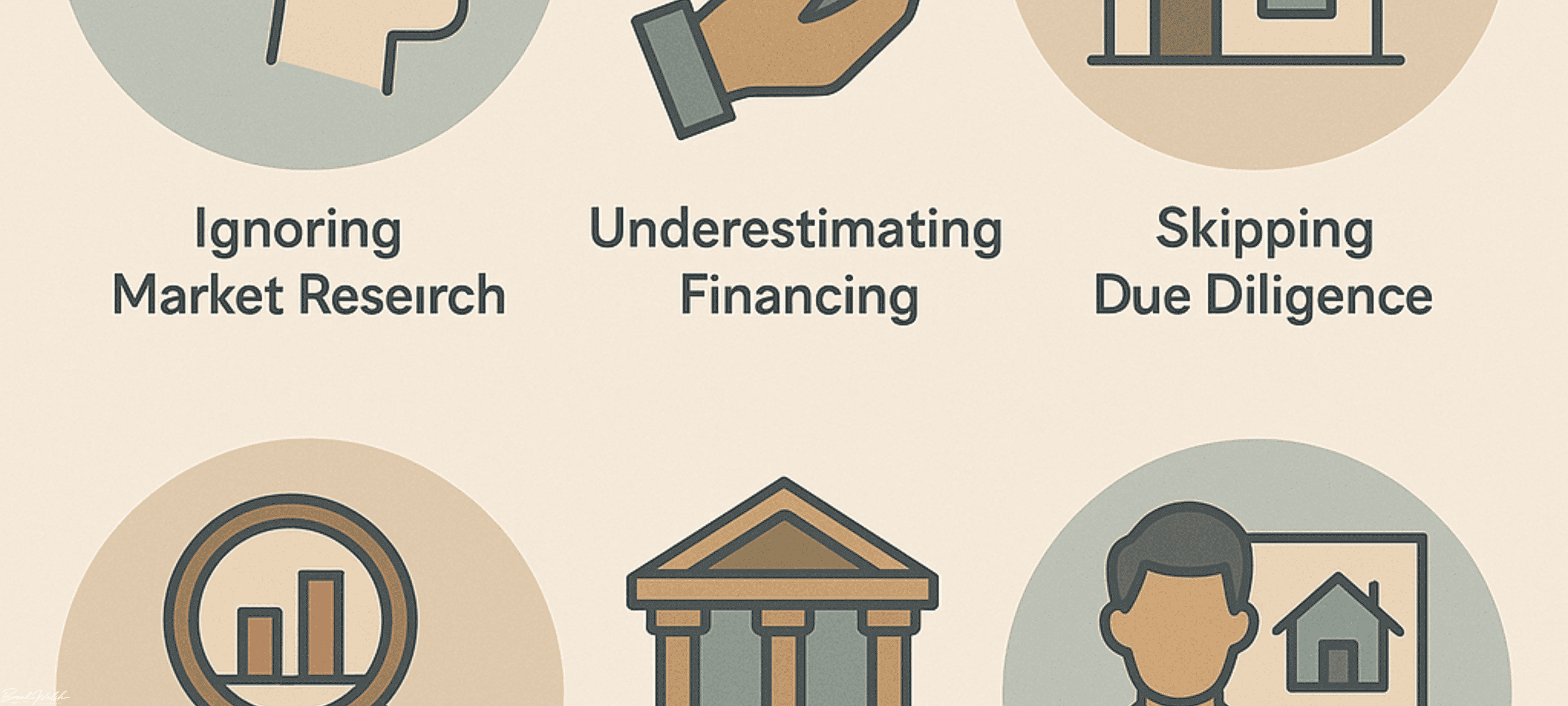

Real Estate Investing: 4 Big Rookie Mistakes Exposed + 3 Proven Fixes

Investing in real estate can feel like striking gold—provided you know where to dig. Real Estate Investing is a powerful wealth-building tool, but many beginners stumble at the same four hurdles.

1. Ignoring Market Research

Skimping on market research is like setting sail without a compass—you’ll drift. New investors often rush to buy the first “bargain” they spot, only to discover later that demand is weak or property values are stagnant.

1.1 Failing to Analyze Neighborhood Trends

Every neighborhood has its own rhythm—schools, crime rates, new developments, and demographic shifts all matter. Rookie investors often look at a property in isolation. Without neighborhood context, you might buy in an area headed for decline, not growth.

1.2 Overlooking Economic Indicators

Economic health indicators—employment rates, job growth, and local business expansions—directly affect property demand. Ignoring these can leave you holding a property in a market with shrinking tenant pools and declining rents.

1.3 Skipping Comparative Market Analyses

A Comparative Market Analysis (CMA) benchmarks your property against recent sales in similar conditions. It’s not optional. Without a CMA, you risk overpaying or setting unreasonable rent expectations that hamper cash flow.

2. Underestimating Financing Requirements

Money isn’t just for closing costs. From loan terms to operating reserves, financing fundamentals can make or break your deal.

