Real Estate Statistics

| Average Price | $240K |

|---|---|

| Lowest Price | $125K |

| Highest Price | $569K |

| Total Listings | 4 |

| Avg. Price/SQFT | $78 |

Property Types (active listings)

Browse Atlanta, MI Commercial Real Estate for Sale and Lease

- All Listings

- $100,000 - $200,000

- $500,000 - $600,000

Atlanta, MI Commercial Real Estate for Sale and Lease + Prime Deals + 7 Strategies

Discover prime deals, strategic investment tips, and top listings in this thriving Michigan market. Explore expert insights and actionable strategies today.

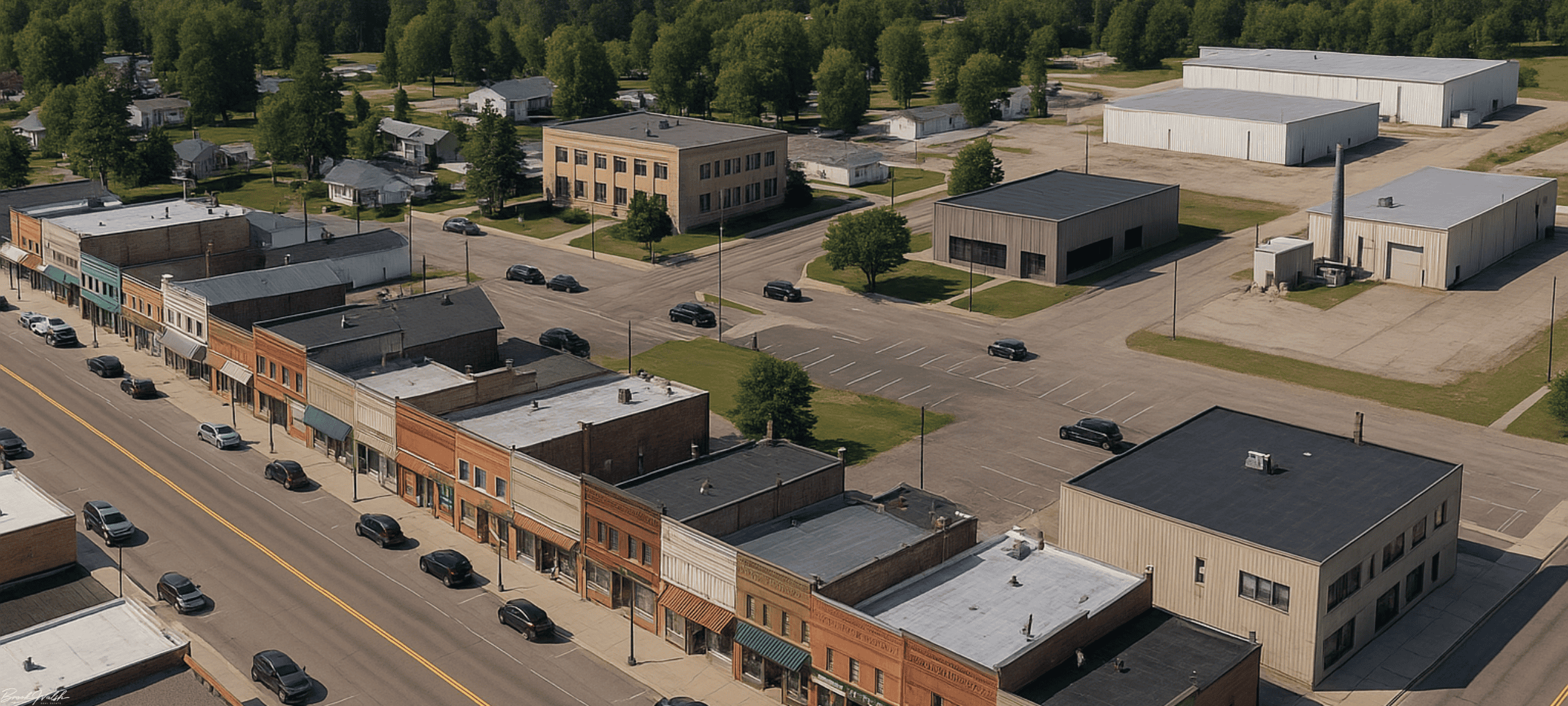

Introduction to Atlanta, MI Commercial Real Estate

Atlanta, MI Commercial Real Estate for Sale and Lease offers business owners and investors a unique blend of small-town charm and robust economic opportunity. Nestled in the heart of northeast Michigan, this market is ripe for savvy professionals looking to buy or lease properties that balance affordability, growth potential, and community engagement.

