Real Estate Statistics

| Average Price | $441K |

|---|---|

| Lowest Price | $125K |

| Highest Price | $1.5M |

| Total Listings | 7 |

| Avg. Price/SQFT | $60 |

Property Types (active listings)

Browse Lewiston, MI Commercial Real Estate for Sale and Lease

Lewiston, MI Commercial Real Estate for Sale and Lease: 7 Essential Opportunities

Market Overview and Trends

Lewiston, Michigan, may fly under the radar compared to larger urban markets, but its commercial real estate scene is quietly thriving. Nestled in Montmorency County, this small town offers a blend of stable historic performance and promising future growth projections that savvy investors won’t want to miss. Over the past decade, Lewiston’s commercial property values have steadily climbed—averaging annual appreciation rates of 3–4%—driven by local entrepreneurship and a resurgence of specialty retail and service businesses.

Historical Performance

Looking back ten years, property values downtown have leaped by roughly 35%, according to county assessor records. Small‐scale developments—think family-owned bistros and craft shops—kick-started this uptick, and the momentum has held fast even during wider economic slowdowns. Local brokers like those at BrookWalsh.com highlight that—while not explosive—the market’s steady climb showcases Lewiston’s resilience and the reliability of investing here.

Current Supply and Demand

Today, vacancy rates hover around 8%, lower than the 10–12% seen in comparable northern Michigan towns. Established businesses renewing leases at premium rates signal that demand is solid. New listings—predominantly light industrial spaces and storefronts—move quickly, often going under contract within 60 days of hitting the market. This supply-and-demand balance means you won’t find rock-bottom fire-sale deals, but you will encounter fair, transparent pricing backed by multiple local buyers.

Future Growth Projections

Looking ahead, infrastructure investments—such as planned improvements to M-32 and E. Michigan Avenue—are slated to enhance traffic flow and commercial visibility. A proposed mixed-use development near the Black River has garnered municipal support, suggesting a boost in both foot traffic and property values over the next 3–5 years. Combine that with tourism spillover from nearby Alpine Alpine attractions, and you have a recipe for gradual, reliable growth.

In short, Lewiston’s commercial real estate market blends historical stability with targeted growth catalysts. Whether you’re aiming to lease a local storefront or acquire an industrial building, the trends are in your favor—steady rents, modest appreciation, and upcoming development projects to sweeten the pot.

Top Neighborhoods for Commercial Properties

When examining Lewiston’s commercial offerings, location is everything. Let’s zero in on three districts where opportunity knocks loudest.

