In this post, you’ll learn how to do a 1031 exchange with real estate. Topics include 1031 exchange rules, types of exchanges, success stories, and more. Continue reading to learn how to use this powerful strategy!

Introduction:

A 1031 Exchange, also called a Starker Exchange or Like-Kind Exchange is a powerful tax-deferment strategy used by some of the most financially successful investors. This is, perhaps, even more, true as we head into 2018. Why? Because in many U.S. cities' prices real estate has surpassed the “bubble levels” of a decade ago. Because of this, many investors think that today is the optimal time to exchange properties in expensive markets for cash-flowing properties across the country. (Click here to see all Lake Charlevoix Homes for Sale)

If you’re interested in learning about how to do a tax-deferred exchange, there’s no better time than now. In this comprehensive article, you’ll get answers to five of the most frequently asked questions investors ask. We’ve also included some case studies and investor success stories at the end of the article. Enjoy!

What is a 1031 Exchange?

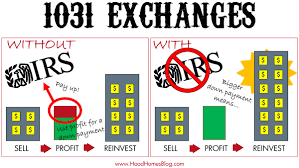

The term 1031 Exchange is defined under section 1031 of the IRS Code. (1) To put it simply, this strategy allows an investor to “defer” paying capital gains taxes on an investment property when it is sold, as long another “like-kind property” is purchased with the profit gained by the sale of the first property. We’ll discuss the like-kind property in more detail in section four. (Click here to see Northern Michigan's finest collection of vacation rentals)

Brook Walsh explains that this strategy has more benefits than just saving yourself from taxes. According to Brook, a starker exchange can allow real estate investors to shift the focus of their investing without incurring tax liability. For example, perhaps you are investing in properties that are low-income and thus high-maintenance. You could exchange the high-maintenance investment for a low-maintenance investment without needing to pay a significant amount of taxes. Or perhaps you want to move your investments from one location to another without the IRS knocking. 1031 makes this possible. (2)

Note: Traditionally, a 1031 exchange is where one property is swapped for another property of like-kind. However, the likelihood that the property you want is owned by someone who wants your property is unlikely. According to Forbes, this is why “the vast majority of exchanges are delayed, three-party, or Starker exchanges (named for the first tax case that allowed them). In a delayed exchange, you need a middleman who holds the cash after you “sell” your property and uses it to “buy” the replacement property for you. This three-party exchange is treated as a swap.” (3)

FAQ 2 When To Do a 1031 Exchange?

When you sell an investment property, even if you weren’t the one who initially purchased it, you end up on the hook to pay capital gains tax.

If you’ve made some bad investments, or you just have bad luck, selling your investment can cost you more than you make.

But, if you own a rental property that is worth significantly more today than what you (or the original owner) purchased it for, you can make a killing using this powerful strategy.

The big question: how do you use this strategy? Continue reading the next section to learn some tips and strategies for success!

FAQ 3 How To Do a 1031 Exchange Right Now

To use this strategy effectively, you must exchange one property for another property of similar value. In the process, you avoid capital gains, at least for a while.

An investor will eventually cash out and pay taxes, but in the meantime, an investor can trade properties without incurring a sudden tax obligation. It’s an important tool for real estate investors that have become a bulls-eye for tax reform evangelists.

However, the exchange rules require that both the purchase price and the new loan amount be the same or higher on the replacement property.

That means that if an investor were selling a $1 Million property in San Jose that had a $650,000 loan, they would have to buy $1 Million or more of replacement property with $650,000 or more leverage.

We’ll talk more about section 1031 rules in section 5. First, you’ll want to know about the four types of Starker Exchanges used by real estate investors.

What Are the 4 Types of Exchanges for Real Estate?

There are four main types of like-kind exchanges investors can choose from. The most common like-kind exchange types include simultaneous, delayed, reverse, and construction/ improvement exchange. Continue reading to learn more about each type of exchange.

Simultaneous Exchange

A simultaneous exchange occurs when the replacement property and relinquished property close on the same day. As the name suggests, these closings occur simultaneously.

It is important to note that the exchange must occur simultaneously; any delay, even a short delay caused by wiring money to an escrow company, can result in the disqualification of the exchange and the immediate application of full taxes.

There are three basic ways that a simultaneous exchange can occur.

- Swap or complete a two-party trade, whereby the two parties exchange or “swap” deeds.

- A three-party exchange where an “accommodating party” is used to facilitate the transaction simultaneously for the exchanger.

- Simultaneous exchange with a qualified intermediary who structures the entire exchange.

Delayed Exchange

The delayed like-kind exchange, which is by far the most common type of exchange chosen by investors today, occurs when the exchanger relinquishes the original property before he acquires the replacement property.

In other words, the property the Exchangor owns (which is called the “relinquished” property) is transferred first and the property the Exchangor wishes to exchange it for (the “replacement” property) is acquired second.

The Exchangor is responsible for marketing his property, securing a buyer, and executing a sale and purchase agreement before the delayed exchange can be initiated. Once this has occurred, the Exchangor must hire a third-party Exchange Intermediary to initiate the sale of the relinquished property and hold the proceeds from the sale in a binding trust for up to 180 days while the seller acquires a like-kind property.

