Real Estate Statistics

| Average Price | $408K |

|---|---|

| Lowest Price | $59K |

| Highest Price | $1.7M |

| Total Listings | 39 |

| Avg. Days On Market | 48 |

| Avg. Price/SQFT | $165 |

Property Types (active listings)

Browse Gaylord, MI Commercial Real Estate for Sale and Lease

- All Listings

- Under $100,000

- $100,000 - $200,000

- $200,000 - $300,000

- $300,000 - $400,000

- $400,000 - $500,000

- $500,000 - $600,000

- $700,000 - $800,000

- Over $1,000,000

Gaylord, MI Commercial Real Estate for Sale and Lease: Prime Investment Opportunities

Discover top-tier commercial properties in Gaylord, MI. Explore office spaces, retail hubs, industrial facilities, and value-add investments in Northern Michigan’s thriving market.

Market Overview of Gaylord, MI

Gaylord, nestled in the heart of Northern Michigan, has seen steady growth over the past decade. Up north, business is booming thanks to a blend of tourism, manufacturing, and retail expansion.

As of 2024, the population hovers around 4,200 residents, with day-trip visitors adding another 2,000 on weekends. It’s a small-town feel, but don’t let the size fool you—local employment has grown by roughly 3% annually, driven by outdoor recreation, healthcare, and specialty manufacturing. Moreover, median household income sits near $50,000, and local officials are proactive in courting new businesses.

In addition to a stable demographic base, Gaylord benefits from its strategic location at the junction of I-75 and US-131. These corridors funnel thousands of travelers through town each day, making it an ideal spot for service-oriented enterprises. Furthermore, city incentives—including tax abatements and development grants—make launching a new commercial venture here even more appealing.

Key Takeaways:

-

Population & Visitors: ~4,200 residents + 2,000 weekend visitors

-

Economic Growth: 3% annual job growth

-

Transportation: Major highway junction (I-75 & US-131)

-

Incentives: Tax abatements, development grants

Gaylord’s commercial real estate market performed robustly in 2024, with average absorption rates around 80%. Vacancy in core retail zones remains under 5%, and office space vacancy is hovering near 10%, indicating strong demand and healthy leasing activity. Local brokers report that properties with mixed-use zoning or flexible floor plans lease out fastest, often within 60 days of hitting the market.

Types of Commercial Properties Available

Gaylord’s commercial landscape caters to a range of investors. Whether you’re seeking turnkey office suites or raw land primed for build-to-suit, you’ll find options to match your strategy.

Office Spaces

-

Class A: Modern finishes, central HVAC, ample parking

-

Class B: Standard fit-outs, smaller floorplates, lower rents

-

Co-working: Flexible desks, shared amenities, month-to-month leases

“If you need a simple four-cubicle layout or 3,000 sq ft of executive offices, Gaylord’s office market has you covered,” says a local broker.

Retail Properties

-

Strip Centers: High-visibility storefronts, anchor tenants like Michigan-based chains