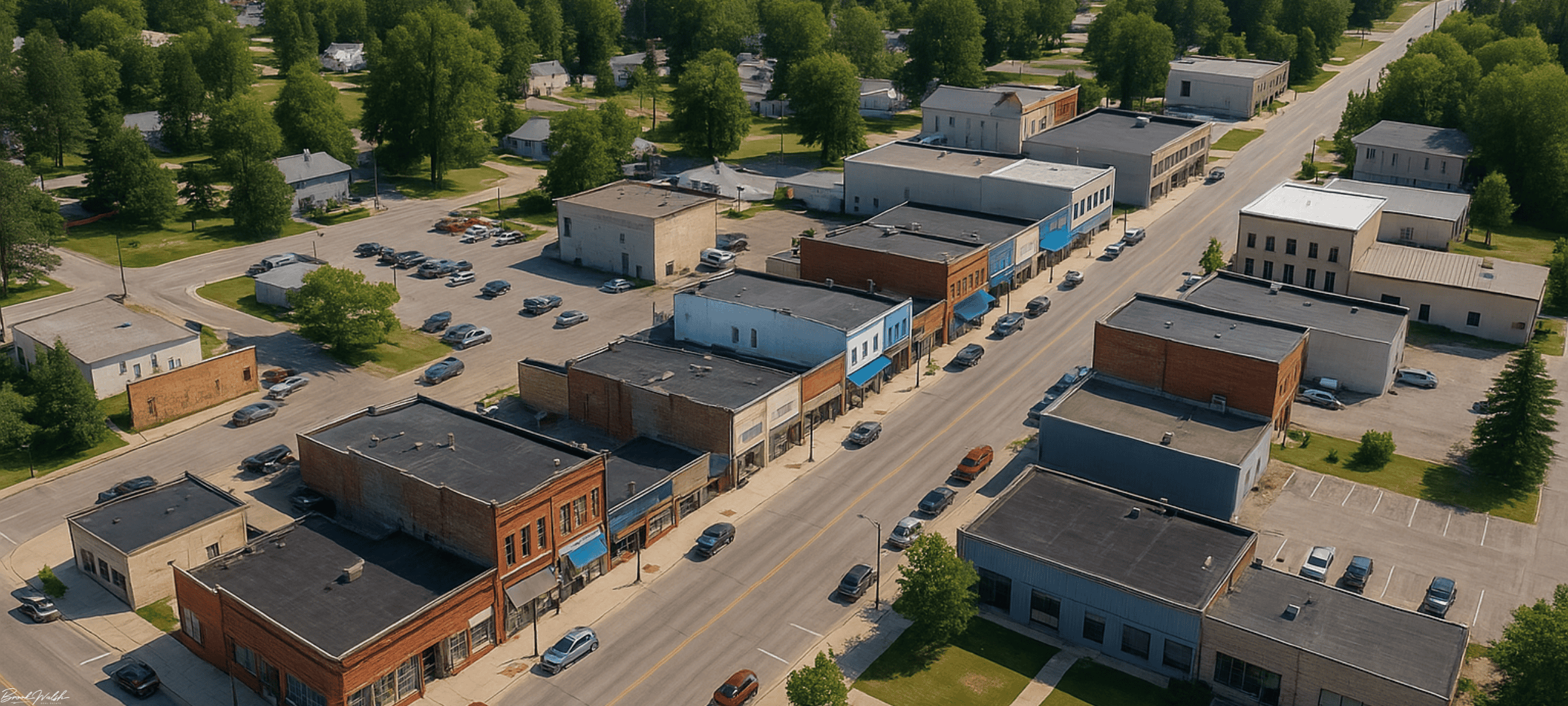

Downtown Lewiston

The heart of town, downtown Lewiston, is where you’ll find a concentration of retail shops, law offices, and specialty cafes. Properties here typically feature historic brick façades and welcoming sidewalks. Average lease rates sit at $12–$15 per square foot annually, with triple-net (NNN) structures common. Recent transactions include a 2,500-sq-ft vacant storefront purchased for $240,000 and quickly flipped to a boutique fitness studio.

Key attractions: pedestrian-friendly streetscape, proximity to municipal parking, regular community events (farmers markets, art fairs).

North Shore District

Bordering the scenic banks of the Black River, the North Shore District is emerging as a light commercial corridor. You’ll find auto-service garages, small manufacturing shops, and flexible flex-spaces leasing for $8–$10 per square foot. Zoning here allows for up to 50% office use, making it ideal for startups needing both warehousing and administrative areas under one roof.

Highlights: river views, less congested traffic, lower entry prices, room for expansion on adjoining lots.

Industrial Park Area

On the town’s outskirts, the Industrial Park boasts heavy-duty utilities and wide loading docks. Warehouse spaces ranging from 5,000 to 20,000 sq ft lease from $5–$6 per square foot, while sale prices average $40–$55 per square foot. Tenants include regional logistics firms and specialty manufacturers. The park’s strategic location near M-32 ensures easy trucking access to I-75.

Benefits: modern infrastructure, ample parking, newer construction, attractive to high-volume operators.

Types of Commercial Properties

Lewiston’s market caters to varied investor profiles. Let’s break down the key property types you’ll encounter.

Retail Spaces

From quaint boutiques to national-brand satellite stores, retail properties dominate downtown. Average sizes range from 1,000 to 4,000 sq ft. Investors appreciate the high visibility and turnover potential, especially with local festivals driving foot traffic. Common lease terms: five-year initial term with two five-year options.

Office Buildings

Small professional offices—legal, accounting, real estate—cluster around Michigan Avenue. One-story office complexes (3,000–6,000 sq ft) lease at $10–$12 per square foot. Many come with shared conference rooms and on-site management, which appeals to solo practitioners and small teams alike.

Industrial and Warehouse

Light manufacturing and warehousing properties are scattered, particularly near the Industrial Park. Clear-span steel structures, drive-in bays, and 16- to 20-ft clear heights make these ideal for distribution, fabrication, and assembly operations. Sale prices: $40–$60 per square foot.

Mixed-Use Developments

A newer trend is mixed-use buildings combining retail on ground floors with residential or office above. These properties offer diversified income streams and often qualify for tax credits on rehabilitation. Typical lease breakdown: ground floor retail at $12–$14 PSF; upper-floor office/residential at $8–$10 PSF.

Financing, Investment Opportunities, and Strategies

Securing the right deal goes beyond finding the perfect property. Financing, ROI analysis, and negotiation tactics can make or break your investment.

Financing Options and Local Lenders

Local banks such as Northern Michigan Bank & Trust offer competitive commercial loans with fixed rates around 5.5–6% APR. The USDA Rural Development program also provides low-interest loans and grants for qualifying small towns. SBA 7(a) loans—backed by the federal government—are another solid choice for up to 85% financing. Craft your application with clear business plans and local market comps to smooth approval.

Investment ROI Analysis

Calculating return starts with net operating income (NOI)—gross rent minus operating expenses. For example, a $300,000 retail building with $30,000 annual rent and $8,000 in expenses yields a $22,000 NOI. Divide that by purchase price for a 7.3% cap rate, which is attractive in Lewiston’s stable market. Compare similar properties to ensure you’re not overpaying.

Negotiation Tactics

-

Leverage Inspections: Use due-diligence findings (roof age, HVAC maintenance) to negotiate seller‐financing credits or price reductions.

-

Bundle Deals: Consider purchasing adjacent lots or multi‐tenant buildings to secure volume discounts.

-

Tie to Local Incentives: Montmorency County may offer façade grants or façade improvement programs—factor these into your negotiation.

By combining smart financing with rigorous ROI analysis and savvy negotiation, you position yourself to capture the “7 Essential Opportunities” Lewiston has to offer.