Using this strategy, an investor has a maximum of 45 days to identify the replacement property and 180 days to complete the sale of their property. In addition to the numerous tax benefits, this extended timeframe is one of the reasons that the delayed exchange is so popular.

Note: we’ll discuss the rules associated with a Delayed Starker Exchange in-depth in the next section.

Reverse Exchange

A reverse exchange, also known as a forward exchange, occurs when you acquire a replacement property through an exchange accommodation titleholder before you identify the replacement property. In theory, this type of exchange is very simple: you buy first and you pay later.

What makes reverse exchanges tricky is that they require all cash. Additionally, many banks won’t offer loans for reverse exchanges, especially difficult are commercial real estate loans. Taxpayers must also decide which of their investment properties are going to be acquired and which will be “parked.” A failure to close on the relinquished property during the established 180 day period that the acquired property is parked will result in a forfeit of the exchange.

The reverse exchange follows many of the same rules as the delayed exchange. However, there are a few key differences to note:

- Taxpayers have 45 days to identify what property is going to be sold as “the relinquished property.”

- After the initial 45 days, taxpayers have 135 days to complete the sale of the identified property and close out the reverse 1031 exchange with the purchase of the replacement property

Construction/Improvement Exchange

The construction exchange allows taxpayers to make improvements on the replacement property by using the exchange equity. To put this into layman’s terms, the taxpayer can use their tax-deferred dollars to enhance the replacement property while it is placed in the hands of a qualified intermediary for the remainder of the 180 days.

It is important to note that the taxpayer must also meet three requirements if they want to defer all of the gain (from the sale of the relinquished property) and instead use it as part of the construction or improvement exchange.

- The entire exchange equity must be spent on completed improvements or as a down payment by the 180th day.

- The taxpayer must receive “substantially the same property” that they identified by the 45th day.

- The replacement property must be equal or greater in value when it is deeded back to the taxpayer. The improvements must be in place before the taxpayer can take the title back from the qualified intermediary.

FAQ 5 What Real Estate 1031 Exchange Rules Must I Follow?

Rule 1: Like-Kind Property

To qualify as a 1031 exchange, the property being sold and the property being acquired must be “like-kind.”

Like-Kind Property Definition: Like-Kind property is a very broad term which means that both the original and replacement properties must be of “the same nature or character, even if they differ in grade or quality.” (4) In other words, you can’t exchange farming equipment for an apartment building, because they’re not the same asset. In terms of real estate, you can exchange almost any type of property, as long as it’s not personal property.

For example:

- Exchanging an apartment building for a duplex would be allowed.

- Exchanging a single-family rental property for a commercial office building would be allowed

- Exchanging a rental property or vacation rental for a restaurant space would be allowed.

EXCEPTION: It’s important to note that the original and replacement property must be within the U.S. to qualify under section 1031.

**Another fun fact: Starker Exchanges can include more than two properties. For example, you can exchange one property for multiple replacement properties and vice versa: you can exchange multiple properties and for one larger property. As long as the new properties are like your original properties, you’re good to go. Do yourself a favor and get a good qualified intermediary to assist you.

Rule 2: Investment or Business Property Only

A 1031 exchange is only applicable for Investment or business property, not personal property. In other words, you can’t swap one primary residence for another.

For example:

- If you moved from California to Georgia, you could not exchange your primary residence in California for another primary residence in Georgia.

- If you were to get married and move into the home of your partner, you could not exchange your current primary residence for a vacation property.

- If you were to own a single-family rental property in Idaho, you could exchange it for a commercial rental property in Texas.

Rule 3: Greater or Equal Value

To completely avoid paying any taxes upon the sale of your property, the IRS requires the net market value and equity of the property purchased must be the same as, or greater than the property sold. Otherwise, you will not be able to defer 100% of the tax.

For example, let’s say you have a property worth $2,000,000, and a mortgage of $500,000. To receive the full benefit of 1031, the new property (or properties) you purchase need to have a net worth of at least 2 million dollars, and you’ll have to carry over at least a $500,000 mortgage. It’s important to note that the $2,000,000+ value, and $500,000 mortgage, can go towards one apartment building or three different properties with a total value of $2,000,000+. (FYI: Acquisition costs, such as inspections and broker fees also apply toward the total cost of the new property.)

Rule 4: Must Not Receive “Boot”

A Taxpayer Must Not Receive “Boot” for the exchange to be completely tax-free. Any boot received is taxable to the extent of the gain realized on the exchange. In other words, you can carry out a partial 1031 exchange, in which the new property is of lesser value, but this will not be 100% tax-free. The difference is called “Boot,” which is the amount you will have to pay capital gains taxes on. This option is completely okay and often used when a seller wants to make some cash and is willing to pay some taxes to do so.

An example of this would be if your original property is sold for $2,000,000 and the property you wish to exchange under section 1031 is worth $1,500,000, you would need to pay the normal capital gains tax on the $500,000 “boot.”