-

Standalone Retail: Former bank buildings, former quick-service restaurants

-

Mixed-Use Development: Retail on ground floor, residential or office above

Industrial Facilities

-

Light Manufacturing: 5,000–20,000 sq ft with 16–20 ft clear heights

-

Warehousing: Cross-dock capabilities, multiple loading docks

-

Flex Space: Combined office/warehouse, ideal for small-batch production

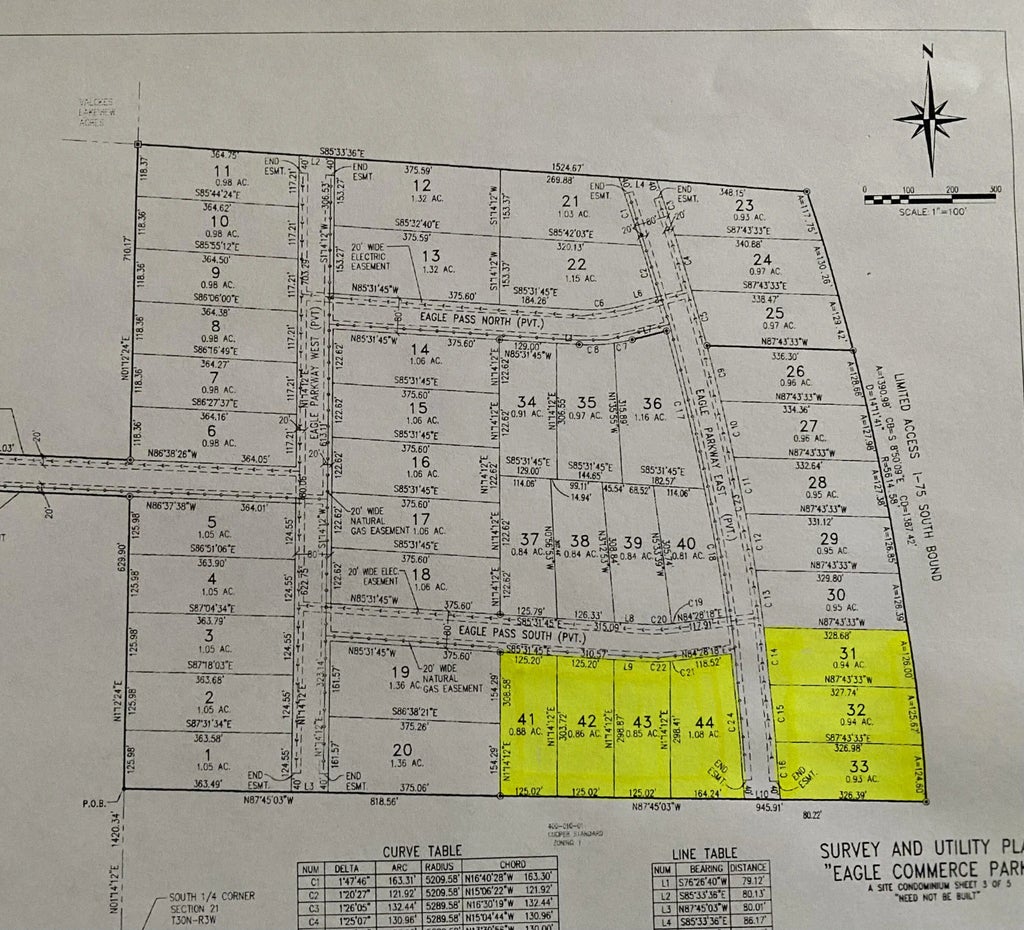

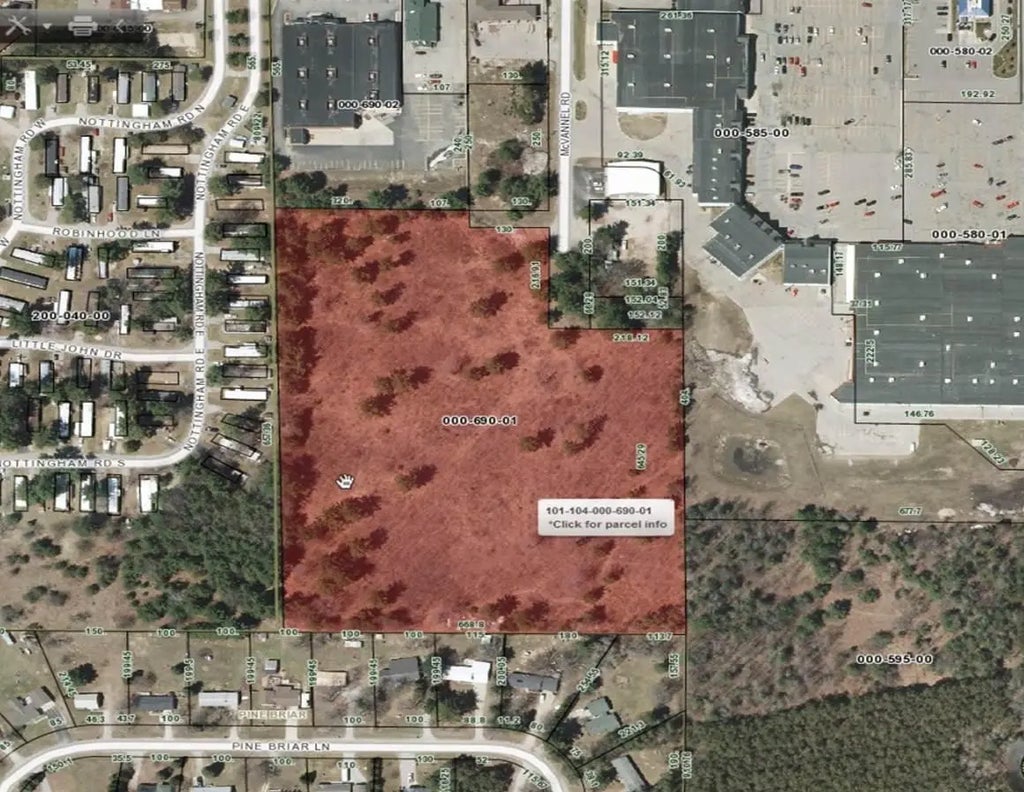

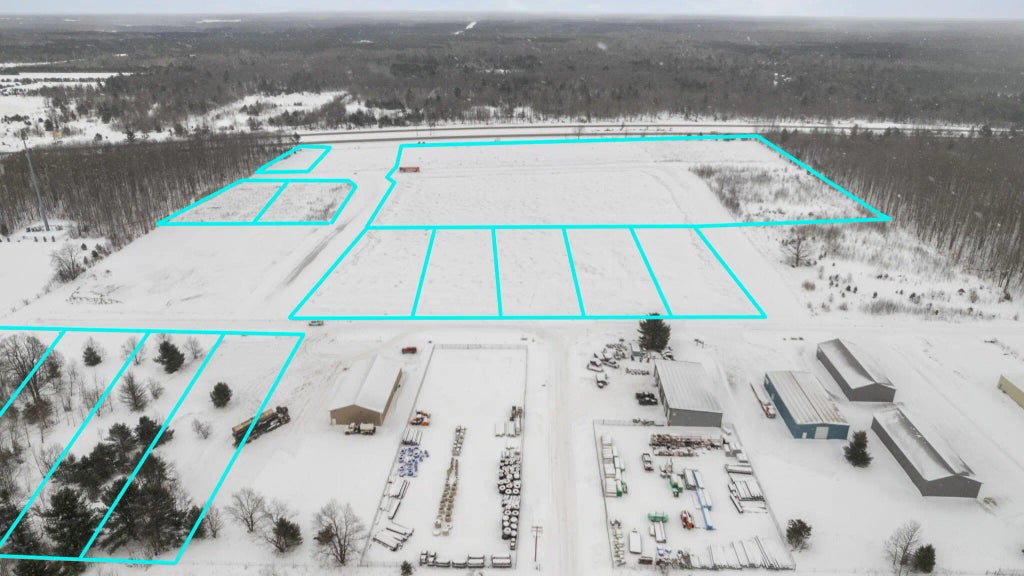

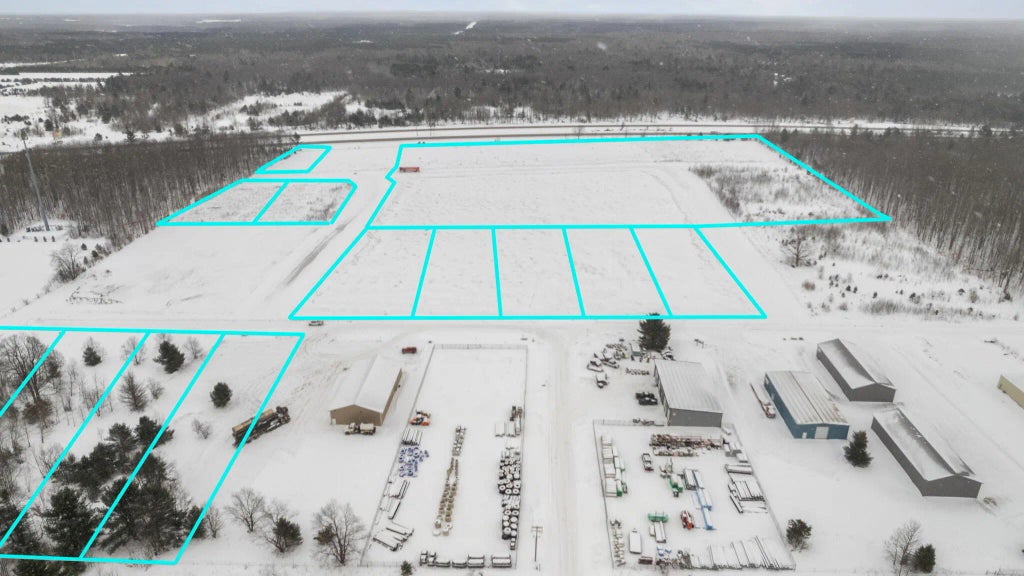

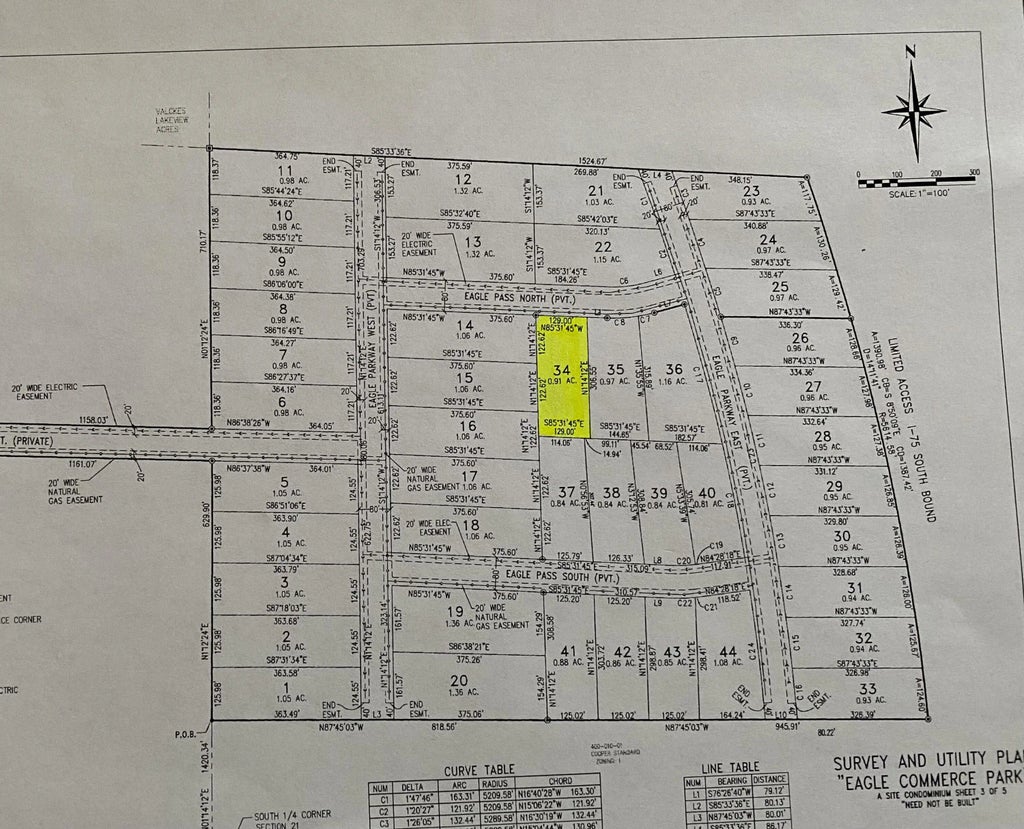

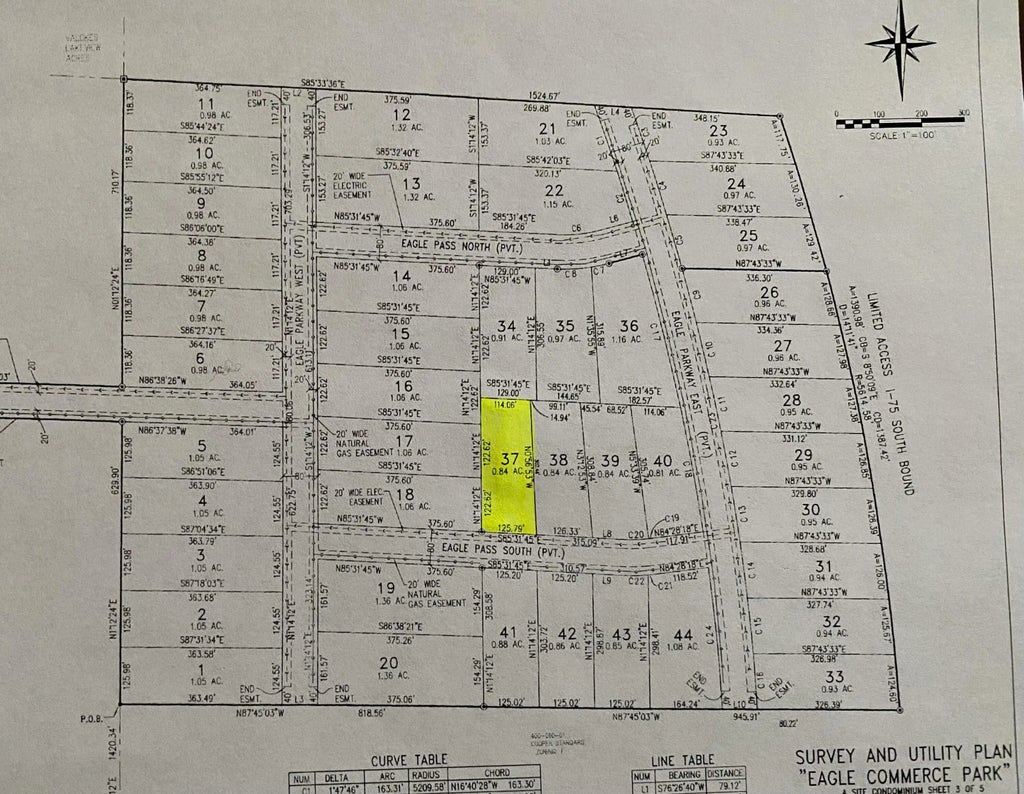

Land Development Opportunities

-

Commercial Parcels: Zoned C-1 and C-2, ready for retail or office parks

-

Industrial Tracts: Large acreage in Silver Creek Industrial Park

-

Hospitality-Ready Lots: Near Otsego Club resort and local ski hills

Table: Average Price & Lease Terms by Property Type

| Property Type | Avg. Price per Sq Ft | Typical Lease Term |

|---|---|---|

| Office | $15 – $20 | 3 – 5 years |

| Retail | $12 – $18 | 5 – 10 years |

| Industrial | $8 – $12 | 5 – 7 years |

| Land | $5 – $10 | N/A |

This mix of inventory gives investors the flexibility to pick assets that match risk tolerance and growth expectations.

Prime Neighborhoods in Gaylord for Commercial Investment

Understanding location is half the battle. Here are the most sought-after districts:

Downtown Gaylord

Historic storefronts, pedestrian traffic, events like the Bavarian Festival. Ideal for boutiques, cafés, professional offices.

