Real Estate Statistics

| Average Price | $234K |

|---|---|

| Lowest Price | $59.9K |

| Highest Price | $750K |

| Total Listings | 17 |

| Avg. Days On Market | 281 |

| Avg. Price/SQFT | $109 |

Property Types (active listings)

Browse Bellaire, MI Commercial Real Estate for Sale and Lease

- All Listings

- Under $100,000

- $100,000 - $200,000

- $200,000 - $300,000

- $300,000 - $400,000

- $400,000 - $500,000

- $500,000 - $600,000

- $700,000 - $800,000

Bellaire, MI Commercial Real Estate for Sale and Lease: 7 Prime Opportunities

A dynamic Northern Michigan market with prime retail, office, industrial, and mixed-use properties.

Introduction

Bellaire, MI Commercial Real Estate for Sale and Lease is drawing growing attention from savvy investors seeking a blend of small-town charm and solid economic fundamentals. Nestled at the southern tip of scenic Torch Lake and serving as the county seat of Antrim County, Bellaire combines outdoor lifestyle amenities with a stable business climate.

Whether you’re hunting for retail storefronts, office suites, light industrial warehouses, or mixed-use developments, this village offers an array of prime properties—and a competitive edge in Northern Michigan’s commercial landscape. In this guide, we’ll dive deep into market dynamics, property types, investment strategies, financing options, and how partnering with Brook Walsh at NorthernMichiganEscapes.com can streamline your acquisition journey. Let’s explore the top seven opportunities waiting for you in Bellaire.

Market Overview of Bellaire Commercial Real Estate

Bellaire’s commercial real estate market balances small-town accessibility with regional growth prospects. Over the past decade, the village has seen steady population growth—up roughly 5% since 2010—with an uptick in both seasonal tourism and remote-work professionals choosing Northern Michigan for its quality of life. Key employment sectors include healthcare, education, retail, and light manufacturing, each fueling demand for specialized commercial spaces.

Economic and Demographic Drivers

Two main factors underpin Bellaire’s commercial market: its role as an administrative hub and its proximity to Torch Lake recreation. As the county seat, Bellaire hosts government offices, professional services, and legal practices—driving consistent demand for office and mixed-use properties. Demographically, Bellaire’s median household income sits around $45,000, with a growing segment of retirees and remote workers seeking part-time business ventures or service-oriented enterprises.

Historical Market Performance

Between 2015 and 2024, vacancy rates for retail spaces in downtown Bellaire averaged just under 7%, compared to 9% statewide for similar villages. Office properties have enjoyed even tighter occupancy, with average lease terms extending five to seven years. On the investment side, cap rates have hovered between 6% and 7.5%—attractive for both first-time and seasoned investors looking for steady cash flow.

Current Trends and Demand

Recent trends include:

-

Pop-up Retail and Co-working: Entrepreneurs are converting underutilized storefronts into seasonal shops or shared office spaces.

-

Industrial Flex: Light manufacturing and artisan studios are moving into former warehouse zones, thanks to flexible zoning changes.

-

Mixed-Use Revitalization: Developers are combining ground-floor retail with upper-floor residential units to maximize ROI and community vibrancy.

Taken together, these dynamics create a resilient market—one that blends local demand with visitor-driven growth during summer and fall peak seasons.

Types of Commercial Properties in Bellaire

When exploring Bellaire, you’ll encounter a variety of asset classes, each suited to different investment strategies and tenant profiles.

Retail Spaces and Shopping Centers

Downtown Bellaire’s main corridor along Cayuga Street features historic brick storefronts ideal for boutiques, galleries, and cafés. Average storefront sizes range from 800 to 2,500 square feet, with lease rates between $12 and $18 per square foot NNN. On the village outskirts, small strip centers and standalone buildings serve grocery, hardware, and specialty food tenants.

Office and Professional Buildings

Government and professional services anchor Bellaire’s office market. Class B office buildings—typically built in the 1980s and 1990s—offer suites from 500 to 3,000 square feet. Modern conversions of former school buildings have yielded creative office loft spaces, appealing to architects, designers, and tech consultants.