Whether you’re scouting retail storefronts, office suites, or industrial facilities, Atlanta’s commercial scene serves up prime deals backed by local expertise and seven strategic approaches you won’t want to miss.

Overview of Atlanta, Michigan's Commercial Real Estate Market

Atlanta, MI Commercial Real Estate for Sale and Lease: Market Snapshot

Atlanta’s commercial real estate sector has steadily evolved over the last decade, driven by a healthy mix of tourism, light manufacturing, and service industries. Today, you’ll find anywhere from quaint storefronts along M-32 to modern warehouse complexes on the city’s outskirts. Vacancy rates hover around 8–10%, reflecting moderate demand that’s balanced by a stable supply of properties. Average lease rates for Class A office space sit near $12–14 per square foot annually, while retail spaces can range from $8–12 per square foot, depending on location and build-out. Investors appreciate that land prices average just $1–3 per square foot—much lower than metro markets—and yet yield competitive returns thanks to low overhead costs and growing visitor foot traffic during peak seasons.

Key highlights:

-

Diverse Inventory: From historic brick buildings downtown to recently built flex spaces.

-

Affordable Entry Points: Lower acquisition costs compared to larger Michigan cities.

-

Balanced Demand: Mix of seasonal tourism tenants and year-round local businesses.

Historical Market Trends

Over the past 15 years, Atlanta’s commercial landscape has mirrored broader Michigan trends—recovering from the 2008 downturn, stabilizing by 2015, and enjoying moderate growth through 2020. Post-pandemic shifts saw a temporary softening in retail demand, but the market rebounded as remote-friendly office tenants sought quieter, cost-effective locations. Industrial space, in particular, experienced a boom with e-commerce logistics firms looking for regional distribution hubs. Year-over-year property appreciation averages 3–5%, a steady clip that underscores Atlanta’s resilience.

Highlights by era:

-

2008–2014 Recovery: Price corrections, owner-occupant leases dominate.

-

2015–2019 Growth: Influx of boutique retailers and health-care offices.

-

2020–Present: Rise in light industrial and mixed-use repurposing projects.

Current Economic Drivers

Several factors are fueling today’s commercial real estate opportunities:

-

Tourism & Hospitality: Proximity to Houghton Lake and local ski resorts drives seasonal retail and lodging leases.

-

Manufacturing & Distribution: Light manufacturing plants and cold-storage facilities have set up along U.S.-127, capitalizing on central location.

-

Tech Adoption: Local incubators in nearby towns are leasing affordable office suites in Atlanta, encouraging start-ups to take root.

-

Infrastructure Investments: Recent state-funded road improvements have improved traffic flow to warehouses and retail corridors, boosting property values.

Furthermore, Georgia Pacific’s regional distribution center expansion in 2024 has added hundreds of jobs, bolstering downtown activity. With unemployment rates below the national average, local entrepreneurs are stepping into retail and professional service spaces, too. As a result, investors have their pick of well-maintained historic buildings and newly constructed flex units—each offering a slice of Atlanta’s expanding economy.

Types of Commercial Properties Available

Retail Spaces

Atlanta’s retail sector spans from Main Street boutiques to strip-center anchoring grocers. Average storefront footprints range between 1,200 and 3,500 sq. ft., ideal for specialty shops, cafes, and service-oriented businesses. Lease terms typically run 3–5 years with renewal options, and landlords often cover CAM (Common Area Maintenance) costs while tenants handle utilities and interior build-outs. Foot traffic peaks in summer and winter holiday seasons, making seasonal pop-up leases a popular short-term play.

Listing highlights:

-

Charming downtown units with historic façades.

-

Streetside parking and adjacent municipal lots.

-

Flexible interior layouts ready for turnkey operations.

Office Buildings

Office inventory includes Class B suites in mid-rise buildings and co-working spaces housed in renovated turn-of-the-century structures. Square-foot costs average $10–$13 per year, often inclusive of utilities and internet. Tenants benefit from on-site parking, shared conference facilities, and proximity to civic amenities like the county courthouse and public library.