Industrial Park District

Home to Silver Creek Industrial Park. Easy highway access, newer infrastructure, suitable for manufacturing and logistics firms.

Main Street Corridor

Recent streetscape upgrades, ample municipal parking, prime for service businesses—salons, fitness studios, and medical clinics.

Emerging Suburban Areas

New subdivisions in the city’s south end attract population growth. Retail pads and neighborhood office buildings here promise long-term appreciation.

Why Location Matters:

-

Foot Traffic: Downtown sees 1,000+ pedestrians on summer weekends.

-

Logistics Efficiency: Industrial Park properties offer quick I-75 access.

-

Community Synergy: Suburban centers nurture local services close to growing housing developments.

Each neighborhood carries its own set of zoning regulations, demographic profiles, and leasing rates, so tailor your search accordingly.

Investment and Leasing Strategies

Commercial real estate isn’t one-size-fits-all. Here are four strategies to consider:

Long-Term Lease Opportunities

Lock in creditworthy tenants for 10+ years. It’s a hands-off approach: predictable income, minimal turnover risk.

Value-Add Investment Approaches

Buy an underperforming asset, upgrade HVAC, improve curb appeal, then bump rents. Typical ROI uplifts run 8–12%.

Financing and Incentive Programs

-

Traditional Mortgages: 65–75% LTV at competitive rates

-

SBA 504 Loans: 90% financing for owner-occupied properties

-

Local Grants: Façade improvement funds from the City of Gaylord

Financing Comparison

| Program | LTV | Term (Years) | Key Benefit |

|---|---|---|---|

| Conventional | 65–75% | 5–25 | Low rates for strong credit |

| SBA 504 | Up to 90% | 10–20 | Low down payment, fixed interest |

| MEDC Grants¹ | Varies | N/A | Funds for façade, streetscape, signage |

¹See Michigan Economic Development Corporation for details.

Opportunity Zones and Tax Benefits

Parts of Gaylord fall within federally designated Opportunity Zones. Investors can defer capital gains and potentially eliminate taxes on appreciation.

By mixing and matching these approaches, you can tilt the risk/reward balance in your favor.

Buying and Leasing Process in Michigan

Navigating Michigan’s rules doesn’t have to be daunting. Here’s a step-by-step:

Working with Brook Walsh and Northern Michigan Escapes

As your local broker and property manager, Brook Walsh leverages years of Northern Michigan expertise to source deals, vet tenants, and handle day-to-day operations.

Due Diligence and Market Analysis

-

Financial Review: Rent rolls, expense statements

-

Physical Inspection: Structural, environmental assessments

-

Comparable Analysis: Benchmarking on local sale and lease comps

Navigating Zoning and Regulations

Gaylord follows the Michigan Zoning Enabling Act (PA 110 of 2006). Confirm allowable uses, parking requirements, and signage ordinances at City Hall.

Closing and Lease Negotiation

Once terms are agreed, attorneys draft purchase agreements or lease contracts. Expect 30–45 days to closing, with contingencies for financing and inspection.

Clear communication and local knowledge cut through red tape, getting you into your new commercial space without headaches.

Frequently Asked Questions

Q. What’s the average cap rate for commercial properties in Gaylord?

A. Cap rates typically range from 6%–8%, depending on property type and tenant credit.

Q. Are there any vacancy requirements for Opportunity Zone benefits?

A. No vacancy requirements—any qualified investment within the zone is eligible for deferment.

Q. How long does it take to lease out a Class A office suite?

A. On average, 60–90 days, though it can be shorter with pre-leased build-to-suit options.

Q. Can out-of-state investors own commercial real estate in Michigan?

A. Absolutely—Michigan imposes no residency restrictions on property ownership.

Q. What lease structures are common?

A. Triple net (NNN) leases are prevalent, shifting property expense obligations to tenants.

Q. Is financing available for mixed-use developments?

A. Yes, conventional lenders and SBA programs often support mixed-use projects, especially in revitalization areas.

Conclusion

Gaylord, MI offers a diverse commercial real estate marketplace that balances small-town charm with strategic growth prospects. Whether you’re eyeing an office building downtown, a retail storefront on Main Street, or industrial acreage in the Silver Creek park, the opportunities are plentiful.

