Real Estate Statistics

| Average Price | $600K |

|---|---|

| Lowest Price | $175K |

| Highest Price | $1.4M |

| Total Listings | 13 |

| Avg. Days On Market | 231 |

| Avg. Price/SQFT | $104 |

Property Types (active listings)

Browse Grayling, MI Commercial Real Estate for Sale and Lease

- All Listings

- $100,000 - $200,000

- $400,000 - $500,000

- $600,000 - $700,000

- $700,000 - $800,000

- $800,000 - $900,000

- Over $1,000,000

Grayling, MI Commercial Real Estate for Sale and Lease: 7 Prime Investment Opportunities

Market Overview of Grayling, MI

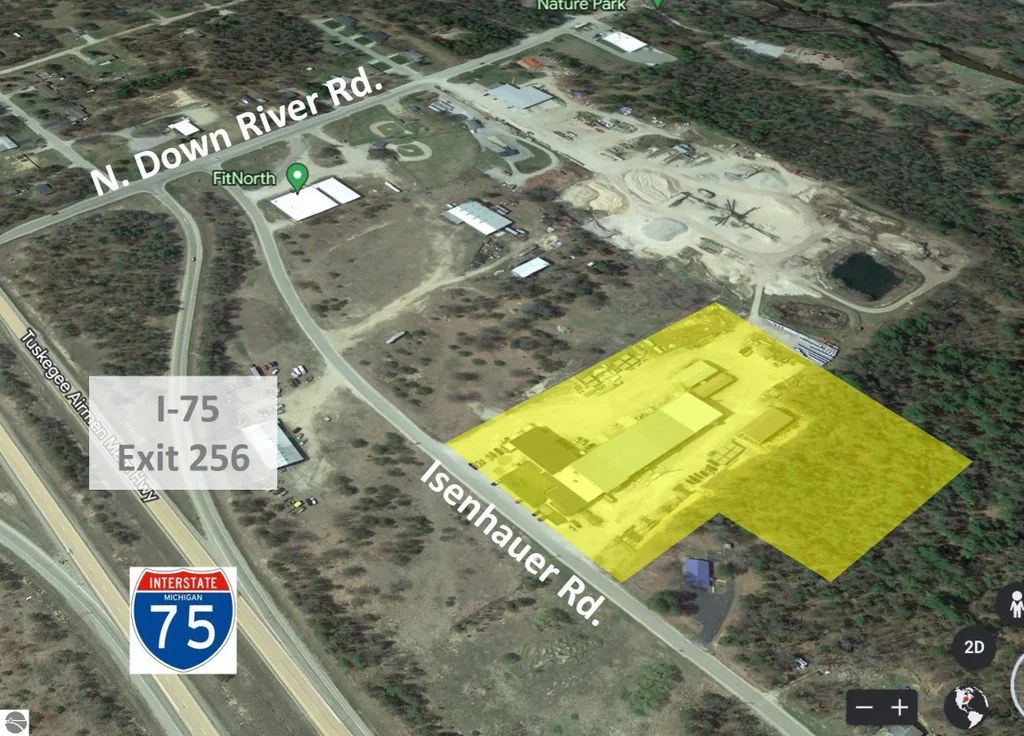

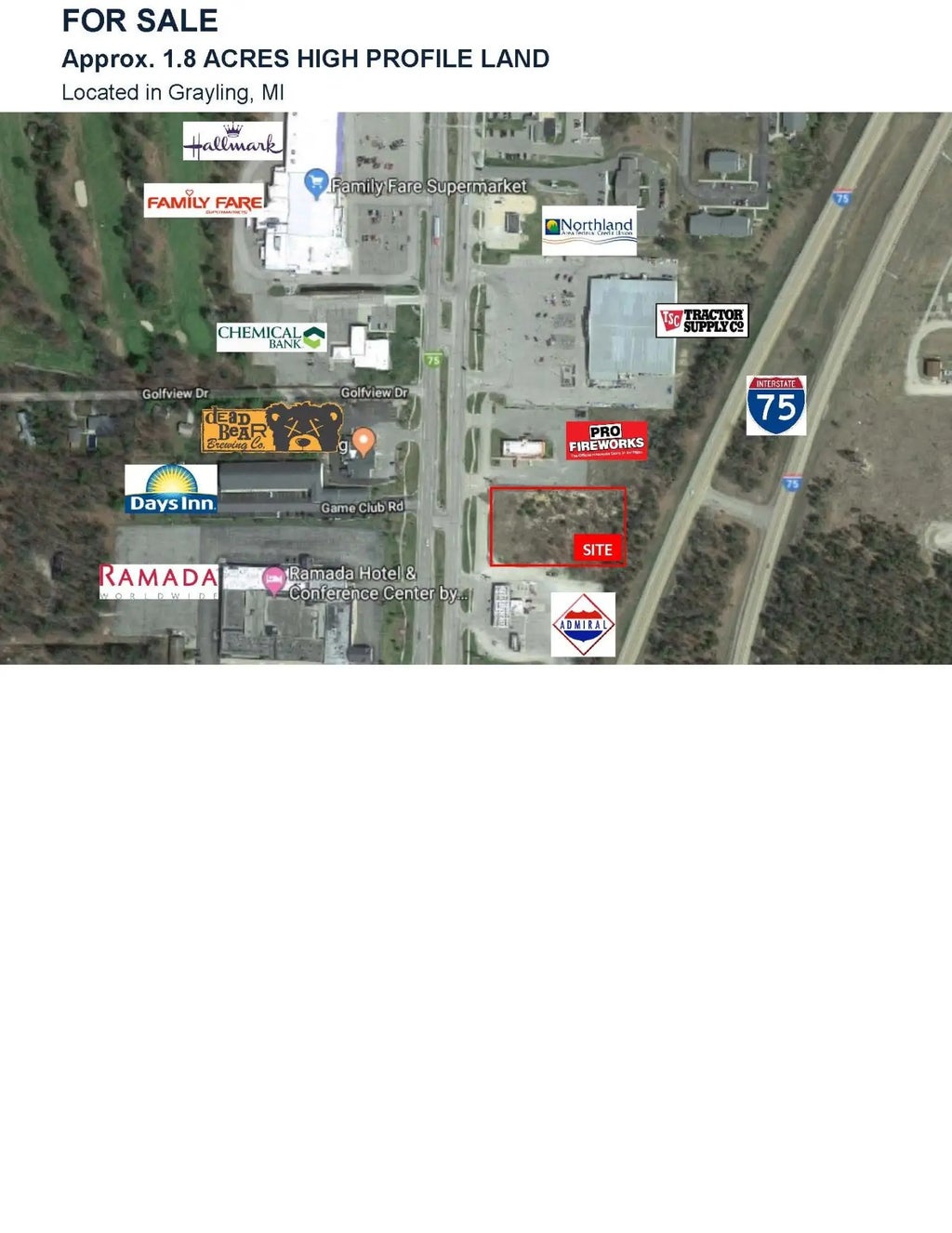

Grayling, nestled in the heart of Northern Michigan, is quickly emerging as a hub for commercial real estate investment. Boasting an ideal crossroads location—intersected by I-75 and US-127—Grayling offers businesses excellent regional accessibility. The economy is anchored by tourism, outdoor recreation, health services, and light manufacturing, creating a diversified demand for commercial properties in northern Michigan.

Economic and Demographic Profile

With a population hovering around 1,500 in the city proper and over 6,000 in the surrounding township, Grayling balances small-town charm with a robust visitor count exceeding 200,000 annually. Key demographic trends include:

-

Steady visitor growth: Driven by Four Seasons resort activity, fishing tournaments on the Au Sable River, and winter sports at nearby slopes.

-

Workforce availability: A mix of local service workers, seasonal hires, and remote professionals drawn by lower living costs.

-

Age distribution: Median age ~37, indicating both established families and young entrepreneurs seeking affordable startup spaces.

These factors underpin a rising need for diverse commercial offerings, from storefronts serving tourists to office space for remote workers tapping into Grayling’s tranquil setting.

Recent Commercial Real Estate Trends

Over the past two years, Grayling’s commercial market has experienced:

| Metric | Change (2023–2025) |

|---|---|

| Average Sale Price per Sq. Ft. | +12% |

| Vacancy Rate for Retail/Office | ↓ 1.5 points |

| Time on Market for Quality Listings | ↓ from 90 to 60 days |

| New Construction Permits Issued | +25% |

These statistics underscore a tightening market, where high-quality assets command premium prices and move more quickly. Investors are particularly eyeing mixed-use redevelopments in core corridors, leading to increased competition and the necessity for strategic guidance.

