Vanderbilt, MI Commercial Real Estate offers a variety of leasing structures designed to suit both landlords and tenants, whether you’re an entrepreneur seeking affordable retail space or an investor targeting long-term income. In the first 10% of this section, let’s dive into the most common lease types you’ll encounter. Triple-Net (NNN) leases are popular for retail and industrial assets, where tenants pay base rent plus property taxes, insurance, and maintenance. Modified Gross leases—often used in office buildings—bundle some operating expenses into the rent, giving tenants predictable costs. Absolute Net leases place nearly all responsibilities on the tenant, while Full Service Gross leases roll all expenses into a single rent payment.

When evaluating lease structures, it’s critical to balance risk and reward. With a Vanderbilt, MI Commercial Real Estate NNN lease, landlords enjoy stable, low-management obligations and typically command cap rates 0.25–0.50% lower than gross‐lease counterparts. Meanwhile, tenants benefit from transparent pass-through costs and often secure longer lease terms—five to ten years with renewal options—providing predictability for business planning. Conversely, Full Service Gross leases simplify budgeting for tenants but expose landlords to variable operating costs, which can erode net operating income if utility rates or maintenance expenses spike.

Financing commercial real estate deals in Vanderbilt, MI follows familiar paths, yet local nuances can unlock competitive advantages. Traditional bank loans—both fixed and adjustable—remain the backbone of property acquisition, offering up to 75% loan-to-value (LTV) for stabilized assets. The Small Business Administration’s 504 and 7(a) programs provide low-down-payment options for owner-occupiers of owner-occupied retail and office properties. For larger investors, commercial mortgage‐backed securities (CMBS) and life company loans deliver attractive long-term, fixed‐rate financing at pre‐Covid-19 pricing levels.

Additionally, community development financial institutions (CDFIs) active in northern Michigan sometimes offer gap financing and mezzanine loans for projects that deliver public benefits—such as mixed-use developments adding residential units above shops. Seller financing can also be negotiated, reducing closing costs and providing flexible payment schedules; it’s especially useful when traditional lenders require extensive historic operating statements for niche properties. In every scenario, lenders will scrutinize your pro forma, debt service coverage ratio (DSCR), and borrower creditworthiness, so having detailed financial models ready is essential.

Return on investment expectations in Vanderbilt, MI Commercial Real Estate hinge on property type and lease structure. Retail assets in the downtown core—often leased on NNN terms to national or regional chains—currently yield cap rates in the 6.5%–7.5% range. Office suites commanded at $16–$18 per square foot gross translate to cash-on-cash returns of 8%–10% for well-leveraged deals. Industrial units offering $8–$10 PSF triple net can deliver slightly higher yields, given lower tenant improvement allowances and longer lease durations. Mixed-use redevelopment projects, while requiring higher upfront capital for construction and entitlement, can produce blended yields of 9%–11% once stabilized.

It’s worth noting that Vanderbilt’s small-town market premiums can differ from urban averages by 0.25%–0.75%, reflecting both lower competitive bidding and seasonal demand fluctuations. Seasonal cash flow modeling is crucial: vacancy spikes in the off-season can depress effective rental rates, so underwriting should include realistic allowance for downtime—usually 5%–10% of annual gross potential rent. By contrast, properties tied to year-round professional services or light manufacturing see more stable occupancy, minimizing revenue variability.

From an investment management perspective, leveraging professional property management firms can enhance net operating income (NOI) through proactive leasing, maintenance oversight, and expense audits. Vanderbilt, MI Commercial Real Estate investors typically allocate 3%–5% of gross revenue to professional management fees, a worthwhile cost to secure higher tenant retention and timely lease renewals. Regular market reviews—conducted quarterly—help investors adjust rental rates in line with local inflation and competitive listings, preserving yield and asset value.

Finally, tax considerations and depreciation play a pivotal role in overall returns. Section 179 expensing and bonus depreciation can accelerate deductions on tenant improvements and equipment purchases, enhancing after-tax cash flow in the first five years. Cost segregation studies—allocating building costs among shorter‐lived components like signage, carpeting, and electrical systems—can further boost early-year depreciation and improve net present value (NPV). Always consult a local CPA familiar with Michigan real estate tax codes to optimize your financing and investment strategy.