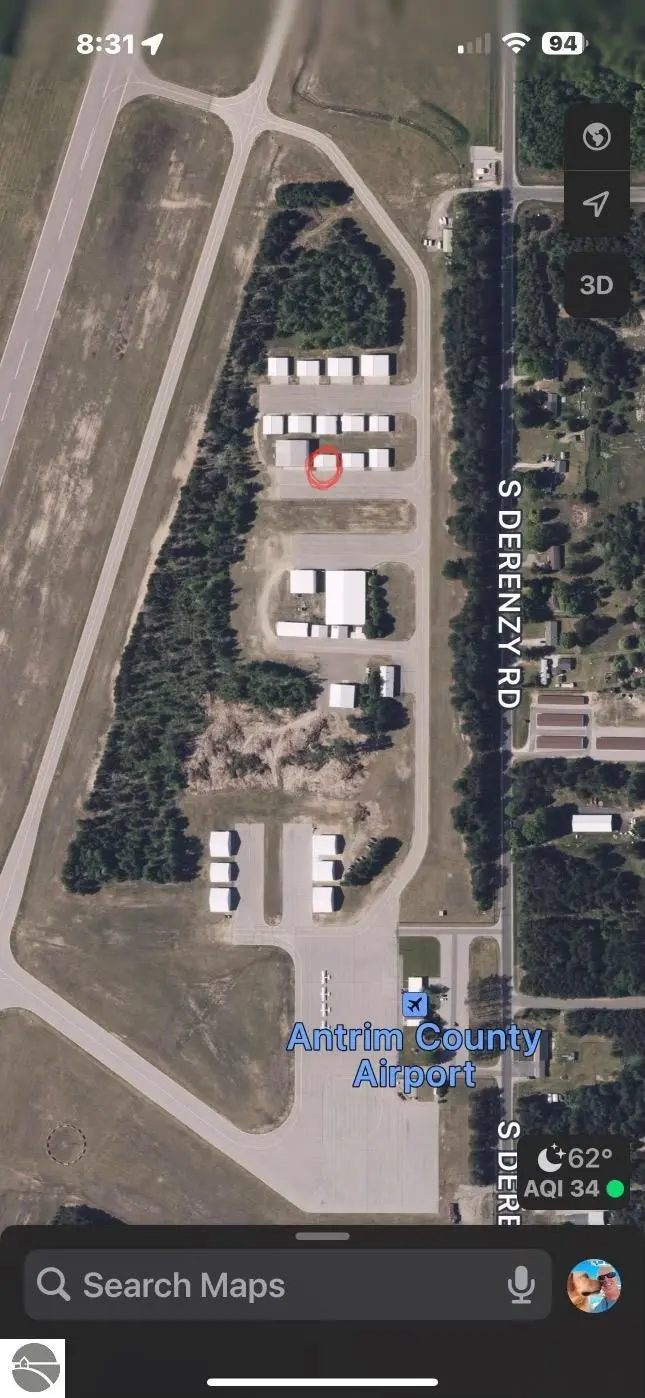

Industrial and Warehouse Facilities

Light industrial zones lie just south of downtown, with units from 1,000 to 10,000 square feet. These spaces support fabrication, assembly, storage, and seasonal boat servicing for nearby Torch Lake and Lake Bellaire. The absence of heavy-industrial zoning keeps sites clean and accessible year-round.

Mixed-Use and Specialty Developments

The hottest new opportunities are in mixed-use projects—ground-floor retail with residential or office units above. Recent approvals on the village’s west side permit up to 30 units combined, with storefront parking and community green spaces. Specialty properties, like artisan studios and adaptive-reuse warehouses, cater to creative entrepreneurs and tourism-focused ventures.

Investors should align property type with their target tenant: a boutique owner favors downtown retail, while a small manufacturer might prefer a warehouse near transit routes. Understanding each class’s demand drivers and lease structures is key to maximizing occupancy and returns.

Investment Strategies and ROI Analysis

Bellaire’s stable yet evolving northern Michigan commercial real estate sector supports several investment playbooks, from core holdings to value-add flips.

Yield Expectations and Cap Rates

Current cap rates by asset class:

-

Retail (Downtown): 6.0% – 7.0%

-

Office (Professional Suites): 6.5% – 8.0%

-

Industrial/Flex: 7.0% – 8.5%

-

Mixed-Use: 5.5% – 6.5%

These yields compare favorably to suburban benchmarks, offering a premium for smaller-market liquidity and lower acquisition costs.