Popular configurations:

-

Private Suites (200–2,000 sq. ft.): For small firms and consultants.

-

Open-Plan Floors (5,000+ sq. ft.): For growing teams with collaborative work models.

-

Coworking Memberships: Month-to-month options for freelancers and remote workers.

Industrial and Warehouse Facilities

Light industrial properties around the Atlanta Business Park cater to distribution, manufacturing, and specialized storage. Building sizes range from 5,000 to 50,000 sq. ft., with clear-height ceilings, loading docks, and yard space. Lease rates typically run $4–$6 per sq. ft. NNN. Investors eye long-term net leases with creditworthy tenants to lock in inflation-resistant income streams.

Key features:

| Feature | Benefit |

|---|---|

| Dock-high loading | Efficient goods handling |

| 24-hour access | Flexible operations |

| Ample truck parking | Smooth logistics |

| On-site security | Peace of mind for high-value inventories |

Investment Opportunities and Financial Considerations

ROI Analysis

When evaluating Atlanta properties, investors often look at cap rates between 6–8% in retail and office segments, and 7–9% in industrial zones. Multifamily conversions of older northern Michigan commercial buildings have produced even higher yields—sometimes exceeding 10%—due to tight housing supply in neighboring towns.

Considerations for ROI:

-

Acquisition cost vs. renovation budget.

-

Lease-up velocity in seasonal markets.

-

Management expenses (property taxes, maintenance, insurance).

Financing Options

Savvy buyers tap into a mix of traditional bank loans, SBA 7(a) programs, and state-sponsored Michigan economic development funds. These options can offer:

-

Lower Down Payments: Through SBA-backed mortgages.

-

Longer Amortizations: Up to 25 years, easing cash flow.

-

Competitive Interest Rates: As low as 5% on fixed-rate terms.

It’s common to bundle acquisition and renovation financing into one package, especially for historic storefronts requiring façade improvements.

Tax Incentives and Regulations

Atlanta falls within certain Tier 3 economic zones, qualifying investors for tax abatements on new construction and historic preservation grants. The Michigan Business Development Program (MBDP) sometimes offsets capital costs for projects that create local jobs. Zoning regulations in the city’s master plan encourage mixed-use development along the downtown corridor, simplifying the approval process for projects combining retail and residential or office space.

Strategic Tips for Buying and Leasing in Atlanta, MI

Working with Local Brokers

Partnering with a broker who knows Atlanta inside out can streamline your search. They’ll have access to off-market listings, understand local lease norms, and advise on neighborhood nuances—everything from seasonal traffic patterns to municipal development plans.

Tip: Look for agents with NAR’s CCIM designation or state-level commercial certifications for added expertise.

Negotiation Best Practices

Here’s how to secure the best deal:

-

Understand Landlord Objectives: Align your proposal with their goals—whether it’s a long-term tenant or quick occupancy.

-

Leverage Market Data: Present comparative rents and recent sales to justify favorable terms.

-

Build in Clauses: Include performance-based rent escalations or tenant improvement allowances.

By negotiating base rent and TI (Tenant Improvement) packages simultaneously, you often end up with a more balanced agreement.

Future Market Predictions

Looking ahead, Atlanta, MI is poised to benefit from:

-

Remote Work Trends: Pushing more professionals to seek local office and coworking spaces.

-

E-Commerce Growth: Driving continued demand for regional distribution centers.

-

Tourism Upside: Investments in lodging and retail along M-32 as year-round destinations expand.

It pays to think proactively—secure properties near planned infrastructure projects or enter early into emerging submarkets.

Frequently Asked Questions

-

What’s the average cap rate for commercial real estate in Atlanta, MI?

A. Most investors see cap rates between 6–8% for retail and office, and 7–9% for industrial properties, depending on location and tenant credit profile. -

How do I find off-market deals in Atlanta?

A. Engage a local broker with deep networks, monitor city tax auctions, and connect with property owners directly for potential sale-leaseback or owner financing opportunities. -

Are there tax incentives for renovating historic buildings?

A. Yes—Atlanta participates in Michigan’s historic preservation tax credit program, which can cover up to 25% of qualified rehabilitation expenses. -

What lease terms should I expect on retail spaces?