Frequently Asked Questions

1. What makes Lewiston, MI a strong market for commercial real estate?

A. Lewiston blends stable historical growth, low vacancy rates (around 8%), and upcoming infrastructure projects like M-32 upgrades—making it a compelling, low‐risk investment.

2. How much should I budget for a retail space lease in downtown Lewiston?

A. Downtown retail leases average $12–$15 per square foot (NNN). Factor in utilities, insurance, and property taxes to estimate your total occupancy cost.

3. Are there tax incentives for commercial property investors?

A. Yes. Michigan offers rehabilitation tax credits for historic buildings, and Montmorency County sometimes provides façade improvement grants for downtown properties. Northern Michigan commercial real estate, in general, is being highly incentivized.

4. What is the typical cap rate in this market?

A. Current cap rates for well‐located properties range from 6.5% to 8%, depending on property type and tenant credit quality.

5. Can out-of-state investors easily finance purchases here?

A. Absolutely. SBA 7(a) loans and USDA Rural Development programs do not restrict based on residency. Local banks also work with non-local buyers who present strong business plans.

6. Where can I find official zoning and land‐use regulations?

A. Visit the City of Lewiston’s Planning Department website or consult the Montmorency County zoning office for the latest ordinance details.

Conclusion

Lewiston, MI’s commercial real estate market is a hidden gem. With stable growth trends, a variety of property types—from downtown retail to Industrial Park warehouses—and robust financing options, you have all the ingredients for a successful investment. Whether you’re an experienced investor or a first‐time buyer, the “7 Essential Opportunities” outlined here offer a roadmap to navigate this vibrant small‐town market. For tailored listings and expert guidance, trust the team at BrookWalsh.com.

For more information on statewide commercial incentives, visit the Michigan Economic Development Corporation’s Commercial Real Estate Services:

Michigan Business

Continue your Northern Michigan commercial real estate search in the communities below or contact Brook Walsh to help you with your search.

Browse Other Communities

- Alanson, MI Commercial Real Estate

- Alpena, MI Commercial Real Estate

- Atlanta, MI Commercial Real Estate

- Bay Harbor, MI Commercial Real Estate

- Beaver Island, MI Commercial Real Estate

- Bellaire, MI Commercial Real Estate

- Beulah, MI Commercial Real Estate

- Brutus, MI Commercial Real Estate

- Boyne City, MI Commercial Real Estate

- Boyne Falls, MI Commercial Real Estate

- Cadillac, MI Commercial Real Estate

- Carp Lake, MI Commercial Real Estate

- Central Lake, MI Commercial Real Estate

- Charlevoix, MI Commercial Real Estate

- Cheboygan, MI Commercial Real Estate

- Cross Village, MI Commercial Real Estate

- East Jordan, MI Commercial Real Estate

- Elk Rapids, MI Commercial Real Estate

- Ellsworth, MI Commercial Real Estate

- Empire, MI Commercial Real Estate

- Fife Lake, MI Commercial Real Estate

- Frankfort, MI Commercial Real Estate

- Gaylord, MI Commercial Real Estate

- Glen Arbor, MI Commercial Real Estate

- Grayling, MI Commercial Real Estate

- Harbor Springs, MI Commercial Real Estate

- Hillman, MI Commercial Real Estate

- Honor, MI Commercial Real Estate

- Houghton Lake, MI Commercial Real Estate

- Indian River, MI Commercial Real Estate

- Interlochen, MI Commercial Real Estate

- Johannesburg, MI Commercial Real Estate

- Kalkaska, MI Commercial Real Estate

- Kewadin, MI Commercial Real Estate

- Kingsley, MI Commercial Real Estate

- Lake Ann, MI Commercial Real Estate

- Lake City, MI Commercial Real Estate

- Leland, MI Commercial Real

- Levering, MI Commercial Real Estate

- Lewiston, MI Commercial Real Estate

- Mackinac Island, MI Commercial Real Estate

- Mackinaw City, MI Commercial Real Estate

- Manton, MI Commercial Real Estate

- Manistee, MI Commercial Real Estate

- Maple City, MI Commercial Real Estate

- Northport, MI Commercial Real Estate

- Onaway, MI Commercial Real Estate

- Onekama, MI Commercial Real Estate

- Pellston, MI Commercial Real Estate

- Petoskey, MI Commercial Real Estate

- Rogers City, MI Commercial Real Estate

- Roscommon, MI Commercial Real Estate

- Suttons Bay, MI Commercial Real Estate

- Tawas City, MI Commercial Real Estate

- Thompsonville, MI Commercial Real Estate

- Topinabee, MI Commercial Real Estate

- Traverse City, MI Commercial Real Estate

- Vanderbilt, MI Commercial Real Estate

- Walloon Lake, MI Commercial Real Estate

- Williamsburg, MI Commercial Real Estate

- Wolverine, MI Commercial Real Estate

Start searching for your dream home now.

When it comes to convenience, our site is unparalleled. Whether you're in the comfort of your home, or on the go.

Our site works flawlessly on multiple devices so you can find the information you need.