Key Commercial Property Types

Grayling’s commercial portfolio caters to a spectrum of investors. Understanding each asset class helps you align your goals with the right property.

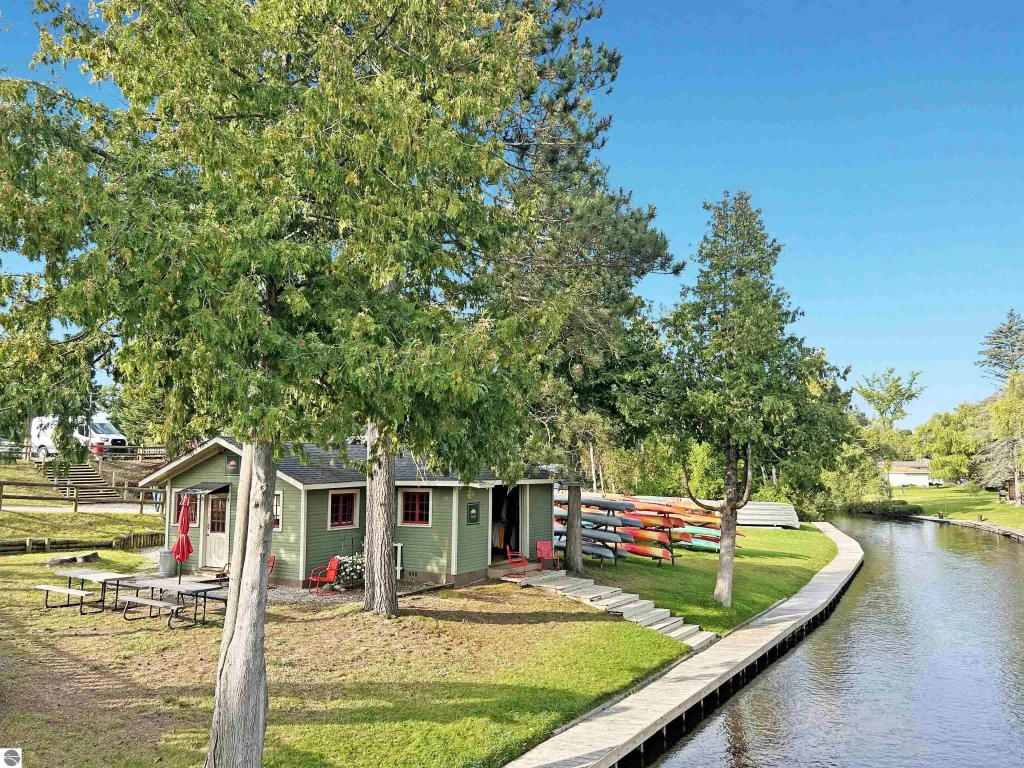

Retail Spaces and Main Street Storefronts

Prime retail opportunities cluster along M-72 and the downtown district:

-

Foot traffic hotspots: Shops near the Au Sable River draw anglers and kayakers.

-

Corner storefronts: Offer visibility for restaurants, boutiques, and galleries.

-

Lease rates: Range from $12 to $18 per sq. ft. NNN, depending on location and build-out.

Office Buildings and Professional Suites

For service providers—lawyers, accountants, therapists—Grayling’s professional suite market offers:

-

Small offices (500–1,500 sq. ft.): Ideal for individual practitioners.

-

Mid-size buildings: 5,000–10,000 sq. ft. properties accommodate multi-tenant configurations.

-

Co-working potential: Increasing interest in flexible, short-term leases for remote workers.

Industrial and Manufacturing Facilities

Industrial assets serve light manufacturing, warehousing, and craft-brew facilities. Key highlights include:

-

Proximity to highway: Easy shipping via I-75.

-

Zoning flexibility: Grayling Township supports agriculture-adjacent manufacturing.

-

Lot Sizes: Parcels from 1 to 5 acres, with some rail-spur access.