A. Standard retail leases run 3–5 years with options to renew. CAM fees are typically passed through to tenants, but utilities and TI vary by landlord. -

Can I convert a downtown office building into mixed-use?

A. Zoning along Atlanta’s main corridor encourages mixed-use projects. You’ll need to submit a site plan and secure approvals from the city planning commission. -

Where can I learn more about local regulations and data?

A. Visit the City of Atlanta’s official website for zoning maps, master plans, and economic incentive details: www.cityofatlantami.org.

Conclusion

Atlanta, MI Commercial Real Estate for Sale and Lease presents a wealth of prime deals and strategic opportunities for investors, owner-occupants, and innovative entrepreneurs alike.

By understanding market dynamics, exploring diverse property types, evaluating financial levers, and partnering with local experts, you can navigate this vibrant market with confidence.

Whether you’re leasing a boutique retail space or acquiring an industrial warehouse, Atlanta’s blend of affordability and growth potential makes it a top choice in northeast Michigan. Ready to take the next step? Connect with a qualified broker and start exploring listings today.

Continue your Northern Michigan commercial real estate search in the communities below or contact Brook Walsh to help you with your search.

Browse Other Communities

- Alanson, MI Commercial Real Estate

- Alpena, MI Commercial Real Estate

- Atlanta, MI Commercial Real Estate

- Bay Harbor, MI Commercial Real Estate

- Beaver Island, MI Commercial Real Estate

- Bellaire, MI Commercial Real Estate

- Beulah, MI Commercial Real Estate

- Brutus, MI Commercial Real Estate

- Boyne City, MI Commercial Real Estate

- Boyne Falls, MI Commercial Real Estate

- Cadillac, MI Commercial Real Estate

- Carp Lake, MI Commercial Real Estate

- Central Lake, MI Commercial Real Estate

- Charlevoix, MI Commercial Real Estate

- Cheboygan, MI Commercial Real Estate

- Cross Village, MI Commercial Real Estate

- East Jordan, MI Commercial Real Estate

- Elk Rapids, MI Commercial Real Estate

- Ellsworth, MI Commercial Real Estate

- Empire, MI Commercial Real Estate

- Fife Lake, MI Commercial Real Estate

- Frankfort, MI Commercial Real Estate

- Gaylord, MI Commercial Real Estate

- Glen Arbor, MI Commercial Real Estate

- Grayling, MI Commercial Real Estate

- Harbor Springs, MI Commercial Real Estate

- Hillman, MI Commercial Real Estate

- Honor, MI Commercial Real Estate

- Houghton Lake, MI Commercial Real Estate

- Indian River, MI Commercial Real Estate

- Interlochen, MI Commercial Real Estate

- Johannesburg, MI Commercial Real Estate

- Kalkaska, MI Commercial Real Estate

- Kewadin, MI Commercial Real Estate

- Kingsley, MI Commercial Real Estate

- Lake Ann, MI Commercial Real Estate

- Lake City, MI Commercial Real Estate

- Leland, MI Commercial Real

- Levering, MI Commercial Real Estate

- Lewiston, MI Commercial Real Estate

- Mackinac Island, MI Commercial Real Estate

- Mackinaw City, MI Commercial Real Estate

- Manton, MI Commercial Real Estate

- Manistee, MI Commercial Real Estate

- Maple City, MI Commercial Real Estate

- Northport, MI Commercial Real Estate

- Onaway, MI Commercial Real Estate

- Onekama, MI Commercial Real Estate

- Pellston, MI Commercial Real Estate

- Petoskey, MI Commercial Real Estate

- Rogers City, MI Commercial Real Estate

- Roscommon, MI Commercial Real Estate

- Suttons Bay, MI Commercial Real Estate

- Tawas City, MI Commercial Real Estate

- Thompsonville, MI Commercial Real Estate

- Topinabee, MI Commercial Real Estate

- Traverse City, MI Commercial Real Estate

- Vanderbilt, MI Commercial Real Estate

- Walloon Lake, MI Commercial Real Estate

- Williamsburg, MI Commercial Real Estate

- Wolverine, MI Commercial Real Estate

Start searching for your dream home now.

When it comes to convenience, our site is unparalleled. Whether you're in the comfort of your home, or on the go.

Our site works flawlessly on multiple devices so you can find the information you need.