Rule 5: Same Tax Payer

The tax return and name appearing on the title of the property being sold must be the same as the tax return and titleholder that buys the new property. However, an exception to this rule occurs in the case of a single-member limited liability company (“smllc”), which is considered a pass-through to the member. Therefore, the smllc may sell the original property, and that sole member may purchase the new property in their name.

For example, the single member of “Sally Jones LLC” is Sally Jones. The LLC can sell the property owned by the LLC, and because Sally Jones is the sole member of the LLC, he can purchase property in his name, and be in compliance with the 1031 code.

Rule 6: 45 Day Identification Window

The property owner has 45 calendar days, post-closing of the first property, to identify up to three potential properties of like-kind. This can be difficult because the deals still need to make sense from a cash perspective. This is true especially in today’s market because people tend to overprice their properties when there are low-interest rates, so finding all the properties you need can be a challenge.

An exception to this is known as the 200% rule. In this situation, you can identify four or more properties as long as the value of those four combined does not exceed 200% of the value of the property sold.

Rule 7: 180 Day Purchase Window

It’s necessary that the replacement property is received and the exchange completed no later than 180 days after the sale of the exchanged property OR the due date of the income tax return (with extensions) for the tax year in which the relinquished property was sold, whichever is earlier.

Recap

As you might realize, there are many rules and qualification requirements that you must comply with to perform a successful exchange. To sum things up, the biggest advantage of using this strategy is that you can avoid having to pay capital gains taxes on the sale of an investment property. This can be a huge benefit for real estate investors who know which markets are primed to grow next. It can also be a huge downfall for beginning investors or those who don’t understand the changing real estate landscape. If you don’t, you risk falling victim to one the biggest disadvantage is the reduced basis for depreciation on the replacement property.

This means that if you were to sell your replacement property, even at a deficit, you would still be accountable for the capital gains on the initial property. In other words, if you want to maximize the benefits of your exchange, it’s important that you choose your replacement property (or properties) wisely, investing in a market that has good potential for growth in the future.

Like-Kind Exchange Benefits To Take Advantage of Now

At its core, a like-kind exchange is executed for one reason: to defer taxes. What many people don’t realize is that it can do so much more than this.

At BrookWalsh.com, we've helped our clients to exchange their high-value investment property for turn-key, cash-flowing, investment properties in the strongest U.S. markets. We do this to help them leverage their tax savings to invest in properties that will (a) generate more cash flow every month, (b) take less time to manage, and (c) give them more freedom.

Here’s an example:

“My favorite [like-kind exchange] success stories was when a woman named Lisa had 3 properties in Lake Tahoe worth about $400,000 each. She said they were very old and in need of repair, and each brought in about $1200 per month in rent. Jill wanted to quit her job and retire but she didn’t think she could live on the net income from those properties, which was about $2400/month (net refers to the remaining cash flow once expenses are paid.)

Jill's financial advisor looked Jill in the eyes and said, ‘I’ve got great news for you. You can retire today.’

He explained that she could exchange her three old, dilapidated Lake Tahoe properties for nine brand new Nevada properties in highly desirable areas.

Here’s how the numbers would look: She owned the 3 Lake Tahoe properties free & clear. They would sell at that time for about $400,000 each. Thanks to Section 1031 of the US tax code, she could exchange those properties tax-deferred for 1.2 million dollars worth of property in Nevada.

The average home price in Las Vegas was $122,000 at the time so finding 9 high-quality properties for under $130,000 each would be easy. And even more surprising was that those properties would easily rent for $1200 each.

Remember, Jill was getting $1200 rent on just three properties in Lake Tahoe, and those homes were in total disrepair. Maintenance and repair costs were eating up the cash flow.

Fortunately, Jill listened to her financial advisor and took the leap, and the results were astounding. She sold the Lake Tahoe homes and he helped her exchange them for nine really lovely Nevada properties. He also helped her put all those properties under excellent property management, so she no longer had to suffer as a typical landlord fixing toilets.

Her gross income went from $3600/month to $10,800/month and her net income went from effectively zero (due to the old homes requiring so much repair) to $6500 in monthly net income. Plus, the homes she bought in Nevada were brand new and would require little or no repair for years.”

— Excerpt from Retire Rich With Rentals.

Important Takeaways

Do you feel inspired now? Hopefully, the answer is yes by now. Why?

Because everyone can end up with passive income from real estate – even if you don’t have any money to start with. All you need is a solid education to know how to do use this powerful strategy correctly. This article is just a basic overview of how to do a 1031 exchange in 2018. For those of you who are more experienced, take some time to get a solid understanding of rules and regulations. You’ll need to know them like the back of your hand, or you still might end up with a huge tax bill. Truth be told, a 1031 tax deferment is incredibly complicated, even if you’re a career investor. Even a small mistake can jeopardize the deferment of your capital gains taxes. This is why most investors seek professional help.

Brook Walsh is from Northern Michigan and understands lifestyle-based real estate investing which is one of the reasons he's chosen to pursue his dream of helping real estate investors with their home buying needs. Learn more about Brook or start your home search now.

Leave A Comment