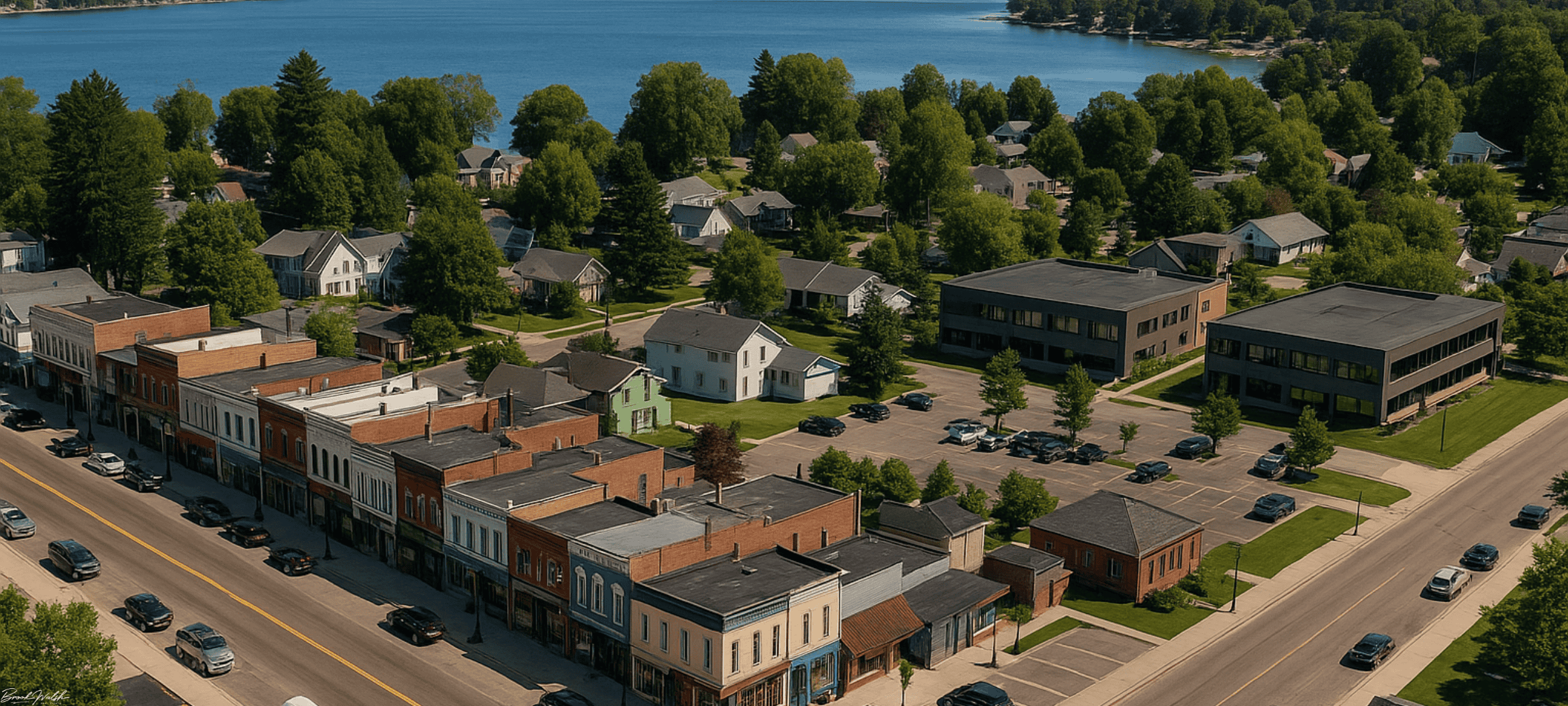

In summary, Vanderbilt, MI Commercial Real Estate leasing and investment opportunities combine flexible lease structures, diverse financing options, and attractive ROI expectations. By understanding the nuances of NNN versus gross leases, exploring SBA and CMBS loan programs, and accurately underwriting seasonal variations, investors can capitalize on this vibrant lakeside market. With careful due diligence, professional management, and strategic tax planning, you’ll be well-positioned to achieve stable, long-term returns in Vanderbilt’s dynamic commercial real estate sector.