Value-Add and Redevelopment Projects

Opportunistic investors target properties with lease expirations or deferred maintenance:

-

Tenant Mix Refresh: Introducing coffee shops, wellness studios, or coworking spaces can boost foot traffic and rents.

-

Building Upgrades: Modernizing façades, upgrading HVAC, and adding energy-efficient lighting often yield rent increases of 10%–15%.

-

Adaptive Reuse: Converting old barns or warehouse shells into event venues or artisanal food halls taps into Bellaire’s tourism economy.

By investing $50,000–$150,000 per asset, investors can often secure rent bumps that pay back renovations within three to five years.

Tenant Mix and Lease Structures

Long-term triple-net (NNN) leases with creditworthy tenants offer predictable cash flows, while short-term gross leases enable market-rate resets more often. A balanced portfolio might allocate 60% to NNN retail, 30% to office leases, and 10% to flex or mixed-use—diversifying risk and aligning with local demand cycles.

Financing Options and Incentive Programs

Securing capital for Bellaire properties involves tapping both traditional and specialized lending channels.

Local Banks, Credit Unions, and Private Lenders

Several Antrim County institutions underwrite commercial loans at competitive rates:

-

Antrim County Bank: Offers fixed-rate commercial mortgages up to 20-year terms.

-

Northern Financial Credit Union: Focuses on small business lines of credit and owner-occupied property loans.

-

Private Hard-Money Lenders: Provide quick closings for bridge loans at higher interest (8%–12%), ideal for brief rehab projects.

SBA Loans and Federal Financing

U.S. Small Business Administration (SBA) 7(a) and 504 programs can finance up to 90% of acquisition and improvement costs, with rates often below 6%. These require owner-occupancy but can be structured for small commercial landlords who meet SBA criteria.

State and Local Incentives

Michigan’s Renaissance Zones and Brownfield Redevelopment Authority programs offer tax abatements, reimbursement of environmental cleanup costs, and low-interest loans for qualifying projects. Bellaire’s DDA (Downtown Development Authority) also provides façade grants up to $10,000 per property.

By layering incentives and traditional debt, investors can lower upfront equity needs and accelerate cash-on-cash returns.

Working with Brook Walsh at NorthernMichiganEscapes.com

Navigating Bellaire’s market is smoother with a seasoned partner—Brook Walsh, Managing Broker at NorthernMichiganEscapes.com.

Why Partner with Brook Walsh

Brook brings:

-

Local Expertise: Born and raised in Northern Michigan, Brook combines deep community ties with a Master of Business Administration and a tech-savvy marketing background.

-

Proven Track Record: Over $500M in real estate transactions, including retail redevelopments and mixed-use conversions.

-

Full-Service Support: From site tours and financial modeling to negotiation and closing, Brook’s team handles every detail.

The Acquisition and Leasing Process

-

Consultation & Needs Assessment: Discuss investment goals, risk tolerance, and preferred property types.

-

Property Identification: Receive tailored listings and off-market opportunities aligned with your criteria.

-

Financial Analysis: Review pro forma models, cap rate estimates, and financing options.

-

Negotiation & Due Diligence: Leverage Brook’s negotiating experience and vendor network for inspections, surveys, and title work.

-

Closing & Lease-Up: Coordinate with lenders, attorneys, and property managers to finalize acquisition and secure tenants.

Client Testimonials and Success Stories

“Working with Brook transformed our portfolio. He found a downtown retail property we never knew existed—and the return has been exceptional.” – J. Thompson, Grand Rapids investor

“Brook’s insights on mixed-use zoning helped us convert an old hardware store into a thriving café and loft apartments.” – M. Reynolds, Bellaire restaurateur

Frequently Asked Questions

Q. What types of commercial properties are most in demand?

A. Retail storefronts in downtown Bellaire and light industrial/flex spaces near Torch Lake support strong year-round occupancy.

Q. How do cap rates in Bellaire compare statewide?

A. Bellaire cap rates average 6.5%–7.5%, typically 0.5% higher than similar villages due to smaller-market premium.

Q. What incentives are available for new developments?

A. Michigan Renaissance Zones, Brownfield grants, and Bellaire DDA façade improvement funds can offset renovation and construction costs.