2.1 Neglecting Pre-Approval

Starting your search without lender pre-approval is a fast track to disappointment. Pre-approval shows sellers you’re serious and helps define a realistic budget. Without it, you may chase impossible price points.

2.2 Miscalculating Cash Flow and ROI

Cash flow isn’t just rent minus mortgage. Factor in property taxes, insurance, maintenance, vacancies, and management fees. Rookie investors often use a simple calculator and wind up with negative cash flow. Always run a detailed pro forma.

2.3 Ignoring Alternative Funding Options

Traditional mortgages aren’t the only path. Consider hard-money loans, private lenders, or partnership structures. Diversifying your financing strategy can reduce barriers and accelerate your portfolio growth.

3. Skimping on Due Diligence

Due diligence is your safety net. Skipping inspections or title searches to close quickly can lead to costly surprises.

3.1 Waiving Inspections Too Hastily

Relying solely on general home inspection summaries may leave structural, electrical, or plumbing issues undetected. Always opt for specialized inspections—roof, HVAC, pest—to avoid repair bills that erase your profit margin.

3.2 Overlooking Title and Legal Issues

A clear title is non-negotiable. Unpaid liens, unresolved easements, or boundary disputes can stall or nullify your transaction. Employ a reputable title company and request title insurance to shield yourself from hidden claims.

3.3 Failing to Vet Contractors and Service Providers

A low bid doesn’t guarantee quality work. Research contractors’ reputations, licenses, and insurance. Get multiple quotes, check references, and insist on written contracts with milestones and penalties to protect your investment.

4. Letting Emotions Drive Decisions

Real estate is emotional: charming kitchens, picket fences, or celebrity-backed developments can cloud judgment.

4.1 Bidding Wars and Overpaying

FOMO-driven bidding wars inflate prices beyond intrinsic value. Set a strict maximum bid based on your CMA and walk away if it’s exceeded. Staying disciplined preserves your ROI.

4.2 Attachment to Cosmetic Features

Granite countertops and hardwood floors look great in glossy magazines, but they rarely boost rental yields. Focus on the fundamentals—location, layout, and structural integrity—before chasing superficial upgrades.

4.3 Ignoring Exit Strategy

Every investment needs an exit plan. Will you flip, hold and rent, or refinance? Lacking clarity on your endgame can trap you in illiquid assets or force a fire sale at a loss when liquidity is needed.

Proven Fixes: 3 Strategies to Avoid These Pitfalls

Turning rookie errors into rookie moves takes intentional strategy. Here are three actionable fixes:

Fix 1: Leverage Data–Driven Market Tools

Use platforms like MLS analytics, neighborhood heat maps, and rental demand trackers. Data-driven decisions replace guesswork with precision, ensuring you buy where demand and appreciation align.

Fix 2: Build Strong Financing Foundations

Establish relationships with multiple lenders—banks, credit unions, private investors. Secure pre-approvals, maintain a robust reserve fund (at least 6 months of expenses), and regularly reassess loan terms to capitalize on refinancing opportunities.

Fix 3: Engage Expert Advisors

You don’t have to go it alone. Hire experienced inspectors, trusted attorneys, and seasoned property managers. Their expertise prevents costly missteps and frees you to focus on scaling your portfolio.

Frequently Asked Questions

Q. What is the most common rookie mistake in real estate investing?

A. The top error is skipping thorough market research. Without data on neighborhood trends and comparable sales, investors often overpay or buy in declining areas.

Q. How much market research is enough?

A. Aim for a minimum of 3 months of local sales data, rent roll analysis, and economic reports. Supplement with on-the-ground visits and community stakeholder interviews for deeper insights.

Q. Should I always get a home inspection?

A. Yes. Even brand-new builds can harbor defects. Comprehensive inspections (roof, HVAC, pest) uncover hidden issues that could cost thousands to fix later.

Q. What financing options are best for beginners?

A. Start with conventional loans for lower rates and down payments as low as 3–5%. As you gain experience, explore private money and partnerships to diversify and increase deal flow.

Q. How do I stay objective when I like a property?

A. Set predetermined criteria—price range, cap rate, neighborhood rating—and stick to them. Walk away if a property fails your checklist, no matter how charming.

Q. When should I call in an expert?

A. If any aspect of a deal—legal, inspection, financing—falls outside your comfort zone, pause and bring in a specialist. Their guidance costs far less than a major oversight.

Conclusion: Building a Successful Foundation

Real estate investing rewards the prepared, disciplined, and data-driven. By avoiding the 4 big rookie mistakes—ignoring market research, underestimating financing, skimping on due diligence, and letting emotions rule—and applying the 3 proven fixes, you’ll lay an unshakeable foundation for wealth creation. Remember, every seasoned investor started as a beginner. Learn from these pitfalls now, and future you will thank present you for making smarter, more profitable decisions.

Continue Your Northern Michigan Real Estate Search

Explore homes and real estate in the Northern Michigan communities below or contact Brook Walsh to help you with your search.

Leave A Comment