With the rising cost of rent in Northern Michigan, you might be thinking this year is finally the year you’re going to buy a home. This is an exciting time for anyone, but there’s one big thing that stands between you and your dream of owning: a mortgage. (Click here to see Northern Michigan's finest collection of ski-in/ski-out vacation rentals)

While you might feel financially ready to take on a mortgage, it’s ultimately up to the lender to deem you responsible and financially stable. One of the ways they do that is to take a peek into your credit history. Maxing out your credit card in college or forgetting to pay a bill here and there might not seem like a big deal at the time, but it could come back to haunt you later in life when trying to apply for a large loan. (Click here to see all Northern Michigan Waterfront Lifestyle Homes for Sale)

If you've been informed you have imperfect credit and need to boost your FICO score fast, here are a few things you can try:

1. KNOWING IS KEY: CHECK YOUR CREDIT SCORE

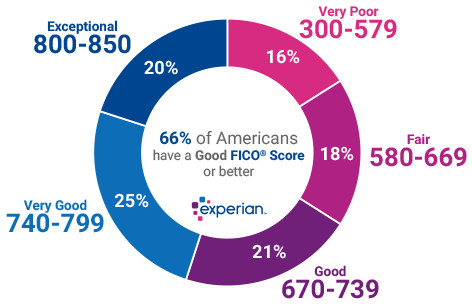

Knowing what your credit score is and where it needs to be is crucial. In most cases, the better your credit score is, the more likely you are to get a good interest rate on your loan. Those with fair credit will often end up with a higher interest rate but still get approved. It's up to you to decide which is more important: buying a home now and paying more over time or waiting a few years until your credit has improved.

The obvious choice for many is to wait a year or two while their credit score improves. But know this: the average price of homes in Northern Michigan is increasing.

A good lender and real estate agent can help you decide if it's worthwhile to take advantage of the housing market now, regardless of your interest rate.

A conventional loan requires a minimum credit score of 740. Anything less than that and you’re looking at a higher interest loan with additional fees.

2. REDUCE THE AMOUNT YOU OWE

It might sound obvious, but simply paying down your current balances can go a long way. Nearly 30% of your FICO score is attributed to the amount you owe compared to the amount that's available to you. This is what’s known as credit utilization. For example, if you owe $3,000 on a credit card that has a limit of $10,000, then you're using 30% of your available credit. The best way to use credit utilization to your advantage is to pay down your loans to around 1% of your credit utilization before your bank reports to the statement to the credit bureaus.

3. START PAYING EVERY BILL ON TIME

Timely bill payments are the most important factor when it comes to credit score. If you frequently miss a payment or are consistently late, suddenly paying all of them on-time is going to make a noticeable difference in as little as a few months. There’s an app for that

The organization isn’t everyone’s strong point. Between the utilities, car loans, student loans, medical coverage, credit cards, and so on, it’s not always easy to keep track of everything every month – but you need to.

Luckily, we live in the age of automation, so it’s never been easier to set it and forget it. Most banks will let you set up recurring bill payments every month via online banking. There are also several third-party apps that track your bills and automatically pay them for you each month from a chosen account. Talk about streamlined!

4. OPEN A NEW ACCOUNT

Applying for more credit might sound counter-intuitive, but it can help in two ways. First, it can increase your credit utilization by adding more available credit. Second, if it’s different than your other existing forms of credit, then it can also improve the variety of your credit sources.

However, there are some caveats to be aware of. Only apply for one account, not several. Every time you apply for more credit, no matter what kind it is, you take a hit on your credit. So find one you like and try not to use it, if possible.

5. BECOME AN AUTHORIZED USER ON ANOTHER ACCOUNT

Being added as an authorized user on an account with great credit can boost your own. The full history of that account is added to your credit report almost immediately. So while you might only have recently been added, if the account has been around for a while it will add its entire history to your list of managed accounts. In as little as a few days, this could give your credit rating the bump it needs to become eligible for a mortgage.

That said, make sure that whoever is adding you does have great credit. If they also have less than perfect credit, it could do more harm than good.

Have a question about the mortgage or just want to learn more about the lending process? Check out our other mortgage articles or get in touch with us today and we’ll connect you with a lending specialist.

Focused on Northern Michigan Investment Real Estate

Brook is focused on lifestyle real estate investment properties as most people want a vacation home to make lifelong memories that endure for their entire family, leave a profound legacy for generations, and they want a solid financial investment at the same time. While the area does have many good realtors, there aren’t many with the unique financial, vacation home investing, and technology marketing background. Brook uses his diverse skill set to help clients properly evaluate and determine whether a vacation home makes financial sense.

Continue Your Northern Michigan Real Estate Search

Explore homes and real estate in the Northern Michigan communities below or contact Brook Walsh to help you with your search.

Leave A Comment