Estate

- Cadillac, MI Commercial Real Estate

- Carp Lake, MI Commercial Real Estate

- Central Lake, MI Commercial Real Estate

- Charlevoix, MI Commercial Real Estate

- Cheboygan, MI Commercial Real Estate

- Cross Village, MI Commercial Real Estate

- East Jordan, MI Commercial Real Estate

- Elk Rapids, MI Commercial Real Estate

- Ellsworth, MI Commercial Real Estate

- Empire, MI Commercial Real Estate

- Fife Lake, MI Commercial Real Estate

- Frankfort, MI Commercial Real Estate

- Gaylord, MI Commercial Real Estate

- Glen Arbor, MI Commercial Real Estate

- Grayling, MI Commercial Real Estate

- Harbor Springs, MI Commercial Real Estate

- Hillman, MI Commercial Real Estate

- Honor, MI Commercial Real Estate

- Houghton Lake, MI Commercial Real Estate

- Indian River, MI Commercial Real Estate

- Interlochen, MI Commercial Real Estate

- Johannesburg, MI Commercial Real Estate

- Kalkaska, MI Commercial Real Estate

- Kewadin, MI Commercial Real Estate

- Kingsley, MI Commercial Real Estate

- Lake Ann, MI Commercial Real Estate

- Lake City, MI Commercial Real Estate

- Leland, MI Commercial Real

- Levering, MI Commercial Real Estate

- Lewiston, MI Commercial Real Estate

- Mackinac Island, MI Commercial Real Estate

- Mackinaw City, MI Commercial Real Estate

- Manton, MI Commercial Real Estate

- Manistee, MI Commercial Real Estate

- Maple City, MI Commercial Real Estate

- Northport, MI Commercial Real Estate

- Onaway, MI Commercial Real Estate

- Onekama, MI Commercial Real Estate

- Pellston, MI Commercial Real Estate

- Petoskey, MI Commercial Real Estate

- Rogers City, MI Commercial Real Estate

- Roscommon, MI Commercial Real Estate

- Suttons Bay, MI Commercial Real Estate

- Tawas City, MI Commercial Real Estate

- Thompsonville, MI Commercial Real Estate

- Topinabee, MI Commercial Real Estate

- Traverse City, MI Commercial Real Estate

- Vanderbilt, MI Commercial Real Estate

- Walloon Lake, MI Commercial Real Estate

- Williamsburg, MI Commercial Real Estate

- Wolverine, MI Commercial Real Estate

Start searching for your dream home now.

When it comes to convenience, our site is unparalleled. Whether you're in the comfort of your home, or on the go.

Our site works flawlessly on multiple devices so you can find the information you need.