Q. Should I lease or buy commercial space here?

A. Leasing offers flexibility and lower upfront costs; buying builds equity and can yield tax advantages under federal depreciation rules.

Q. How long does the acquisition process take?

A. From letter of intent to closing, expect 60–90 days—faster with local financing or cash transactions.

Q. Where can I find official market data?

A. Visit the Village of Bellaire’s official site for zoning maps and economic reports at Bellaire Village.

Conclusion and Next Steps

Bellaire, MI Commercial Real Estate for Sale and Lease represents a unique blend of small-town character and strong investment fundamentals. With retail, office, industrial, and mixed-use opportunities, the market supports diverse strategies—from core NNN buy-and-hold to value-add redevelopment. Financing pathways and incentive programs make acquisitions even more attractive. To explore Bellaire’s top seven opportunities and secure your stake in Northern Michigan’s growth story, connect with Brook Walsh at Northern Michigan Escapes today.

Continue your Northern Michigan commercial real estate search in the communities below or contact Brook Walsh to help you with your search.

Browse Other Communities

- Alanson, MI Commercial Real Estate

- Alpena, MI Commercial Real Estate

- Atlanta, MI Commercial Real Estate

- Bay Harbor, MI Commercial Real Estate

- Beaver Island, MI Commercial Real Estate

- Bellaire, MI Commercial Real Estate

- Beulah, MI Commercial Real Estate

- Brutus, MI Commercial Real Estate

- Boyne City, MI Commercial Real Estate

- Boyne Falls, MI Commercial Real Estate

- Cadillac, MI Commercial Real Estate

- Carp Lake, MI Commercial Real Estate

- Central Lake, MI Commercial Real Estate

- Charlevoix, MI Commercial Real Estate

- Cheboygan, MI Commercial Real Estate

- Cross Village, MI Commercial Real Estate

- East Jordan, MI Commercial Real Estate

- Elk Rapids, MI Commercial Real Estate

- Ellsworth, MI Commercial Real Estate

- Empire, MI Commercial Real Estate

- Fife Lake, MI Commercial Real Estate

- Frankfort, MI Commercial Real Estate

- Gaylord, MI Commercial Real Estate

- Glen Arbor, MI Commercial Real Estate

- Grayling, MI Commercial Real Estate

- Harbor Springs, MI Commercial Real Estate

- Hillman, MI Commercial Real Estate

- Honor, MI Commercial Real Estate

- Houghton Lake, MI Commercial Real Estate

- Indian River, MI Commercial Real Estate

- Interlochen, MI Commercial Real Estate

- Johannesburg, MI Commercial Real Estate

- Kalkaska, MI Commercial Real Estate

- Kewadin, MI Commercial Real Estate

- Kingsley, MI Commercial Real Estate

- Lake Ann, MI Commercial Real Estate

- Lake City, MI Commercial Real Estate

- Leland, MI Commercial Real

- Levering, MI Commercial Real Estate

- Lewiston, MI Commercial Real Estate

- Mackinac Island, MI Commercial Real Estate

- Mackinaw City, MI Commercial Real Estate

- Manton, MI Commercial Real Estate

- Manistee, MI Commercial Real Estate

- Maple City, MI Commercial Real Estate

- Northport, MI Commercial Real Estate

- Onaway, MI Commercial Real Estate

- Onekama, MI Commercial Real Estate

- Pellston, MI Commercial Real Estate

- Petoskey, MI Commercial Real Estate

- Rogers City, MI Commercial Real Estate

- Roscommon, MI Commercial Real Estate

- Suttons Bay, MI Commercial Real Estate

- Tawas City, MI Commercial Real Estate

- Thompsonville, MI Commercial Real Estate

- Topinabee, MI Commercial Real Estate

- Traverse City, MI Commercial Real Estate

- Vanderbilt, MI Commercial Real Estate

- Walloon Lake, MI Commercial Real Estate

- Williamsburg, MI Commercial Real Estate

- Wolverine, MI Commercial Real Estate

Start searching for your dream home now.

When it comes to convenience, our site is unparalleled. Whether you're in the comfort of your home, or on the go.

Our site works flawlessly on multiple devices so you can find the information you need.