Mixed-Use Developments

Combining retail, residential, and office components, mixed-use projects can maximize ROI:

| Component | Benefits |

|---|---|

| Ground-floor retail | Steady foot traffic, visibility |

| Upper-story condos | Diversified income streams |

| Shared parking | Reduced tenant costs |

Mixed-use is a growing trend in Grayling’s revitalization efforts, particularly near the historic downtown and riverfront.

Investment Strategies for Grayling Commercial Real Estate

Selecting the right strategy depends on risk tolerance, capital availability, and desired involvement level.

Buy-and-Hold Approach

Long-term investors often:

-

Purchase stabilized assets: Retail centers with proven tenancy.

-

Lock in financing: Fixed-rate loans over 10–20 years.

-

Benefit from appreciation: Grayling’s market has posted ~5% annual price increases.

This hands-off method suits those seeking steady cash flow and eventual capital gains.

Value-Add and Redevelopment Projects

To generate outsized returns, consider:

-

Property repositioning: Upgrading façades and interiors.

-

Rezoning for denser use: Converting single-story buildings into mixed-use.

-

Lease-up campaigns: Mobilizing local brokers to fill vacancy swiftly.

Though more hands-on, value-add deals can deliver IRRs north of 15–20% if executed properly.

Lease-to-Own and Tenant Management

Leasing strategies include:

-

Triple-net (NNN): Tenants cover taxes, insurance, and maintenance.

-

Full-service gross: Landlord handles all expenses, setting higher rent.

-

Lease-option arrangements: Tenants can buy after a defined period.

Effective tenant screening and management—ideally handled by seasoned brokers—are crucial for stable returns.

Financing and Incentives

Grayling investors can tap multiple funding sources and incentive programs.

Traditional Loan Options

-

SBA 7(a) and 504 loans: Up to 90% LTV for qualifying properties.

-

Local banks: Competitive rates around 5–6% for high-credit profiles.

-

Credit unions: Sometimes offer small-business lines of credit.

State and Local Incentive Programs

Michigan Economic Development Corporation (MEDC) and Crawford County often provide:

-

Brownfield tax increment financing: For cleanup and redevelopment.

-

MEGA tax credits: For large-scale job creation projects.

-

Community Revitalization Program (CRP): Matching grants for downtown improvements.

Tax Abatements and Credits

-

Industrial Facilities Exemption (IFE): Property tax abatement for manufacturing.

-

Neighborhood Enterprise Zone (NEZ): Tax breaks for renovating historic buildings.

-

New Markets Tax Credits: For projects in low-income census tracts.

Leveraging these incentives can materially improve project feasibility and returns.

Working with Brook Walsh and NorthernMichiganEscapes.com

Navigating Grayling’s niche market is smoother with a trusted local expert.

Broker Services and Local Expertise

At BrookWalsh.com, Brook Walsh brings:

-

Decades of Northern Michigan experience: Former tech executive turned real estate broker.

-

Proven track record: Over $500M in transactions closed.

-

Full-service support: Market analysis, site tours, negotiation, due diligence.

Step-by-Step Buying and Leasing Process

-

Consultation: Define objectives, budget, and timeline.

-

Market Research: Detailed reports on Grayling trends and LSI keyword–driven comps.

-

Property Tours: Curated visits to retail, office, industrial, and mixed-use sites.

-

Offer and Negotiation: Strategically structured terms for optimal outcomes.

-

Financing Coordination: Liaise with lenders and incentive agencies.

-

Closing and Handover: Streamlined documentation and tender.

-

Post-Closing Support: Tenant placement, property management via NorthernMichiganEscapes.com if needed.

Whether you’re a first-time investor or seasoned operator, Brook Walsh’s personalized approach ensures your goals are met.

FAQs About Grayling, MI Commercial Real Estate

-

What is the average cap rate for commercial properties in Grayling?

A. Cap rates generally range from 6.5% to 8%, depending on asset class and location. -

Are there any upcoming infrastructure projects in Grayling?

A. Yes—improvements to US-127 interchange and downtown streetscape enhancements. -

Can out-of-state investors purchase commercial real estate in Michigan?

A. Absolutely; there are no residency restrictions, though financing requirements apply. -

How long does due diligence typically take?

A. Expect 30–45 days for environmental, title, and zoning reviews on standard deals. -

What lease terms are common for retail tenants?