With proactive local government, attractive financing options, and expert guidance from Brook Walsh and Northern Michigan Escapes, investors can confidently navigate acquisitions, leasing, and value-add projects. Northern Michigan’s hidden gem welcomes savvy buyers and lessees ready to capitalize on a market that’s as optimistic as the community itself.

Continue your Northern Michigan commercial real estate search in the communities below or contact Brook Walsh to help you with your search.

Browse Other Communities

- Alanson, MI Commercial Real Estate

- Alpena, MI Commercial Real Estate

- Atlanta, MI Commercial Real Estate

- Bay Harbor, MI Commercial Real Estate

- Beaver Island, MI Commercial Real Estate

- Bellaire, MI Commercial Real Estate

- Beulah, MI Commercial Real Estate

- Brutus, MI Commercial Real Estate

- Boyne City, MI Commercial Real Estate

- Boyne Falls, MI Commercial Real Estate

- Cadillac, MI Commercial Real Estate

- Carp Lake, MI Commercial Real Estate

- Central Lake, MI Commercial Real Estate

- Charlevoix, MI Commercial Real Estate

- Cheboygan, MI Commercial Real Estate

- Cross Village, MI Commercial Real Estate

- East Jordan, MI Commercial Real Estate

- Elk Rapids, MI Commercial Real Estate

- Ellsworth, MI Commercial Real Estate

- Empire, MI Commercial Real Estate

- Fife Lake, MI Commercial Real Estate

- Frankfort, MI Commercial Real Estate

- Gaylord, MI Commercial Real Estate

- Glen Arbor, MI Commercial Real Estate

- Grayling, MI Commercial Real Estate

- Harbor Springs, MI Commercial Real Estate

- Hillman, MI Commercial Real Estate

- Honor, MI Commercial Real Estate

- Houghton Lake, MI Commercial Real Estate

- Indian River, MI Commercial Real Estate

- Interlochen, MI Commercial Real Estate

- Johannesburg, MI Commercial Real Estate

- Kalkaska, MI Commercial Real Estate

- Kewadin, MI Commercial Real Estate

- Kingsley, MI Commercial Real Estate

- Lake Ann, MI Commercial Real Estate

- Lake City, MI Commercial Real Estate

- Leland, MI Commercial Real

- Levering, MI Commercial Real Estate

- Lewiston, MI Commercial Real Estate

- Mackinac Island, MI Commercial Real Estate

- Mackinaw City, MI Commercial Real Estate

- Manton, MI Commercial Real Estate

- Manistee, MI Commercial Real Estate

- Maple City, MI Commercial Real Estate

- Northport, MI Commercial Real Estate

- Onaway, MI Commercial Real Estate

- Onekama, MI Commercial Real Estate

- Pellston, MI Commercial Real Estate

- Petoskey, MI Commercial Real Estate

- Rogers City, MI Commercial Real Estate

- Roscommon, MI Commercial Real Estate

- Suttons Bay, MI Commercial Real Estate

- Tawas City, MI Commercial Real Estate

- Thompsonville, MI Commercial Real Estate

- Topinabee, MI Commercial Real Estate

- Traverse City, MI Commercial Real Estate

- Vanderbilt, MI Commercial Real Estate

- Walloon Lake, MI Commercial Real Estate

- Williamsburg, MI Commercial Real Estate

- Wolverine, MI Commercial Real Estate

Start searching for your dream home now.

When it comes to convenience, our site is unparalleled. Whether you're in the comfort of your home, or on the go.

Our site works flawlessly on multiple devices so you can find the information you need.