A. Five- to ten-year NNN leases with renewal options are standard in Grayling. -

Where can I find detailed market reports?

A. Contact Brook Walsh at BrookWalsh.com for proprietary Grayling market analyses. For broader data, see the Grayling Chamber of Commerce: https://www.graylingchamber.org

Conclusion and Next Steps

Grayling, MI’s commercial real estate market presents an array of opportunities—from Main Street retail and professional offices to industrial parks and mixed-use developments. With vacancy rates tightening and investor interest climbing, now is an optimal time to explore:

-

Core acquisitions for stable, long-term cash flow.

-

Value-add plays to maximize ROI through repositioning.

-

Mixed-use projects that capitalize on downtown revitalization.

By partnering with Brook Walsh at BrookWalsh.com and leveraging Northern Michigan Escapes for property management, you gain access to unparalleled local insights, off-market listings, and turnkey support. To begin your Grayling journey, schedule a consultation today and seize one of the 7 prime investment opportunities waiting in Northern Michigan’s hidden gem.

Continue your Northern Michigan commercial real estate search in the communities below or contact Brook Walsh to help you with your search.

Browse Other Communities

- Alanson, MI Commercial Real Estate

- Alpena, MI Commercial Real Estate

- Atlanta, MI Commercial Real Estate

- Bay Harbor, MI Commercial Real Estate

- Beaver Island, MI Commercial Real Estate

- Bellaire, MI Commercial Real Estate

- Beulah, MI Commercial Real Estate

- Brutus, MI Commercial Real Estate

- Boyne City, MI Commercial Real Estate

- Boyne Falls, MI Commercial Real Estate

- Cadillac, MI Commercial Real Estate

- Carp Lake, MI Commercial Real Estate

- Central Lake, MI Commercial Real Estate

- Charlevoix, MI Commercial Real Estate

- Cheboygan, MI Commercial Real Estate

- Cross Village, MI Commercial Real Estate

- East Jordan, MI Commercial Real Estate

- Elk Rapids, MI Commercial Real Estate

- Ellsworth, MI Commercial Real Estate

- Empire, MI Commercial Real Estate

- Fife Lake, MI Commercial Real Estate

- Frankfort, MI Commercial Real Estate

- Gaylord, MI Commercial Real Estate

- Glen Arbor, MI Commercial Real Estate

- Grayling, MI Commercial Real Estate

- Harbor Springs, MI Commercial Real Estate

- Hillman, MI Commercial Real Estate

- Honor, MI Commercial Real Estate

- Houghton Lake, MI Commercial Real Estate

- Indian River, MI Commercial Real Estate

- Interlochen, MI Commercial Real Estate

- Johannesburg, MI Commercial Real Estate

- Kalkaska, MI Commercial Real Estate

- Kewadin, MI Commercial Real Estate

- Kingsley, MI Commercial Real Estate

- Lake Ann, MI Commercial Real Estate

- Lake City, MI Commercial Real Estate

- Leland, MI Commercial Real

- Levering, MI Commercial Real Estate

- Lewiston, MI Commercial Real Estate

- Mackinac Island, MI Commercial Real Estate

- Mackinaw City, MI Commercial Real Estate

- Manton, MI Commercial Real Estate

- Manistee, MI Commercial Real Estate

- Maple City, MI Commercial Real Estate

- Northport, MI Commercial Real Estate

- Onaway, MI Commercial Real Estate

- Onekama, MI Commercial Real Estate

- Pellston, MI Commercial Real Estate

- Petoskey, MI Commercial Real Estate

- Rogers City, MI Commercial Real Estate

- Roscommon, MI Commercial Real Estate

- Suttons Bay, MI Commercial Real Estate

- Tawas City, MI Commercial Real Estate

- Thompsonville, MI Commercial Real Estate

- Topinabee, MI Commercial Real Estate

- Traverse City, MI Commercial Real Estate

- Vanderbilt, MI Commercial Real Estate

- Walloon Lake, MI Commercial Real Estate

- Williamsburg, MI Commercial Real Estate

- Wolverine, MI Commercial Real Estate

Start searching for your dream home now.

When it comes to convenience, our site is unparalleled. Whether you're in the comfort of your home, or on the go.

Our site works flawlessly on multiple devices so you can find the information you need.